Investment groups tell investors to give up tobacco industry

- Published

Four international investment groups have called on investors to quit the tobacco industry.

Axa, Calpers, Scor and AMP Capital have already sold or are selling their tobacco investments.

The companies launched their appeal on the annual World No Tobacco Day (WNTD).

Along with 50 other firms with investments totalling $3.8tn, they have pledged "to openly support the tobacco control measures being taken by governments around the world".

The statement, external reads: "We in the investment community are becoming increasingly aware of the important role we can play in helping to address the health and societal impacts of tobacco.

"We strive within our own scope of action to support the ambition of the World Health Organisation (WHO) in line with our commitment to the positive role finance can play in sustainable development more broadly."

Last year, when Axa announced it was selling its tobacco investments, its chief executive Thomas Buberl told the BBC: "The business case is positive. It makes no sense for us to continue our investments within the tobacco industry. The human cost of tobacco is tragic - its economic cost is huge."

A growing industry

World No Tobacco Day

WNTD is one of eight official global public health campaigns marked by the WHO.

Its Tobacco Fact Sheet, external explains: "Tobacco kills more than seven million people each year. More than six million of those deaths are the result of direct tobacco use, while around 890,000 are the result of non-smokers being exposed to second-hand smoke.

"Nearly 80% of the world's more than one billion smokers live in low and middle-income countries."

In the developing world, tobacco markets are still growing, largely through ignorance of the dangers. A 2009 survey in China, external revealed that only 38% of smokers knew that smoking caused coronary heart disease and only 27% knew that it caused strokes.

More growth

WNTD is the only one of the WHO's health campaigns that pits itself against a specific industry.

The tobacco business remains a formidable adversary. It has been one of the best investments of the last decade, indeed possibly of the post-Second World War era.

The shares in companies listed in the Bloomberg tobacco producers index have risen 351% since 2009, compared with just over 101% for the MSCI global index.

A 2009 survey in China showed only 38% of smokers knew that smoking causes coronary heart disease

Despite the growing aversion of the big investors, many believe there is more growth to come.

Dan Caplinger, of the financial services company The Motley Fool, wrote in January: "As a new year begins, there are reasons to believe that 2017 could be a great year to invest in tobacco stocks."

He goes on to explain that mergers and a move into non-traditional tobacco products, such as e-cigarettes and "heat-not-burn" tobacco products, external, could boost share prices further.

The success of the industry is all the more remarkable, bearing in mind the forces ranged against Big Tobacco.

These include multinational agencies, lobby groups, governments and the global medical establishment, as well as the stark fact, as formulated by the WHO, that "tobacco kills up to half of its users".

Regulations

The regulations are getting tighter, specifically in the way companies can advertise tobacco products. Even so, only 29 countries, representing just 12% of the world's population, have completely banned all forms of tobacco advertising, promotion and sponsorship.

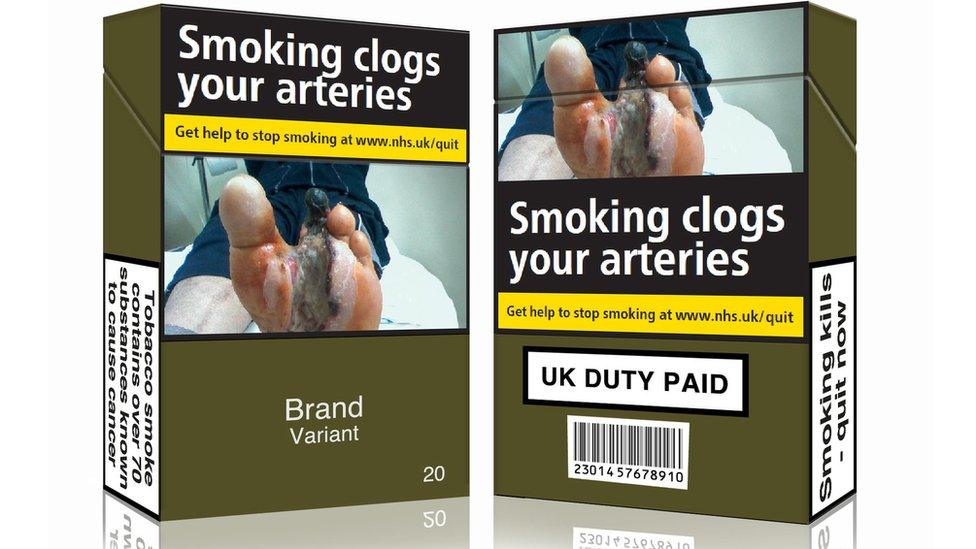

For instance, the European Union's Tobacco Products Directive forced tobacco companies to cover 65% of their packets with health warnings and clamped down on e-cigarette advertising.

The tobacco companies have fought back, complaining that they are being unlawfully deprived of the right to display their brands.

But last month, they lost a High Court challenge in the UK against new plain packaging rules. These mean all cigarette packets must now look the same, with the same green colour, font, size, case and alignment of text on boxes.

The ethical investors

The move by investors against tobacco is part of a wider trend in so-called ethical investing, which seems to be gathering pace.

The US-based Forum for Sustainable and Responsible Investment estimates that there has been 33% growth in what it calls sustainable, responsible and impact investing, external (SRI) over the past two years, and a 14-fold increase since 1995.

Its 2016 report says: "SRI investing continues to expand - now accounting for more than one out of every $5 under professional management in the United States."

The report is only talking about US-domiciled assets, but that's still $8.72tn. Of that, $1.97tn is invested with specific instructions to avoid tobacco and alcohol.

- Published27 April 2017

- Published30 November 2016

- Published17 January 2017