UK house prices in first monthly fall for 20 months

- Published

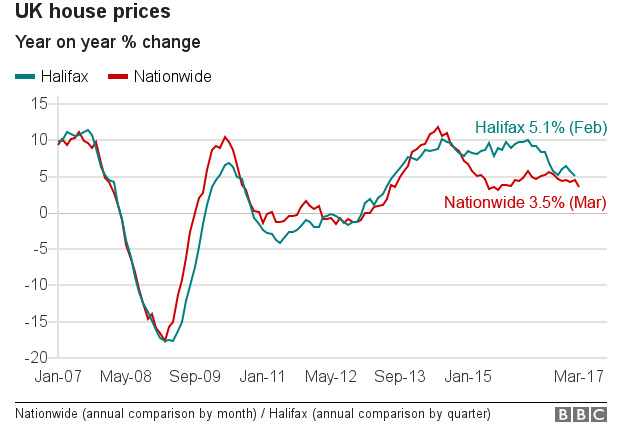

Average house prices across the UK fell by 0.3% in the month of March, according to the Nationwide, the first fall since June 2015.

Although monthly figures can be very volatile, it is the largest such fall for nearly five years.

One economist said it was evidence of the increasing squeeze on consumers.

A separate report warned that five million low-paid workers have been completely priced out of either renting or buying a home.

Mixed picture

The Nationwide figures, external showed that on the more reliable annual comparison, house prices were up 3.5% in March from a year earlier, compared with rate of 4.5% in February.

The average UK house price is now £207,308, the building society said.

"The South of England continued to see slightly stronger price growth than the North of England, but there was a further narrowing in the differential," said Robert Gardner, Nationwide's chief economist.

"Northern Ireland saw a slight pickup in annual house price growth, while conditions remained relatively subdued in Scotland and Wales."

Howard Archer, chief UK economist at IHS Global Insight, said the news "fuels our belief that the housing market is being increasingly affected by the increasing squeeze on consumers and their concerns over the outlook."

'Truly depressing'

A separate report, external from the National Housing Federation (NHF) said there was now only one town in England where a low-paid worker could afford a mortgage.

It said Burnley in Lancashire was the only place that a nursery nurse, for example, could afford to buy.

House prices in England had risen by 120% between 2002 and 2016, the NHF said, while salaries had risen by just 38% over the same period.

As far as renting is concerned, it said there was no area of the country where low-income workers paid less than 30% of their monthly salaries on rent.

"This analysis makes for truly depressing reading," said David Orr, chief executive of the NHF.

"Low-income workers are left with fewer affordable options than ever, even though their jobs are absolutely critical to local economies."