Philippines bank BPI hit by glitch which debited accounts

- Published

The Bank of the Philippines Islands (BPI) says a major system glitch led to customers being hit by unauthorised money withdrawals and deposits.

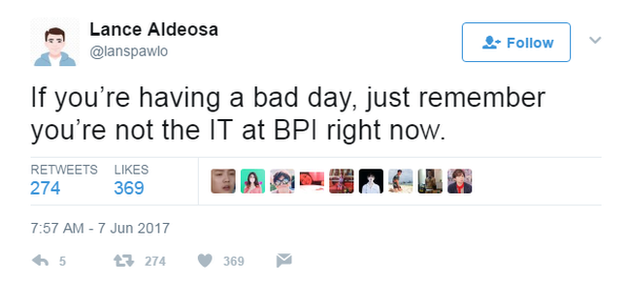

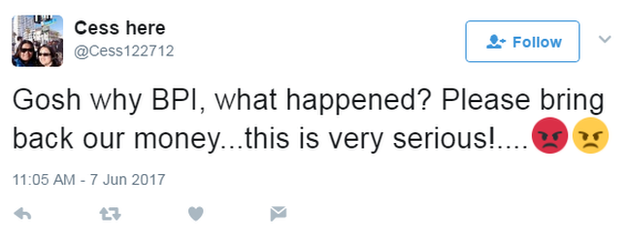

The problematic transactions reached up to thousands of pesos. Some users claimed on social media that their accounts had even gone into the red.

BPI chief executive Cezar Consing apologised on Wednesday morning in an interview with a local TV station.

"This is not a hack, this is an internal issue," he said.

"Over the next few hours, we are making sure the double credits, debits are corrected," he told ANC.

Account holders on social media are claiming to have lost anything from 4,000 pesos ($80; £62) to up to 100,000 pesos.

In a statement posted on Twitter, external, BPI said some clients might have seen their accounts debited twice or credited twice for a past transaction.

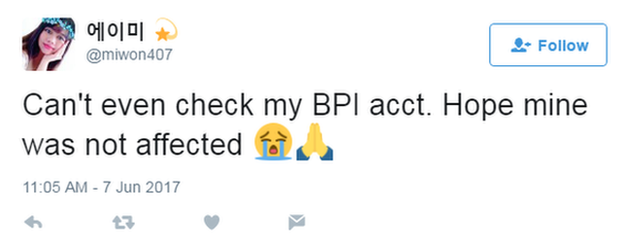

It said they had suspended access to electronic banking while errors were corrected.

However, the move caused other BPI customers to complain they now can't check their accounts to see if they were affected.

BPI had nearly 8 million clients and 1.4tn pesos in total deposits at the end of 2016, according to its latest annual report., external

Shares of BPI fell nearly 2% in early stock market trading in Manila.

The 165 year-old BPI counts Philippines conglomerate Ayala and Singapore sovereign wealth fund GIC among its major shareholders.