Minimum wage push for gig economy workers

- Published

- comments

Deliveroo's takeaway food riders could be in line for the minimum wage

A government review of the rapidly changing world of work is to demand a radical overhaul of employment law and new guarantees on the minimum wage.

The review is set to call for a new category of worker called a "dependent contractor".

Those workers - likely to cover riders for firms like Deliveroo and Uber - should receive benefits such as sick pay and holiday leave, it will say.

And they will be covered by some of the minimum wage requirements.

This will help clear up the present grey area between a fully employed and a self-employed person - presently called a "worker" in employment law.

The review by Matthew Taylor, the head of the Royal Society of Arts and a former Tony Blair adviser, will outline a structure obliging firms to show that a person working for them can earn at least 1.2 times the present national living wage of £7.50 an hour for over-25s.

The companies will do that by modelling the number of tasks - or "gigs" - an average person working at an average rate can achieve.

An estimated 1.1 million people work in the gig economy.

'New world'

I understand the review, due to be published on Tuesday, has looked at the agriculture sector where "piece work" calculations - how much a crop picker can pick in an hour, for example - work in a similar way.

The review has seen evidence that hourly rates in the sector are set at 1.2 times the national minimum wage.

The review will call for the new "dependent contractor" payment system to be overseen by the Low Pay Commission, the official body which sets the minimum wage.

The review of the new world of work - set up by Theresa May before the last election - has also looked positively at models where gig workers can log on at any time and see "real time" earnings potential.

If the company can only offer enough work to earn, say, £5 an hour, because it is a quiet period, then it is up to the gig worker whether they accept that rate.

They would not subsequently be able to take action against the gig company for not paying the minimum wage, the review will suggest.

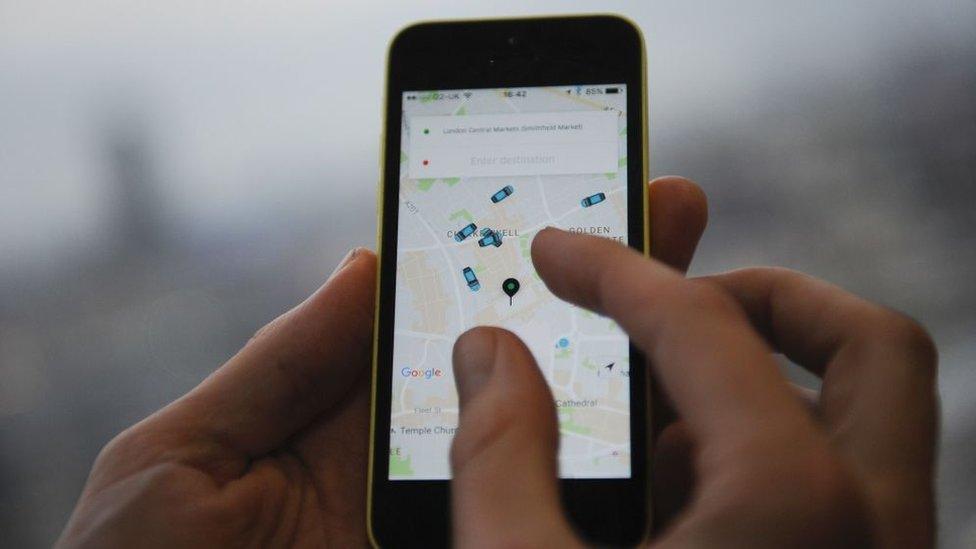

Uber drivers could be classed as 'dependent contractors'

Sources have told me that Mr Taylor and his review panel have been impressed by how many gig firms have transformed the economy both for workers and for consumers.

But Mr Taylor wants to ensure that the relationship between the worker and the digital platform firm is a fair one, offering "two-way flexibility" so that workers receive benefits while at the same time retaining the ability to work when they want.

Firms like Uber, Deliveroo and CitySprint at present insist that their drivers and riders are self-employed and therefore can work when they want.

In return for that flexibility, the workers do not receive the same benefits as full-time employees, such as the guaranteed minimum wage, sick pay, holiday entitlement and pension provision.

'Out of date'

The companies also avoid paying national insurance contributions for the people who work for them.

They have been criticised for exploiting the law on "self-employment" to keep costs down.

Though firms like Deliveroo point out that their riders earn on average between £9.50 and £10 an hour - well above the minimum wage.

Critics say their model also undermines the government's tax base as self-employed people pay lower taxes than the fully employed.

A report by the Trades Union Congress suggested that the Treasury could be losing up to £4bn a year in revenue due to the rapid growth of "insecure" work.

Last week Will Shu, the founder and chief executive of Deliveroo, told me he wanted to offer a wider range of benefits to delivery riders but believed that he was constrained by present-day employment law, which he described as "out of date".

Mr Shu says the law needs to change to catch up with the modern economy

In the BBC interview, Mr Shu said the company would consider paying holiday and pension rights as well as sickness and injury benefits if the law changed.

Sources say that Mr Taylor's report will not name firms but will recognise that the gig economy has raised challenges for the way employment law works.

Uber and the courier firm CitySprint have lost court cases over whether their drivers are truly self-employed or are in fact "workers" who are employed largely by one firm, and therefore should receive more rights.

Turning down work is often not seen as an option by riders and drivers.

It is this category which will become "dependent contractors" if the review's recommendations are implemented.

It could also mean gig firms are obliged to pay national insurance contributions, which they avoid at the moment.

Quality of work

The report goes far wider than the "gig" economy, and also looks at the quality of work on offer.

In an earlier interview with me, Mr Taylor said that the UK had been very good at creating a large number of jobs - which was an economic good - and that now the question was how to make those jobs of a high, and rewarding, quality.

The report will say that the quality of work and enhancing skills should be at the heart of the debate on employment in the UK.

Controversies such as the overuse of zero-hours contracts, for example, also have to be tackled, it will say.

But it will not back Labour's policy of banning zero-hours contracts, saying they are useful for some forms of work where demand fluctuates rapidly, such as organising conferences or in the retail sector.

- Published7 July 2017

- Published7 July 2017

- Published5 July 2017

- Published4 July 2017