Financial Conduct Authority concerned over personal debt

- Published

Personal debt levels are high enough to merit the whole sector coming under the microscope of the UK's financial regulator, the head of the Financial Conduct Authority (FCA) has said.

FCA chief executive Andrew Bailey said that the cap on payday lending had protected consumers.

Now the whole of the high-cost credit market needed examination, rather than "picking off" specific issues, he said.

The FCA is launching its mission statement for this financial year.

The documents, external have considerable focus on personal finances - including plans to protect vulnerable customers, a study of long-term savings, and the completion of compensation for the mis-selling of payment protection insurance (PPI).

The deadline for PPI claims is August 2019 and the FCA is overseeing an awareness campaign to ensure pay-outs are claimed.

Andrew Bailey is the chief executive of the FCA

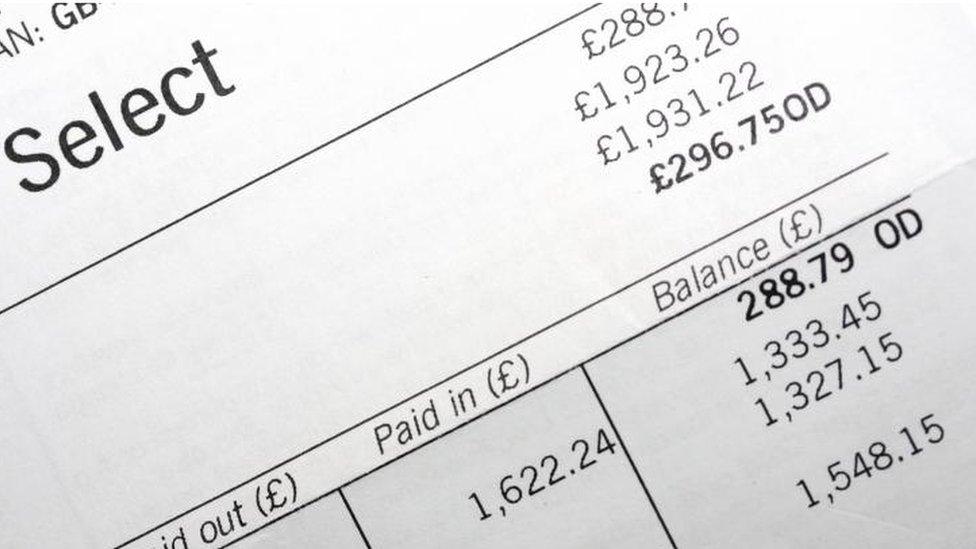

Mr Bailey said there had been a big increase in consumer borrowing, such as loans, overdrafts, credit card debt and car finance.

This echoes concerns raised by the Bank of England. Its Financial Policy Committee said there had been an acceleration in debt last year.

Consumer credit lending is still less than 10% of all lending by UK banks to household borrowers. It is also far smaller than mortgage lending, which amounts to 70% of loans to households.

But UK lenders stand to lose much more on their consumer credit loans if there is an economic downturn and their borrowers default on their credit card and other personal loans.

A Lords committee also recently called for stronger controls such as a cap on "rent to own" products.

The FCA is already conducting is own inquiry into overdrafts, door-to-door lending and other forms of "guaranteed" loans.

This includes considering whether a compulsory limit should be placed on overdraft charges. Consumer groups have consistently argued there should be one in place.

Post-Brexit

The FCA's mission statement also signals it is aiming to remain "flexible" in its response to Brexit.

"The UK's decision to leave the European Union creates uncertainty for both the UK's financial industry and the FCA," Mr Bailey said.

"Both we and the government are keen to ensure that the financial services industry remains resilient and well placed to meet users' needs and thus make the most of opportunities in a post-Brexit world.

"Leaving the EU inevitably creates a higher risk of disruption to our business plan priorities."

Mr Bailey was asked on the BBC's Today programme whether he would be happy regulating firms in the City if the UK had no say in making the European rules that firms in London may have to adhere to.

"We can't just be a rule taker, that frankly doesn't work for any country," he replied.

- Published3 April 2017

- Published25 March 2017

- Published3 November 2016