US's Foxconn subsidies stir debate

- Published

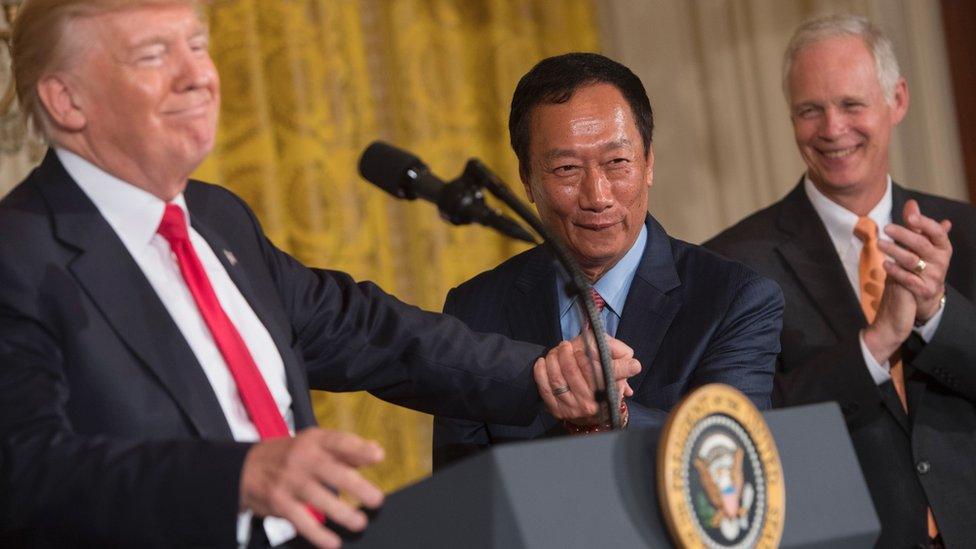

Donald Trump shakes hands with Terry Gou in July after announcing Foxconn's investment

Wisconsin, a state located in the middle of the US on the shores of Lake Michigan, has offered $3bn (£2.3bn) in subsidies to convince Taiwanese manufacturer Foxconn to construct a new plant there.

President Donald Trump and others say the investment will help spur a US manufacturing revival. But as state legislators debate the costs of the proposal, another question looms in the background: will it work?

Foxconn, one of the largest electronics manufacturers in the world, said it expects to invest $10bn over four years in the plant.

It will make liquid crystal display panels - screens for everything from televisions to cars and healthcare equipment.

The firm said it would employ 3,000 workers initially, with the potential for up to 13,000.

Wisconsin leaders say the investment is a once-in-a-century opportunity that will jumpstart a new electronics manufacturing industry in the US.

They see a bright future well worth the $3bn in subsidies that the state is offering in exchange for hiring and spending in the state.

"It is transformational and once in a while, I think it's worthwhile for Wisconsin to do something to take that big leap," said Robin Vos, who leads Republicans in the Wisconsin State Assembly.

The deal got a high-profile endorsement from President Trump, who announced Foxconn's investment last month at the White House, claiming it as a victory for his push to revive US manufacturing.

"We have companies pouring into our country. Foxconn and car companies, and so many others, they're coming back to our country," he said at an event this month.

But critics say Foxconn and the president have histories of making big promises that don't pan out.

They point to Foxconn announcements in places such as Pennsylvania, India and China that have not borne fruit. And they say the subsidy proposal does not have strong enough safeguards if the firm's investment is smaller - and less transformative - than promised.

"How much Kool-Aid do you have to drink to believe that is going to happen?" asked Gordon Hintz, a Democrat, during the debate in the Wisconsin State Assembly.

What's the case for the subsidy?

Foxconn, which employs about one million people globally, told the BBC it was "committed to all of the projects that have been proposed... and have invested billions more to ensure that those investments are realised".

The firm, which works with US companies such as Apple and Tesla, has cast the investment as part of a global expansion that will place it in the heart of one of the world's major markets. It expects to use the plant to create cutting-edge manufacturing systems.

Foxconn, which considered offers from other states before picking Wisconsin, said it always worked with governments on big projects because of the infrastructure needs involved.

"If we are to make large investments, in any location, we need a government partner who is able to commit the levels of support needed to make them economically viable for our company and, in many cases, also for the many other companies whose investments are attracted by the technology manufacturing hub we establish," the firm said in a statement.

