RBS settlement has left business couple feeling 'gutted'

- Published

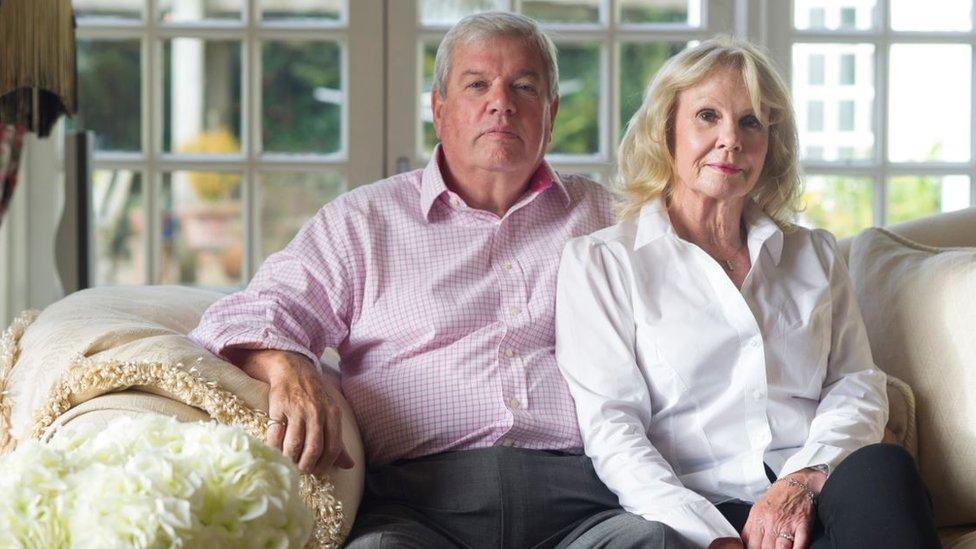

Diane and Mike Hockin said they felt they had no option but to settle with RBS

A couple say they still feel "gutted" after settling with Royal Bank of Scotland for allegedly mis-selling them a financial insurance product.

Mike and Diane Hockin had been claiming £30m in damages after losing their property business in 2012.

Mr Hockin told the BBC's Wake Up to Money that he had wanted to expose the bank on behalf of other small businesses, but felt he had to settle.

RBS has admitted no liability and the final amount has not been disclosed.

The two sides reached an agreement three days into a five-week trial earlier this month, ending a four-year legal battle.

"I was gutted, I didn't want to (settle) because I don't feel that justice has been done," Mr Hockin told the BBC.

"It's not us, it's hundreds of small businesses who have been completely stuffed by this crowd and we weren't able to completely expose them because it would have put us in jeopardy basically.

"I made the decision to call it a day but I wasn't happy. But I really had no choice with it," Mr Hockin said.

Restructuring businesses

A number of small business owners have claimed RBS pushed them towards its former turnaround division known as the Global Restructuring Group (GRG).

They then alleged it attempted to profit from their problems by charging them high fees and buying their properties at discounted prices.

The Financial Conduct Authority is investigating GRG but has cleared RBS of trying to deliberately profit from those business transferred to it.

Mike and Diane Hockin are still angry at their treatment.

RBS has admitted some shortcomings in the level of service it provided and has set aside £400m to compensate affected small business owners

The Hockins ran London and Westcountry Estates, a commercial property business based in Plymouth, with hundreds of small business tenants across 27 business parks.

They had banked with RBS for years, and as the business grew, so did their debts - reaching £55m by 2008.

Financial Crisis

That year they took on an insurance product called an interest rate swap that was designed to protect against the impact of rising rates on their repayments.

But during the financial crisis interest rates plunged to record lows which meant the company incurred extra heavy repayments.

This put the company under pressure and it was moved into GRG.

London and Westcountry's debt was later sold on to another company, Isobel Assetco - 75% owned by RBS - which appointed administrators in 2012.

RBS strongly contests the allegation that it caused London and Westcountry to fail, arguing in court papers that the business had prior experience of interest rate hedging products.

It said the company went to GRG because the downturn had caused cash flow problems and it had too much debt.

Mr Hockin said: "People say to me, 'you've been paid out'. But I'm still angry - what makes me angry is this has gone on for eight years.

"It's been completely deceitful. It's been done by a government-sponsored bank with effectively my money, it's cost a fortune and our business was a good business, a perfectly good business."

Court costs

The Hockins' legal fight began with an action against the accountancy group EY. As administrator, EY held the right to sue RBS, but would not pass that on to the Hockins until it was forced to do so in a 2014 court judgement.

Mrs Hockin said: "Until the assignment court (the EY case) we spent about £250,000 and then subsequently the costs have risen greatly to circa £12m.

"The RBS solicitors kept going back to court and each time you go to court it costs you a fortune.

"We went to mediation in September which was an absolute total waste of time - and that's £100,000. The costs are horrendous," she said.

The case was initially funded by a large inheritance, but the couple then turned to a litigation funder, which invested in the case in the hope of securing high returns if the case was settled.

In a statement RBS said: "We have a duty to act in the best interests of all of our shareholders, including the UK taxpayer. We had strong defences to this claim and were thus prepared to defend ourselves vigorously in court."

"We are pleased to have resolved this matter, with no admission of liability. The settlement allows the bank to minimise material litigation expense and management distraction."

- Published10 January 2017

- Published19 April 2017