Debt fears remain despite manifesto 'breathing space' plans

- Published

How much household debt do we owe?

People in serious debt can expect more legal protection from bailiffs, charges and interest after pledges in the major parties' manifestos.

The Conservatives and Labour have vowed to extend a "breathing space" scheme used in Scotland to allow people time to organise repayments.

Others, including the Lib Dems, want more regulation in the debt sector.

There is widespread concern over the levels of personal debt among working households.

Warnings

The City regulator - the Financial Conduct Authority (FCA) - has warned of an acceleration in consumer borrowing, such as loans, overdrafts, credit card debt and car finance. This echoes concerns raised by the Bank of England.

The total amount of consumer debt tops £1.5 trillion. Although this is dominated by mortgage borrowing, there is a vast array of debt products creating concern.

A Lords committee also recently called for stronger controls such as a cap on "rent to own" products.

Car sales have boomed in recent years

The FCA is already conducting is own inquiry into overdrafts, door-to-door lending and other forms of loans. Consumer groups have consistently argued there should be an overdraft cap in place.

The regulator estimates that 3.3 million people are in persistent credit card debt.

The biggest focus in recent times has been on car finance deals. The value of finance deals used to buy new cars has soared to a new monthly record, according to latest figures, with motorists having spent £3.6bn on deals in March.

'Dangerous'

The fear is that households, with a regular but stagnant salary, are using their income to fund an increasing amount of debt, leaving them at risk if interest rates were to rise from historic lows.

Mike O'Connor, chief executive of debt charity StepChange, said: "In addition to better protections for people in debt, the next government should commit to action to prevent the 8.8 million people currently showing signs of financial difficulty from falling into serious hardship.

"It should work to ensure better alternatives to dangerous forms of high-cost credit, and it should act to help families build up savings to insulate them from problem debt."

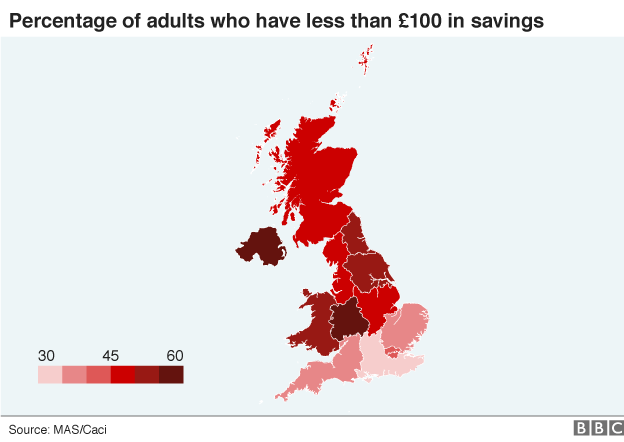

More than 16 million people in the UK have savings of less than £100, according to the Money Advice Service, leaving them further exposed to a financial shock.

In five areas - Northern Ireland, the West Midlands, Yorkshire and Humber, North East England and Wales - more than half the adult population has savings below £100.

There is a risk to UK economic stability too, with lenders standing to lose much more on their consumer credit loans than they would on mortgage lending if there is an economic downturn and their borrowers default on their credit card and other personal loans.

Proposed action includes:

A commitment from Labour and the Conservatives for a legal right to "breathing space", echoing the Scottish system in which borrowers can apply to have six weeks free from further interest, charges or debt collection to get debt advice and set up a repayment plan

Widespread pledges across political parties to tackle financial exclusion

FCA proposals that could mean credit card companies cancelling any interest or charges in extreme cases

An investigation by the regulator into car finance deals, over worries about a "lack of transparency, potential conflicts of interest and irresponsible lending in the motor finance industry"

StepChange welcomed the breathing space scheme for those in serious debt - but said this should be extended to a year.

It said this would allow those in debt owing to issues such as family breakdown or a reduction in working hours to be allowed time to rebuild their income to prepare to repay what they borrowed.

Campaigners have also called for greater protection for those facing mental health difficulties, particularly regarding store cards and "impulse" borrowing.

Polly Mackenzie, director of the Money and Mental Health Policy Institute, said: "Customers are encouraged to take out complex new credit deals on the spur of the moment, at the front of a queue in a shop or in a few clicks at an online checkout.

"For people with mental health problems in particular this is leading to real financial difficulty, encouraging impulsive spending that can be a symptom of a number of mental health problems, and setting people up in credit arrangements that they often don't fully understand."

- Published21 May 2017

- Published3 April 2017

- Published12 May 2017