Foxconn does much of its manufacturing in China

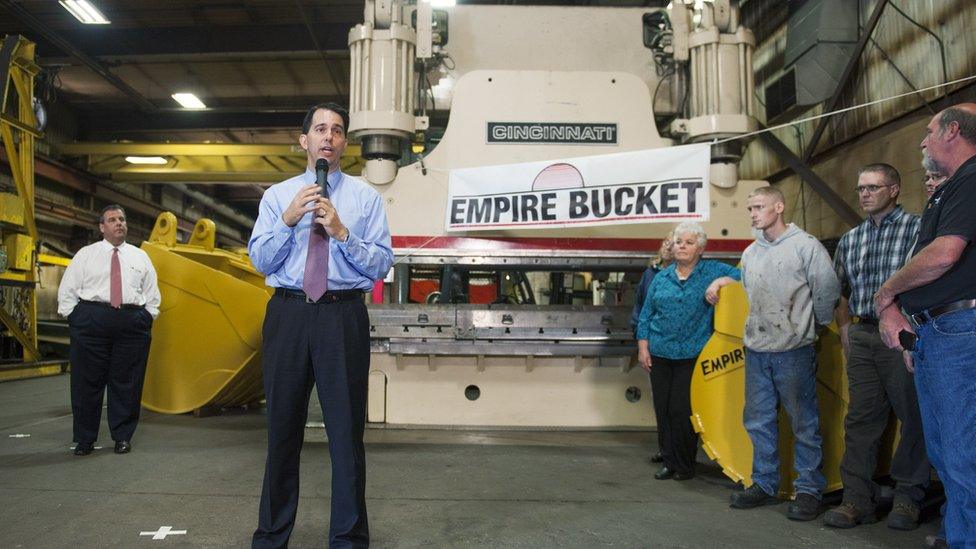

The subsidy package negotiated by Wisconsin Governor Scott Walker, a Republican, has won widespread support from business groups.

Despite fierce debate, it is expected to pass in the Republican-controlled state legislature, where advocates say the deal will help reverse decades of manufacturing job losses and have broad economic impact.

Supporters say benefits are already evident, as Foxconn announces partnerships with local ginseng growers and other companies. Glass-maker Corning is expected to follow Foxconn with an investment of its own.

Daniel Gouge, vice-president of sales at Triangle Tool Corp, says he expects his company to win work from Foxconn if the proposal moves forward and cannot believe the state would hesitate with this type of investment at its door.

"This is a huge win for Wisconsin," he said. "Everyone should be on board."

Donald Trump wants to revive American manufacturing

Analysts said the choice of Wisconsin - which helped secure President Trump's victory in the 2016 election and is home of leading Republican Paul Ryan - underscores Foxconn's political calculation, as it responds to the president's tough-on-trade talk.

Mr Gouge, who voted for Mr Trump in the 2016 election, said he is optimistic Foxconn's plans are a sign that the president's strategy will produce more announcements.

"He may be totally bluffing, but it's working," he said.

What do opponents say?

Environmental groups have raised alarm about exceptions promised to Foxconn as part of the subsidy package.

But the price is the major sticking point, drawing objections even from Americans for Prosperity, which typically supports Republicans.

The Foxconn deal ranks as the fourth-largest subsidy package in the US, behind deals for firms such as aerospace giant Boeing and aluminium-maker Alcoa, according to Good Jobs First, which tracks them.

Assuming that the firm hires 13,000 people, the proposal works out to more than $230,000 a job, not including anything it makes back in the form of new economic activity.

State analysts estimate that Wisconsin would not start collecting any new tax revenue until 2032 and would not break even for more than 25 years.

State officials are negotiating a contract with Foxconn that will outline what the firm must do to receive the money, but critics say they want clearer commitments.

"My constituents want to be assured that these jobs will actually happen," said Todd Novak, one of two Republicans in the Wisconsin state assembly to vote against the deal.

"They want a guarantee, a timetable for making it happen. Without it, I worry about whether this is the best deal for Wisconsin."

Foxconn has invested heavily in automation. Chairman Terry Gou meets one of the firm's robots

Some economists say costs are likely to be even higher than estimated, since the analysis does not include local government expenses that might be triggered by the project or factor in the possibility that many workers will commute from nearby Illinois.

That means the state will probably have to raise taxes or cut other kinds of spending, said Timothy Bartik, a senior economist at the WE Upjohn Institute for Employment Research, a non-partisan research organisation.

"There's not a free lunch here," he said. "The money comes from somewhere."

The money might be worth it if the project is as successful as promised in its broader aim of creating a new industry, Mr Bartik says. But he thinks claims of Foxconn's impact are overblown.

"I'm somewhat sceptical," he said. "When you come down to it, this is a production facility to make flat-screen TVs."

Opponent Carrie Scherpelz, a marketing and communication professional based in the Madison area, said the state would do better to invest in education or public infrastructure, instead of providing a handout to a single company.

"It makes no sense to me," she said.

Do these kinds of deals work?

The high-profile nature of the Foxconn deal has reignited a perennial debate in the US over corporate subsidies, which critics say produce draining bidding wars between states and come without clear benefits for taxpayers.

In the EU, member states are permitted to offer benefits to companies only under certain conditions, typically tied to an area's wealth, because of concerns that it skews competition.

But these kinds of packages remain a popular tool in countries such as the US, China, India and Brazil, says Kenneth Thomas, a professor of political science at University of Missouri-St Louis.

Wisconsin Gov Scott Walker campaigned at a manufacturing facility in Wisconsin in 2014

Sceptics say previous announcements made by President Trump show the risks of relying on subsidies to keep manufacturing in the US.

Last year, he claimed a jobs victory at a Carrier plant in Indiana. In that case, the company received $7m from the state in exchange for agreeing to keep 1,100 jobs at the plant for 10 years and invest $16m in the facility.

But the company issued layoff notices to 632 workers in May - manufacturing jobs that the president suggested would remain.

Despite their mixed record, state subsidies appear to have a champion in the president, says Greg LeRoy, executive director of Good Jobs First, which tracks these deals in the US.

"I don't like where this is going," he said. The Foxconn deal, he said, "is like a checklist of everything that's gone wrong with economic development".