Elliott Management: The hedge fund not afraid of a fight

- Published

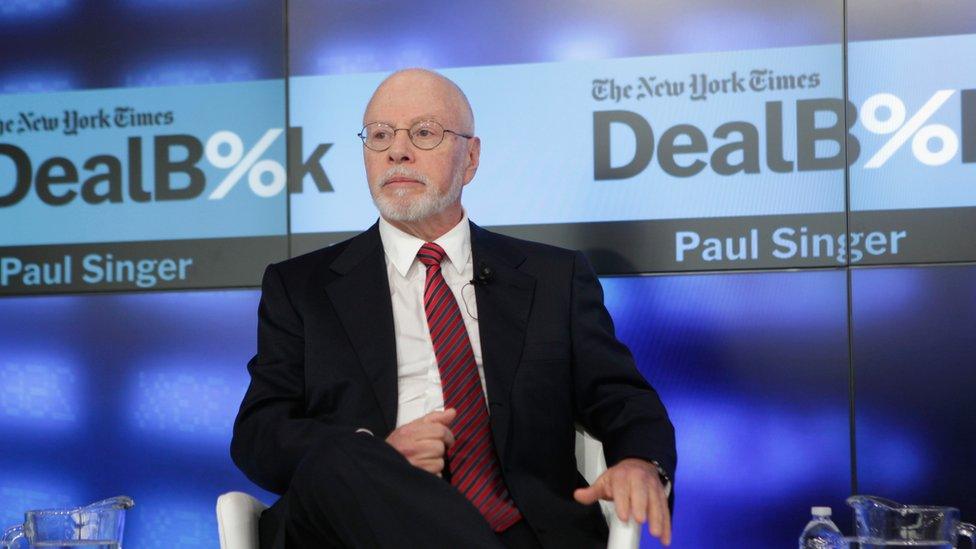

Paul Singer, founder of Elliott Management, warned of the 2008 financial crash

Amid a spate of high-profile fights in the business world, one New York hedge fund has thrown a lot of punches.

Elliott Management, which oversees more than $31bn (£22bn) worth of assets, has earned a reputation over 40 years as a no-holds-barred activist investor, with an unusually large appetite for public face-offs.

The firm famously pursued Argentine debt for more than a decade, seizing one of the country's naval ships while it was docked in Ghana and prompting the country to default.

It has taken on some of the world's biggest companies.

In the UK, it intervened in coach operator National Express and fought supermarket Tesco for damages stemming from a 2014 accounting scandal.

Elliott pushed Australian mining giant BHP Billiton to reorganise and last year, BHP agreed to sell its US shale business, one of Elliott's recommendations.

It has also pressured South Korea giant Samsung to restructure.

Meanwhile, AkzoNobel successfully fended off a takeover and reached a truce with Elliott, committing to improvements that included the sale of its chemicals business.

Now it has struck again, this time buying a 6% stake in Whitbread. Reports say Elliott wants Whitbread to split its coffee chain from its hotel business.

"They're renowned for being very involved and active," says Josh Black, editor-in-chief of Activist Insight, which tracks shareholder activism. "Just by virtue of their size… they're able to cope with more public situations at any one time."

Family firm to hedge fund giant

Founded in 1977 by Paul Singer, Elliott launched with $1.3m.

Singer, a New Jersey native who trained at Harvard Law School, described it at the time as a "tiny, little friends-and-family" firm.

Assets under management have risen sharply since, to about $19bn in 2012 and $31bn today. Its investor include very wealthy private individuals, sovereign wealth funds, foundations and pension funds.

The hedge fund, which has had a base in London since 1994 as Elliott Advisors, has said it's only lost money twice - in 1998 and 2008.

Costa owner, Whitbread, is the latest firm to attract the interest of Elliott

The firm's success has vaulted Singer into the ranks of the mega rich, with a net worth that Forbes estimates at $2.7bn. The 72-year-old Wall Street titan has also reportedly jammed with rocker Meat Loaf.

A supporter of gay rights and Jewish charities, Singer has also attracted attention for his politics.

He's put millions into Republican causes, backing the failed presidential campaigns of Mitt Romney, Marco Rubio and Rudy Giuliani.

Last year, he said Donald Trump's anti-trade policies would lead to a global depression, but he opposed new financial rules introduced under former President Barack Obama and is likely to support some of the changes contemplated by the new regime.

Varied strategies

His firm's investment strategies range widely, from buying distressed debt, to intervening during mergers. It often targets companies where it believes the stock is undervalued, pushing for leadership changes, spin-offs, or share buybacks, which boost share values for existing stockholders.

Critics compare the firm to a vulture capitalist, with a focus on short-term wins in its own interest. In 2014, French regulators fined Elliott for insider trading, external.

Politicians worried about jobs in their districts are among those pushing back on some of the firm's recent efforts.

Singer has rejected those characterisations.

"I believe in a balance of power," he said at a conference in 2016, external. "There's a whole industry of people to protect corporations, an industry devoted to saying that long-termism is a valuable, moral thing and short-termism is bad.

"There are activist strategies that are destructive and harmful... but we think the things that we have done have added to stakeholder value."

Elliott itself has made demands on dozens of companies in recent years, turning its attention beyond the technology firms that were once its primary focus. The firm has also branched out its partnerships, working with a private equity firm in at least one instance and taking a large stake in Bentham Ventures, a firm focused on shareholder lawsuits.

"That's all quite new," Black says.

- Published22 March 2017

- Published6 October 2016