BP profits helped by higher oil prices

- Published

The recent increase in oil prices has helped BP to record a healthy profit for the three months to March.

The $1.4bn (£1.1bn) profit,, external on the replacement cost measure, compared with a $485m loss a year earlier.

Oil prices have been about 35% higher in the first three months of 2017 compared with a year earlier, boosting revenue from BP's core oil and gas production division.

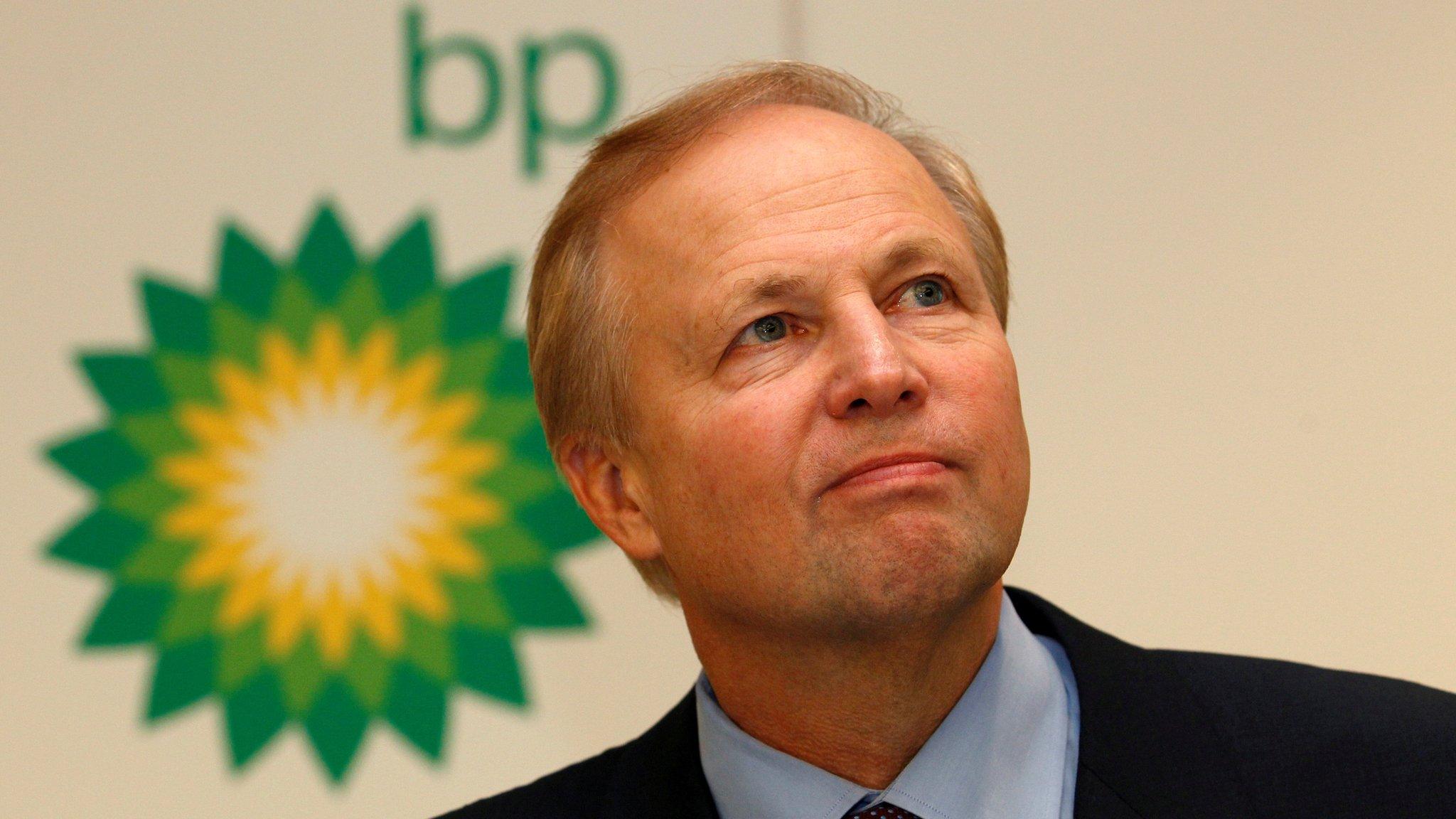

BP chief executive Bob Dudley said: "Our year has started well."

He added: "BP is focused on the disciplined delivery of our plans. First quarter earnings and cash flow were robust."

New projects

Underlying replacement cost profit - the company's preferred measure - was $1.5bn compared with $532m a year ago.

And operating cash flow rose to $4.4bn from $3bn a year earlier

Reported oil and gas production was 5% higher than same period in 2016.

BP held the quarterly dividend at 10 cents. Given the size of BP, the payout is watched closely by investors.

The London-based giant is set to begin eight projects this year - including in Oman and Azerbaijan - the largest number in its history in a year.

Meanwhile, it hopes to add 800,000 barrels a day of new production by the end of the decade.

"Rising production from new upstream projects is expected to drive a material improvement in operating cash flow from the second half of 2017," BP said in its results statement.

Michael Hewson, chief market analyst at CMC Markets UK, said:, external "Earlier this year BP management raised the price it needed oil prices to be to $60 a barrel to break even, after reporting an annual loss of $542m in its oil and gas upstream division at the end of the last fiscal year.

"Though Brent crude prices did get close to that $60 level in February they have struggled ever since, despite the output freeze by Opec that is due to be reviewed later this month."

Pay row

The figures come after strong earnings from US peers ExxonMobil and Chevron last week as the oil industry benefits from a rebound in crude prices, which hit near 13-year lows in early 2016.

Royal Dutch Shell is also expected to post a leap in profits when it reports later this week.

Last month, BP slashed Mr Dudley's 2016 pay package by 40% and cut his maximum earnings by $3.7m.

Its annual report showed Mr Dudley's pay was reduced to $11.6m as it looked to head off a repeat of last year's shareholder revolt against his remuneration.

- Published6 April 2017

- Published3 April 2017

- Published7 February 2017