Alibaba surges while Walmart stalls

- Published

Online retail giant Alibaba has again reported strong earnings, posting a 56% rise in quarterly revenue.

Net income grew by 94% to 14.7bn yuan ($2.2bn; £1.7bn;) for the three months ending June 30, compared to the same period last year.

The performance is in sharp contrast to US big box retailer Walmart, which posted a 23% drop in net income.

Analysts say the two results reflect both a global shift towards e-commerce and a broader shift towards Asia.

Alibaba's surging earnings

Investors have shown unbridled enthusiasm for Alibaba this year. The company's shares were up 5% on the results, and they are up 81% this year.

While these numbers seem almost unbelievable by US or European standards, some analysts think there's still plenty of room for growth.

"That's the challenge evaluating these companies because the market dynamics are so different than in the US and Europe," said Ben Cavender, from China Market Research Group.

He says e-commerce still only accounts for about 15% of the total retail market in China, so there's still plenty of untapped potential.

Walmart plays catch-up

The news isn't all bad for the once-dominant retailer.

Store traffic is higher, but profits were down, in part because Walmart is spending money to keep pace with rival Amazon.

Walmart's US stores saw a 1.8% rise in sales compared with the second quarter of last year.

Still, its net income fell 23.2% to due to aggressive spending on e-commerce as well as costs of $788m connected to a one-time debt payment.

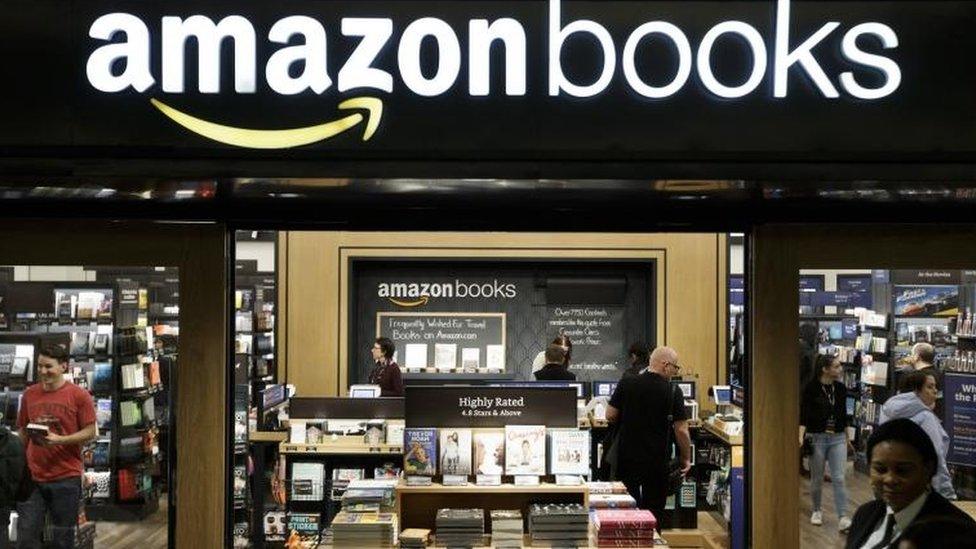

The Amazon in the room

Both companies are in competition with US ecommerce giant Amazon, which has also seen significant growth in the last year.

But while Walmart is directly squaring off against Amazon, Alibaba's chief executive, Jack Ma, has made it clear that he's not relying on the US market for the company's growth.

And while Amazon has a presence in China, it hasn't made huge inroads.

"They don't have the funding, they don't have the brand recognition. They don't have the product that people want at the end of the day," said Mr Cavender.

On its home turf, Alibaba might be more worried about Walmart, which has a significant bricks-and-mortar presence, and has also formed an alliance with Alibaba's local rival JD.com

Battleground South East Asia

South East Asia, with its rapidly expanding middle class, is shaping up as the next battleground for global e-commerce giants.

"All of these players are looking at where the emerging spending growth is coming from," said Mr Cavender.

Amazon Prime has dipped its toes into South East Asia by setting up shop in Singapore.

Alibaba has opted for a different route by partnering with established local players.

In June, it invested a further $1bn in Singapore-based e-commerce platform Lazada Group, and on Thursday it revealed it had invested $1.1bn in Indonesia's Tokopedia.

- Published30 May 2017

- Published3 August 2017