Hunting rhinos: What Dalian Wanda saga says about China

- Published

"Nobody is safe".

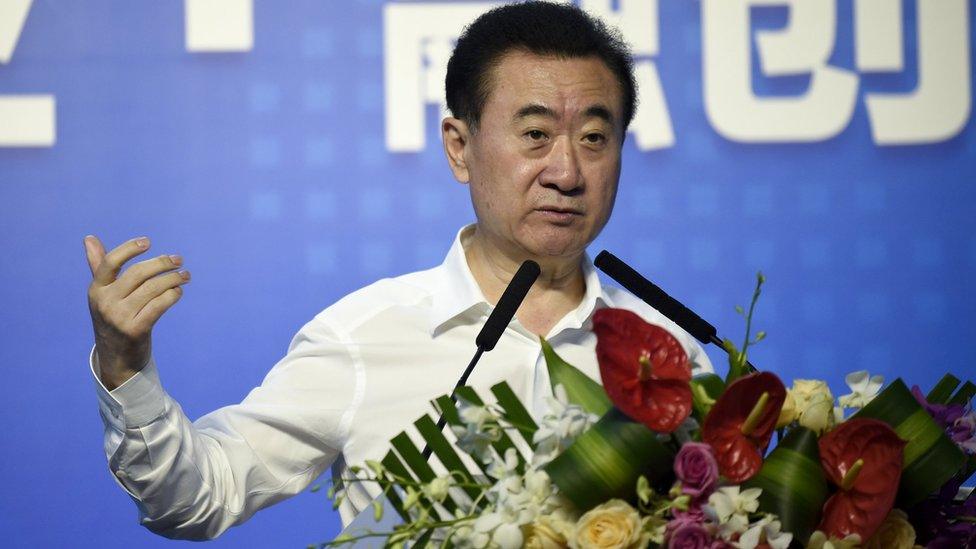

That was the stark assessment a long-time China watcher gave me while discussing what's happening to one of the country's richest men, Wang Jianlin.

Mr Wang, once considered a Beijing favourite, seems to have fallen foul of the establishment.

His business, Dalian Wanda, grew into one of the country's most prominent property developers.

And overseas it has invested heavily too, most noticeably in Hollywood - controlling the AMC cinema chain as well as Legendary Entertainment, co-producer of hit films including Godzilla and The Dark Knight Rises.

'Unpredictable'

But China is now reportedly ordering banks and financiers to stop lending to several high profile firms - including Wanda.

Wang Jianlin wanted his firm to become China's Disney but it has done a U-turn

That forced it to suddenly sell off theme parks and hotels to raise cash and reduce debt. A subsequent rejigging of the deal just added to the picture of chaos.

"The business strategy of the company is changing, and is a bit unpredictable," Cindy Huang from S&P Global Ratings told me.

"Just a couple of weeks ago, the chairman was signing new theme park projects...but then decided to sell off 91% of the company's theme parks to a rival developer. The transaction is unusual."

Rhino hunt

That's putting it mildly. So what could lead a smart and savvy business operator like Mr Wang to make such a seemingly crazy U-turn?

Well there's speculation he couldn't do much else. Certainly if reports are to be believed, the clampdown on companies spending money overseas has come from the very top - President Xi Jinping himself.

And that's because while many in the West are concerned about "black swans" - rare, unexpected events that threaten financial markets - China has a different animal in its sights: "grey rhinos".

The term refers to large, visible problems in an economy which are often ignored - until they start moving fast and trampling everything in their wake.

And in this case the term it's being applied to a group of the country's corporate giants which despite growing so big and borrowing so much, were seen as untouchable because of their political connections.

But not any more.

A recent front page report, external in state mouthpiece People's Daily, warned of the need to avoid these grey rhinos, which as well as Dalian Wanda, also include:

HNA Group - which one of my colleagues recently branded the biggest company you've never heard of

Fosun International - owner of a stake in Cirque de Soleil and controls Wolverhampton Wanderers football club

Anbang Insurance - which came close to buying the Starwood Hotel group last year

Stocks and bonds of these companies fell as investors struggled to make sense of Beijing's new economic priorities.

"No one will touch these companies for a while," Dickie Wong of Kingston Financial Services told me.

"And don't expect these companies to invest or acquire any assets overseas. They will go quiet for a while."

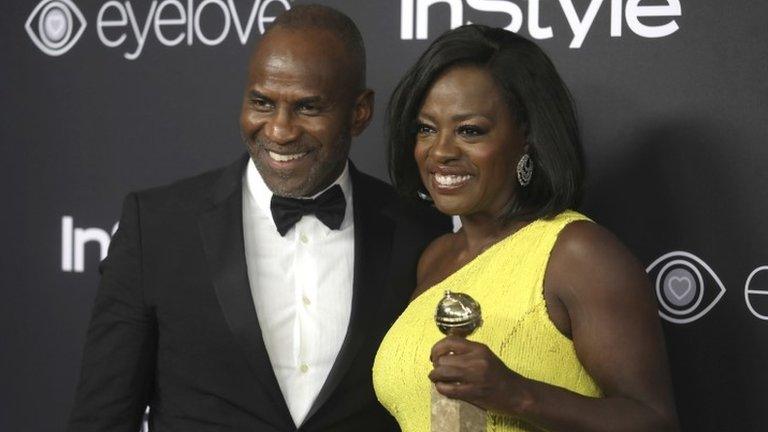

Dalian Wanda's move into the US didn't meet universal approval

'Sympathetic'

In the past though, companies like Dalian Wanda had been actively encouraged by Beijing to go forth and conquer.

As I wrote in a piece last year about Chinese acquisitions, China Inc. went on a spending spree and was among the most active investors in UK, US and Australian property markets.

That splurge fuelled by cheap loans from state-owned banks. The powers-that-be in Beijing approved of this economic colonialism because, frankly, it made China look good.

"I'm a little bit sympathetic to Wanda, HNA and the like," Christopher Balding, an economics and politics professor at Peking University told me.

"Twelve months ago what they were doing was being heavily encouraged by Chinese regulators... because Beijing wanted to improve its soft power. Now, they've clearly fallen into a bit of a mess."

Opening up... in one direction

And this isn't just a Chinese problem.

If China's corporations stop spending cash overseas, then that's that's going to have knock-on effects for the global economy.

Chinese money has helped to push property prices up in many parts of the world (though that's not always a good thing, as those trying to get on the housing ladder in cities like London, Sydney and Melbourne will emphatically tell you).

And if demand dries up as Chinese businesses keep their hands in their pockets, global asset prices may drop too.

But what this really shows, above all else, is a government reasserting control.

And it's doing so in a way that directly contradicts Beijing's claims to be developing an economy more driven by free markets.

That opening up might be happening in one direction - for example allowing money into China through the Bond Connect programme and China's inclusion on the MSCI emerging markets index.

But from Beijing's recent moves, getting money out of China is becoming much harder.

- Published20 July 2017

- Published10 July 2017

- Published13 March 2017