Thousands may be let down by funeral plans, report warns

- Published

Thousands of people could be let down by poor funeral plans they don't understand, a new report has claimed.

Consumer group Fairer Finance said people who paid for their funerals in advance could find their relatives faced extra costs after they died.

It also accused the industry of high-pressure sales tactics with vulnerable consumers, and claimed there was a danger of some firms collapsing.

The funeral industry itself said it was already campaigning for change.

The Fairer Finance study called for proper regulation of funeral plans, suggesting that the Financial Conduct Authority (FCA) should play a role.

The report , externalwas commissioned by Dignity, one of the biggest providers. It said the scale of unscrupulous sales practices in the market was significant and growing.

However it also says that buying a funeral plan from a reputable provider can provide good value for money, as it locks in current prices.

Shortfalls

The average cost of a pre-paid funeral plan is about £4,000, according to the report.

But many plans do not cover costs such as embalming, limousines, a funeral service, a wake, burial plots or memorial stones.

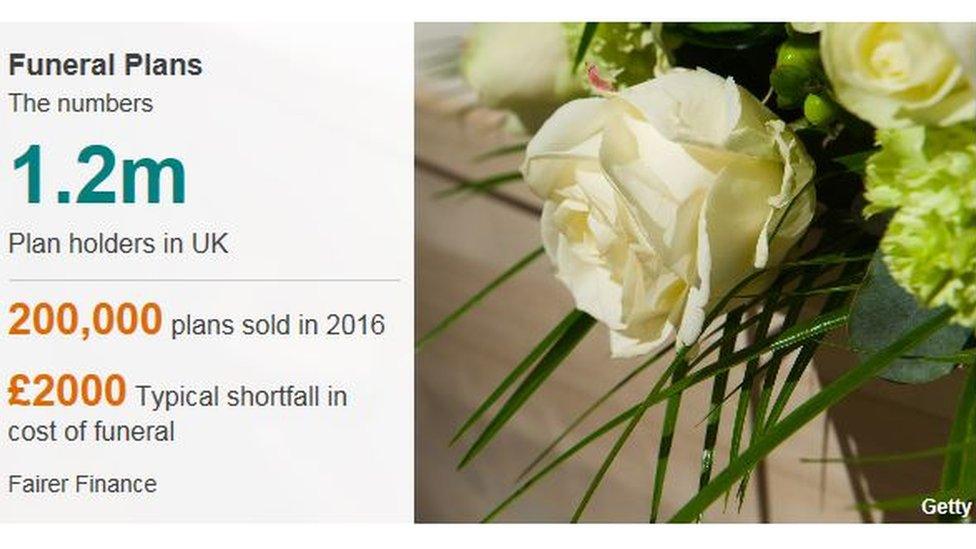

In some cases, families are left having to find an extra £2,000, even though they expect such items to be included.

Many customers buying such plans are elderly or vulnerable, and will not be around to check whether the product met their expectations, Fairer Finance said.

'High pressure' sales

As many as 1.2 million people in the UK have pre-payment plans, and the industry is growing fast - up by 350% over the last 10 years.

Sales representatives have targeted at least six million adults over the age of 50, using what the report describes as "high-pressure" techniques.

Some people have been subject to aggressive telephone marketing or in-home visits, it claimed.

In a telephone survey, nearly half of those contacted by sales reps said they felt as if they had been "pushed" to buy a plan.

In some instances, funeral plan firms pay commissions and fees of up to £1,000 for each policy sold - around a quarter of the total plan cost.

The report also said there was very little transparency over what happens to clients' money after they had paid it.

Regulation

The National Association of Funeral Directors (NAFD) said it had been campaigning for tighter rules since November last year.

"In our view, the current lack of comprehensive oversight is allowing sharp sales practices and a lack of transparency to flourish in parts of the market," said Alison Crake, president of the NAFD.

"Members have reported numerous instances to us where funeral plan providers have not acted in the best interests of either the public who have paid for funeral plans, or the funeral directors who will care for them."

The industry is currently subject only to voluntary regulation, by the Funeral Planning Authority (FPA), and there is no ombudsman service for consumers to complain to.

However, the report argues that funeral plans are financial products and should therefore be regulated by the FCA.