South Africa's credit rating has been cut to junk status

- Published

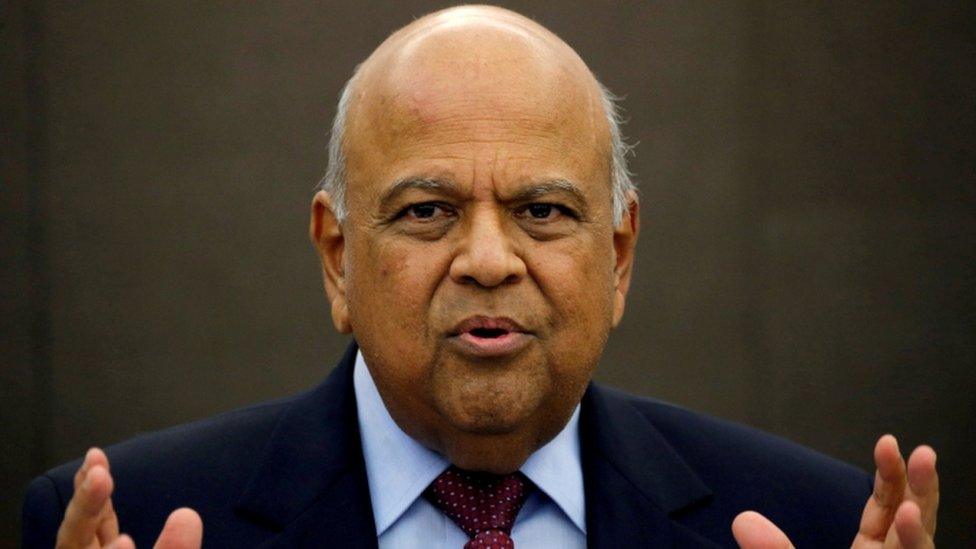

New finance minister Malusi Gigaba says economic change has been too slow

South Africa's credit rating has been cut to junk status by the ratings agency S&P Global.

The agency said that political upheaval, including the recent sacking of finance minister Pravin Gordhan, was endangering the economy.

S&P also expressed concern over government debt, and in particular the expense of supporting the state energy firm Eskom.

The news put more pressure on the rand, which was down 2% against the dollar.

The sacking of Mr Gordhan, seen as a safe pair of hands and with a reputation for financial prudence, led to a 4% fall in the rand on Friday and prompted strong criticism.

His replacement as finance minister by Malusi Gigaba was part of a cabinet reshuffle by President Jacob Zuma.

However the country's deputy president, Cyril Ramaphosa, called Mr Gordhan's sacking "totally, totally unacceptable" and Gwede Mantashe, secretary-general of the ruling African National Congress (ANC), also opposed it.

The financial downgrading is likely to make it more expensive for South Africa to borrow money on the international markets, as lending to the country would be seen as riskier.

'Trust eroded'

S&P explained its decision, stating that: "Internal government and party divisions could, we believe, delay fiscal and structural reforms, and potentially erode the trust that had been established between business leaders and labour representatives (including in the critical mining sector)."

"An additional risk is that businesses may now choose to withhold investment decisions that would otherwise have supported economic growth," S&P added.

The agency also raised concern about the level of borrowing by state energy firm Eskom.

The government guarantees 350bn rand ($25bn) of its debt, which is equivalent to about 7% of the nation's economic output.

For his part, Mr Gigaba spoke at the weekend of plans to "radically transform" the country's economy.

While he has a track record of policymaking, most recently as home affairs minister, he lacks a background in economics.

That prompted criticism that Mr Gigaba was too inexperienced for the job.

In 2014, the ANC adopted "radical economic transformation" policies to boost the economic position of the black majority in the post-apartheid nation.

But many in the ruling party believe the process has been "too slow and in many instances superficial", said Mr Gigaba on Saturday.

"The ownership of wealth and assets remains concentrated in the hands of a small part of the population," he said.

But Mr Gigaba added that he did not "seek to implement a reckless lurch in a particular direction".

"We will stay the course in terms of the fiscal policy stance approved by government," the new minister said.

South Africa's economy expanded by 0.3% in 2016, compared with 1.3% in the previous year.

Junk status

S&P lowered its credit rating on South African government debt from BBB- to BB+, which makes the debt "non-investment grade" or "speculative", or in the shorthand term, "junk".

If another ratings agency follows suit, many international investment funds, under their owns rules, will be unable to lend to the South African government by buying its bonds, which are glorified IOUs.

On Monday, Moody's Investors Service placed South African government debt on review for a possible downgrade.

Like S&P it expressed concern over the political upheaval: "Moody's could downgrade South Africa's issuer rating if the rating agency were to conclude that recent events signalled a deterioration in the effectiveness of government or in the credibility of its policy-making."

- Published1 April 2017

- Published31 March 2017

- Published31 October 2016

- Published11 October 2016

- Published23 August 2016

- Published22 September 2016

- Published9 July 2024