Sir Philip 'favoured' Arcadia pension schemes over BHS

- Published

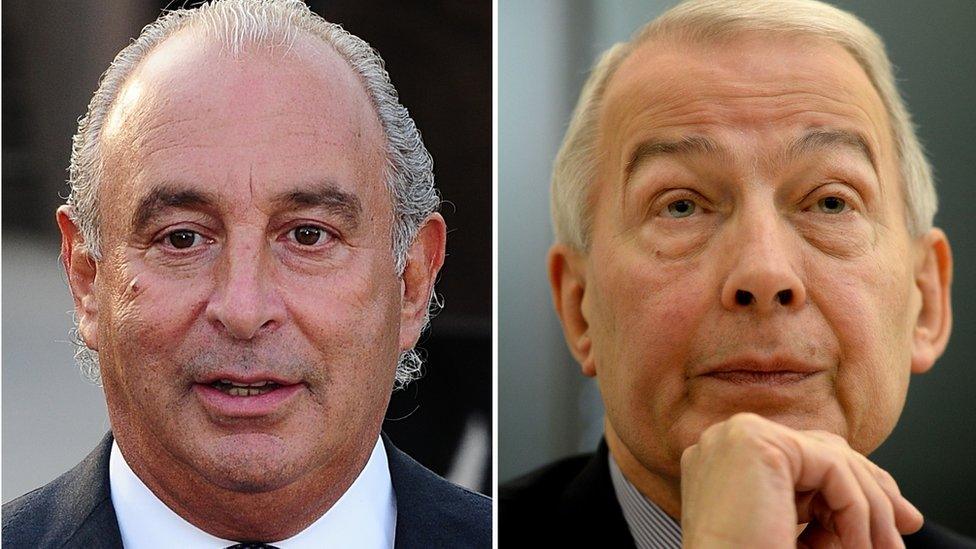

Sir Philip Green (left) clashed with Frank Field MP over BHS

Sir Philip Green has been "long favouring" the pension schemes of Arcadia over those of BHS, according to the chairman of the Commons Work and Pensions Committee, Frank Field.

Sir Philip had put a "substantial" recovery plan in place to resolve the deficit in pension schemes at Top Shop owner Arcadia, Mr Field said.

However, the original fix for the BHS scheme had been "inadequate", he said.

Sir Philip owned BHS for 15 years before selling it in March 2015.

It was bought for £1 by Dominic Chappell, a former bankrupt with little experience in retailing, and went into administration a year later.

There followed a lengthy and often rancorous investigation by the Work and Pensions Committee into the handling of the BHS pension fund.

Sir Philip promised to "sort" the problem and after months of negotiations with the Pensions Regulator, he agreed, in February, to pay £363m to bolster the BHS scheme.

BHS filed for administration in 2016

The Work and Pensions Committee also sought information about the pension schemes of Arcadia, the owner of Dorothy Perkins and Miss Selfridge, and controlled by Sir Philip.

Over the weekend, documents published by the committee showed that Arcadia had a deficit in its pension schemes of almost £565m in March 2016.

That is up from almost £456m, when the previous assessment was made in March 2013.

To address that shortfall Arcadia has doubled its annual contribution to the two main funds to £50m.

"This is a credible plan for tackling a giant deficit and great news for Arcadia pensioners who must have been concerned," said Mr Field.

"It is though clear from these figures that Sir Philip was long favouring the Arcadia schemes over their BHS counterparts, which have more members," he said.

'Ludicrous' plan

In 2012, while BHS was under the ownership of Sir Philip, a 23-year plan to fix the pension deficit was agreed.

Mr Field described that plan as "ludicrous" and contrasted it with a 13-year recovery plan for Arcadia pension schemes, which included much bigger contributions to cover the deficit.

"I imagine Sir Philip would say that Arcadia could afford it because it was profitable, whereas BHS was not," Mr Field said.

Sir Philip has not responded to Mr Field's comments.