Lloyds misses own compensation deadline

- Published

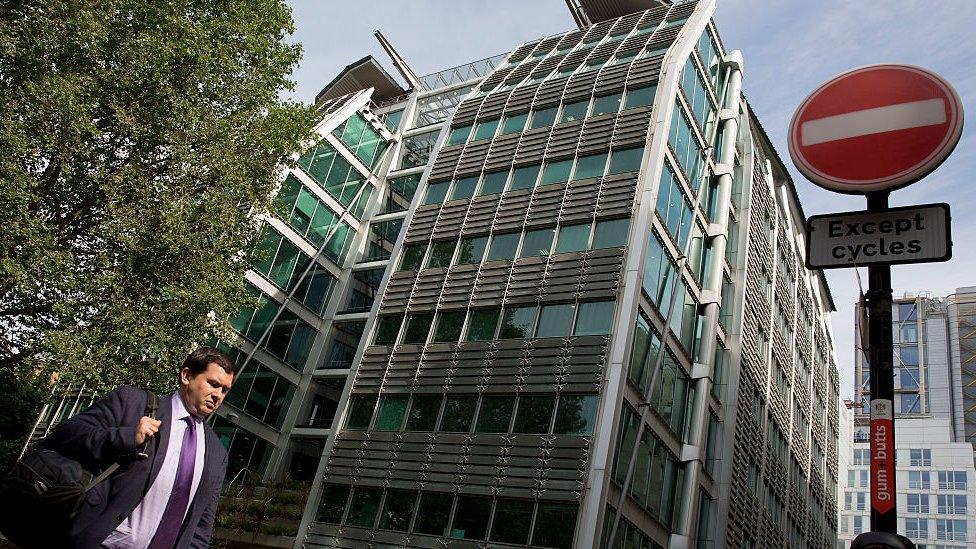

Lloyds Banking Group has expressed its deep regret over the fraud

Victims of a one billion pound fraud at HBOS have criticised Lloyds Banking Group for failing to meet its own deadline for paying compensation.

In the wake of guilty verdicts in a fraud trial that ended in February, Lloyds said it would offer compensation to the victims by the end of June.

However only a small fraction of the £100m it set aside has been paid out.

Lloyds, which bought HBOS in 2009, said many of the victims themselves had asked for more time to prepare.

Lloyds' Adrian White, who is leading the review, said; "Since the end of the HBOS Reading fraud trial, we have been working hard to provide fair, swift and appropriate compensation.

"But, as we have met and spoken with victims, many have asked us for more time. We are disappointed that getting to offers is taking longer than we had hoped, but we are committed to doing everything we can to support those affected as we continue with the review."

Cash and prostitutes

In the HBOS fraud, two corrupt HBOS bankers pressured small business customers into hiring a firm of so-called turnaround consultants called Quayside Corporate Services, led by David Mills.

Mills and his accomplices bribed the bank managers with cash, gifts and prostitutes, then used their relationship with the bank to bully the business owners into handing over exorbitant fees and, eventually, control of their companies. Many business owners were not only ruined but lost their marriages and their health.

Mills and the others, including former HBOS banker Lynden Scourfield, were convicted in January of various charges of fraud, corruption and money laundering between 2003 and 2007.

Dictate

After years of denying any knowledge of criminality, Lloyds Banking Group came under pressure to take responsibility for crimes committed by its own staff. On 27 April the bank said it would offer victims compensation by the end of June.

However, the victims say the bank's compensation scheme isn't impartial. Of the 64 who've joined it, it's understood that fewer than 10 have received offers and only one settlement has been reached. Lloyds has yet to comment.

Dozens more victims have declined to join the scheme amid concern that the bank is seeking to dictate terms, imposing its own compensation scheme rather than consulting them.

'Awful'

Nigel Morgan, whose family lost millions and was driven into bankruptcy following the fraud, says the bank refused to help him with a modest sum to prepare a compensation claim. He says the bank has made no effort to try to reverse the bankruptcy and the trustee in bankruptcy now wants to control the claim for compensation.

"It's been 12 years since we were ruined by this and a very tough 12 years. I thought the bank would be decent enough to admit when it was wrong - but the way they're behaving to the victims is disgusting. The first thing they should have done is to send someone round and apologise unreservedly.

"We're constantly living on the edge, worried we won't keep what we have left; I'm having panic attacks every day. It's just an awful situation."

But Nikki Turner, one of the SME victims who also uncovered the fraud said: "We knew this process was biased and flawed, but now we learn it is also painfully slow.

"Lloyds says there are 67 business owners it knows to be impacted by the HBOS Reading scandal, but we believe it could be at least three times that number. If all are processed in this way, it will take... around four and a half years to finish the review."

- Published7 April 2017

- Published2 February 2017