Banks 'must show action' in fraud cases

- Published

Banks must take "meaningful action" to tackle the threat of customers losing "life-changing sums of money" to fraudsters, a consumer group has said.

Consumer group Which? says banks have made little progress in protecting people from so-called push fraud.

Victims are conned into transferring money to the accounts of fraudsters, believing they are legitimate firms.

The banks' anti-fraud group said it had a clear action plan which was being worked through.

Extra protection

The issue of bank transfer scams was raised by Which? last year when it submitted a "super complaint" - a legally-backed demand for a review - to the Payment Systems Regulator (PSR).

Which? wanted banks to refund consumers in cases where victims had accidentally transferred money to a fraudster, similar to the protections provided on credit card transactions.

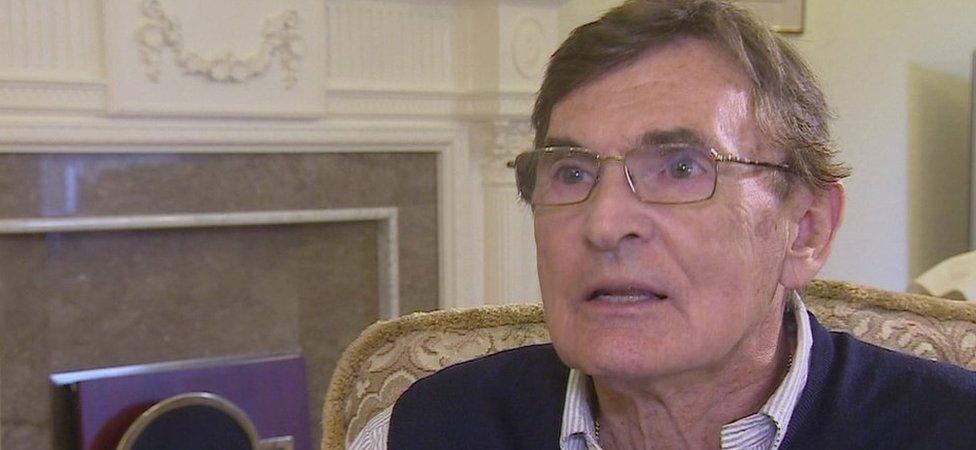

Christopher Mills accidentally transferred £10,000 to a fraudster

In one example highlighted by Which?, Christopher Mills, from York, was tricked into paying a £10,000 house deposit to a fraudster who posed as his estate agent. The bank refused to cover his loss.

More recently, BBC News revealed a civil action was being prepared aimed at trying to recoup the losses of Santander customers caught out by fraudsters.

Campaigner Richard Emery claims a loophole in Santander's system was exploited by fraudsters to direct people into transferring money. Santander refutes any claim of a loophole.

The PSR's initial findings following the Which? super-complaint stopped short of recommending automatic compensation for victims of fraud.

However, it did say that banks should be doing more to combat this type of fraud.

Specifically, this included a demand for a common approach from banks in tackling fraud and the collection of more data on the issue.

The PSR's full report into the issue is not expected until late August or early September.

Action plan

Which? said that, in the meantime, there was not enough evidence of banks taking "meaningful action".

In a new letter to banks, it is demanding that they outline what has been done so far.

Gareth Shaw, money expert at Which?, said: "Despite the fact that consumers are still losing life-changing sums of money to fraudsters, it is not clear what meaningful action the banks have taken to protect their customers.

"People assume that banks will look after them and their money. So it is vital that the industry, regulator and next government act quickly and decisively to tackle financial fraud. Failure to do so will continue to leave consumers paying the price."

But a spokesman for Financial Fraud Action UK, which coordinates the banks' anti-fraud strategy, said: "We have agreed a clear action plan with the regulator on push payment fraud and the industry is working hard to deliver this to the agreed timetable.

"The PSR has already stated it will review progress in the second half of 2017.

"Across the industry, and with partners, we are developing new processes to help police intervene when potential victims visit a bank branch, and we are exploring new ways to track stolen funds moved between multiple bank accounts. We are also running our largest ever fraud awareness campaign."

How to protect yourself against "push" fraud

When you transfer money from your bank account, you are asked to enter three pieces of information: the name of the payee, their account number, and the sort code. However, only the last two are cross-checked by the bank. So putting in the correct name is no guarantee that person will get the money.

Financial Fraud Action UK offers the following advice:

Never disclose security details, such as your PIN or full banking password

Don't assume an email, text or phone call is authentic

Don't be rushed - a genuine organisation won't mind waiting

Listen to your instincts - you know if something doesn't feel right

Stay in control - don't panic and make a decision you'll regret

- Published5 May 2017

- Published20 September 2016

- Published23 September 2016