Is this the next financial scandal waiting to happen?

- Published

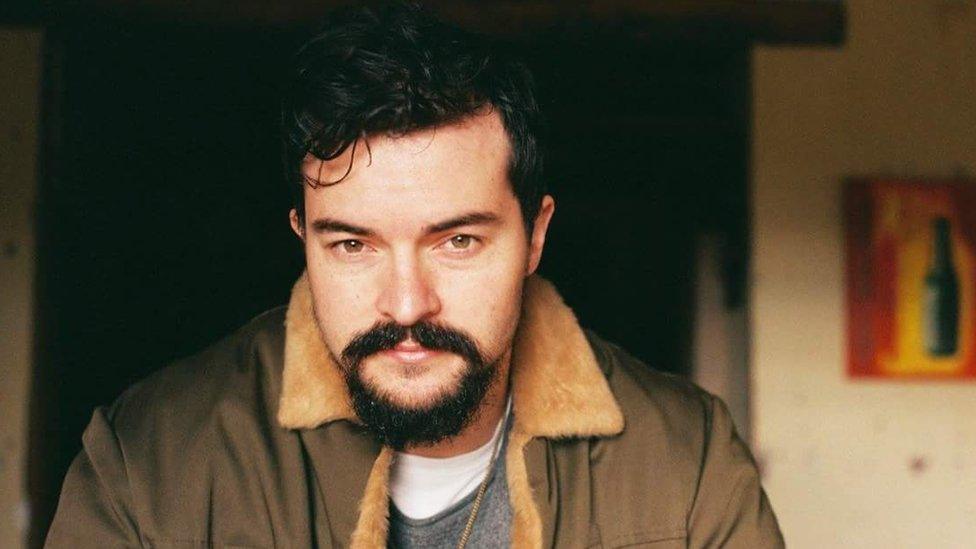

Sean Boulanger says initial coin offerings give small investors a chance to invest in start-ups

A growing number of tech companies are raising funds through initial coin offerings - issuing their own digital currencies for investors to buy. But the practice is completely unregulated. Is another financial scandal just around the corner?

Sean Boulanger, a senior community manager at a Cape Town digital agency, doesn't consider himself a serious investor.

But he came across US tech company Civic, run by fellow South African entrepreneur Vinny Lingham. It was planning to raise money in a way Mr Boulanger had never heard of before.

Instead of issuing shares and floating all or part of the company on the stock market - known as an initial public offering or IPO - Civic decided to issue its own tokens, or digital currency, to help fund the identity verification platform it was developing.

Mr Boulanger was impressed with Civic's product and decided to invest.

"It has allowed me to jump in and invest in a start-up, which is very difficult in this country to do, especially with limited funds," says Mr Boulanger.

"The risk is high, but so is the reward."

Civic raised $33m (£26m) via this initial coin offering (ICO), as it's known.

Civic founder Vinny Lingham says an initial coin offering was the "right thing to do" for his firm

The cost of the new currency is set by the issuing company and investors hold the "coins" in digital wallets, hoping that their value will rise as the company flourishes.

Several other companies developing blockchain-based applications have raised money this way, including Bancor ($153m) and Tezos ($232m) with more than $1bn being raised in total so far this year.

Companies like ICOs because they are quick, easy, and free from regulatory red tape.

"Preparing an ICO takes only weeks and can be targeted directly at the interested investors and customers rather than going through venture capitalists," says Michael Marcovici, a director of Cayman Islands-based Digital Developers Fund.

The Fund is currently offering tokens for sale to raise money for its own investments in crypto-currencies.

But the lack of regulatory oversight is alarming many commentators.

The US Securities and Exchange Commission recently warned investors, external against fake ICOs and "pump and dump" scams, whereby fraudsters spread rumours and false information about potential ICOs in the hope of boosting a company's share price.

Once the share price rises, the fraudsters sell, or dump, the shares at a profit.

Mr Boulanger says he was wary of the negative publicity surrounding scam ICOs before he invested - token launches taking place even before a viable product has been developed, for example.

The 17th Century Tulip mania was the first investment bubble. Could ICOs be the latest?

"I found out that it's really still the Wild West out there," he says.

But so far, at least, he doesn't regret it.

He took the plunge with Civic because he trusted Mr Lingham - a proven entrepreneur and fellow South African who acknowledges that there are risks on both sides.

"This is uncharted territory, but we feel confident that it was the right thing to do for the company," says Mr Lingham, who aimed to make his firm's token sale as transparent as possible to avoid any future allegations of wrongdoing.

"There are unfortunately also many scams operating in this space," he warns.

The worry is that ICOs are creating a classic investment bubble - similar to the Tulip mania in the 17th Century - and attracting fraudsters and hackers to this new, unregulated market.

Nearly 10% (about $150m) of the money invested in ICOs this year using Ethereum - the blockchain-based platform - has been stolen, according to a recent report by Chainalysis, a firm specialising in monitoring crypto-currency transactions.

One of the risks of badly managed ICOs is hackers stealing the digital currency

"There are already stories of fraudsters capitalising on this somewhat irrational exuberance over ICOs," says Gray Sasser of US law firm Frost Brown Todd, a blockchain specialist.

He believes that regulation is inevitable. Indeed, the SEC recently suggested ICOs should be registered in the same way as conventional investments.

But advocates like Mr Marcovici believe investors should be left to carry out their own due diligence.

"There will be attempts [to regulate the sector] that is for sure, but as a manager of a fund I must say that regulations mainly add cost to the investor and reduce the options of investors drastically," he says.

"There will be money lost... but this will be an important step for self-regulation of the market."

Civic's Mr Lingham has no doubt that regulation will eventually come in.

More Technology of Business

"We're in the early days of a very new industry," he says. "I'm very happy to see that places like Zug in Switzerland and Singapore are creating regulatory frameworks for token sales to ensure that they can be controlled and benefit society."

But Mr Sasser fears that it may take a headline-grabbing fraud to force US regulators into action, given the current US administration's antipathy towards more regulation.

The risk for firms that have pre-sold tokens before launching any underlying software, he warns, is that new regulation could raise compliance costs to such an extent that this wipes out any money already raised.

"It is only a matter of time before a disgruntled investor makes a securities fraud claim against an issuer," he says.

"Right now, both investors and issuers are playing without a net."

Follow Technology of Business editor Matthew Wall on Twitter, external and Facebook, external