Pound soars and FTSE 100 tumbles after election announcement

- Published

- comments

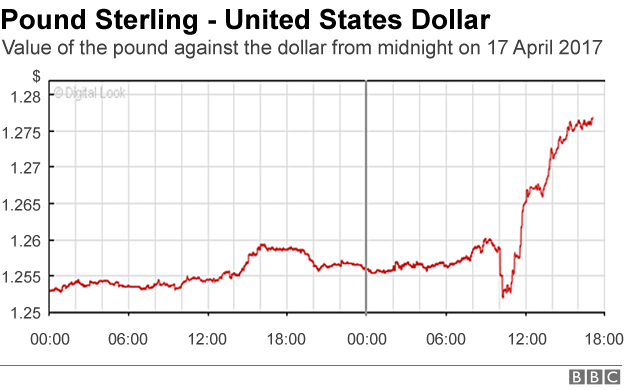

The pound rose strongly and share prices in London fell sharply after Theresa May announced plans to call a general election on 8 June.

Sterling had fallen before the statement, but it quickly recovered following Mrs May's announcement.

The pound charged 2.2% higher at $1.2846 and rose 1.4% against the euro to 1.1968 euros.

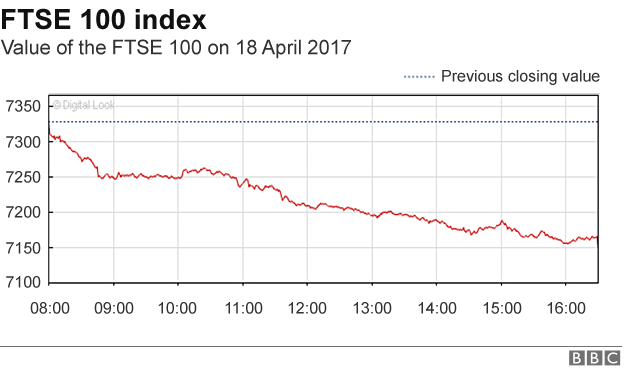

On the stock market, the benchmark FTSE 100 share index fell 180 points, or 2.5%, to 7,148.

That left the blue-chip index at its lowest level for nearly 10 weeks and meant the FTSE 100 was just 0.2% higher than at the start of the year.

The FTSE 100 had already been lower ahead of Mrs May's announcement, with shares in mining companies suffering some of the biggest falls due to lower iron ore prices.

Simon Jack: City's relaxed reaction to election surprise

But the increase in the pound hit the FTSE down further as many of the companies listed on the index make most of their revenues abroad.

A stronger pound cuts the value of these revenues when they are converted back into sterling, meaning lower profits.

Laith Khalaf of Hargreaves Lansdown, said: "Currency markets have roared their approval for a snap UK election, with the pound enjoying strong gains against the dollar and the euro.

"The fall in the stock market is not a negative response to the UK election per se, rather it is a knock-on effect of a surging pound, combined with price falls in some key commodity markets, all of which has taken its toll on the heavyweights of the FTSE 100 index."

The rise in sterling took it to its highest point for 10 weeks, although the pound still remains well below levels seen before the UK's Brexit vote last June.

One of Europe's largest investment banks, Deutsche Bank, said the news of the forthcoming UK election meant it would not be so downbeat about the outlook for the UK and its currency.

"It makes the deadline to deliver a 'clean' Brexit without a lengthy transitional arrangement after 2019 far less pressing given that no general election will be due the year after," its analysts said.

Deutsche also argued that if the election gave the Tories a bigger majority, this would strengthen Theresa May's negotiating stance, and it would "dilute the influence of MPs pushing for hard Brexit".

All this, the bank said, reduced the "crash risk" of Brexit negotiations.

Luke Bartholomew, of investment firm Aberdeen Asset Management, said: "The election should hand Theresa May a much bigger mandate to stand up to the harder line, anti-EU backbenchers which currently hold a disproportionate sway over her party's stance on Brexit.

"That would be welcomed by financial markets," he added.

However, Neil Wilson, of ETX Capital, said: "For investors [the snap election] adds another layer of complexity to an already uncertain picture for UK and European assets.

"Volatility is likely to remain elevated over the coming weeks. And as elections are so unpredictable, there is always the outside risk it could spark a reversal in the entire Brexit process."

- Published18 April 2017

- Published18 April 2017

- Published18 April 2017

- Published18 April 2017