UK unemployment drops to 1.49m

- Published

- comments

UK unemployment fell by 64,000 to 1.49 million in the three months to May, official figures show.

It meant the unemployment rate fell by 0.2% to its lowest since 1975, at 4.5%, the Office for National Statistics (ONS) added.

But wage increases continued to fall further behind inflation.

Excluding bonuses, earnings rose by 2.0% year-on-year. However, inflation had hit an almost four-year high of 2.9% in May.

When the impact of inflation is factored in, real weekly wages fell by 0.5% compared with a year earlier.

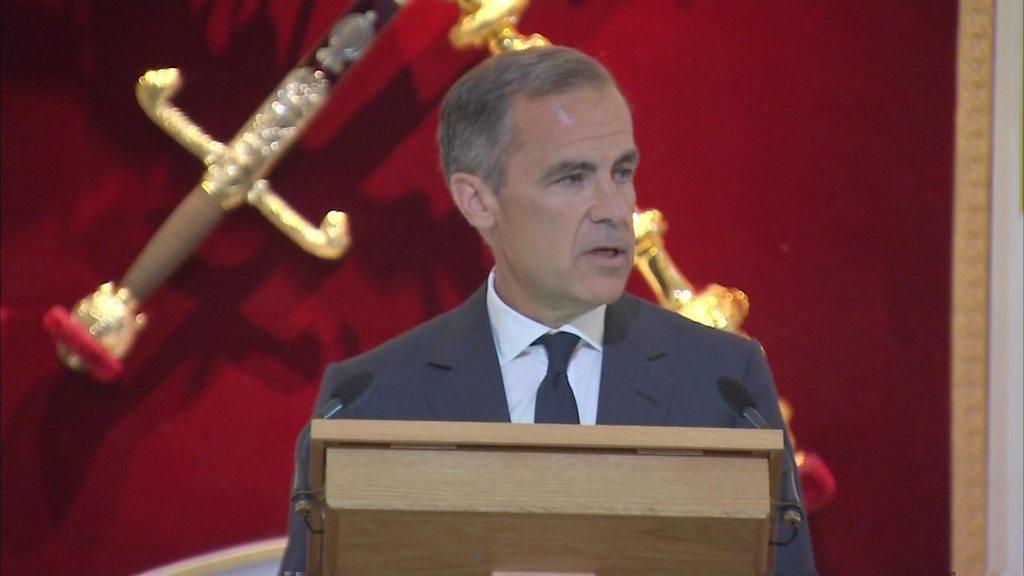

Mark Carney: UK wage growth 'anaemic'

'Picture little changed'

"Despite the strong jobs picture... there has been another real-terms fall in total earnings, with the growth in weekly wages low and inflation still rising," said Matt Hughes, senior statistician at the Office for National Statistics.

Those in work climbed to around 32 million, a rise of 324,000 on last year and the largest total since records began in 1971.

The employment rate rose by 0.3% on the quarter to a record high of 74.9%.

"The general picture is little changed on last month, with the overall employment rate and that for women both at record highs, the inactivity rate at a joint record low and the unemployment rate falling to its lowest since early summer 1975," said Mr Hughes.

The unemployment rate for 16 to 24-year-olds was 12.5%, lower than for a year earlier when it was 13.5%, and well below its highest rate of 22.5% in late 2011.

The sluggish pay data may cause Bank of England officials to think again about the need to raise interest rates, after a narrow 5-3 vote by the Monetary Policy Committee (MPC) last month to leave rates at 0.25%.

MPC to hold off?

"The continued weakness of wage growth provides some ammunition to the more dovish members of the MPC that now is not the time to raise interest rates," said Paul Hollingsworth, UK economist at Capital Economics.

He added: "Given the emphasis that some members of the Monetary Policy Committee, including Governor Carney, have put on wanting to see a clear "firming" in wage growth before they join others in voting to hike interest rates, we still think it is more likely than not that the MPC will hold off for a while longer, rather than raise interest rates imminently."

Meanwhile, Minister for Employment, Damian Hinds said the employment figures were "another reminder that our strong economy is giving record numbers of people the chance to find and stay in work".

But TUC general secretary Frances O'Grady said: "Ministers must set out a plan to get real wages rising across the public and the private sectors."

After trading lower against the dollar, the pound gained ground to trade 0.1% stronger on the day at $1.2858. Sterling also gained 0.1% against the euro, with one pound getting you 1.1217 euros.

- Published29 June 2017

- Published20 June 2017

- Published13 June 2017