India's growth rate slows as new sales tax confuses firms

- Published

India's economy grew at its slowest pace for three years in the April-to-June quarter, official figures show.

The economy grew by 5.7% compared with a year earlier, down from a rate of 6.1% in the previous quarter.

Many analysts had expected the economy to bounce back after the government's crackdown on black market cash last year.

However, confusion among some firms over a new tax on goods and services was blamed for holding back growth.

Some retailers said ambiguous rules over the new sales tax, which began on 1 July, left them unsure over how to price their products.

But manufacturing saw the sharpest slowdown in growth, expanding at just 1.2% compared to 10.7% a year earlier.

Growth in the financial, insurance, real estate and professional services sectors also slowed from 9.4% to 6.4%.

Analysis: Sameer Hashmi, India business reporter

The latest economic growth figure clearly shows that the economy is still to recover from the cash ban that was introduced last year. Investments and consumption have seen a sharp drop, with medium and small-sized businesses still struggling.

India's economic growth figure does not take into account the performance of small businesses and the unorganised sector, which constitute more than 50% of total economic output in India. These segments were the worst hit after the cash ban. That means the slowdown may be even more severe than these latest figures suggest.

But the worst may not be over for India's economy. The new Goods and Services Tax, which came into effect in July, has completely overhauled the way businesses pay tax. Many small firms are still finding it difficult to adapt - and that will delay investments and expansion plans.

The World Bank and IMF have projected India's economy to grow by more than 7% in 2017. But with the latest figures coming in, that target looks difficult to achieve.

"[The] GDP numbers are certainly disappointing," said Abheek Barua, chief economist at HDFC Bank in New Delhi.

"The numbers seem to suggest that the slowdown from [the] last quarter has intensified due to the combination of long-term slowdown and temporary shock factors like demonetisation and GST (goods and services tax) destocking".

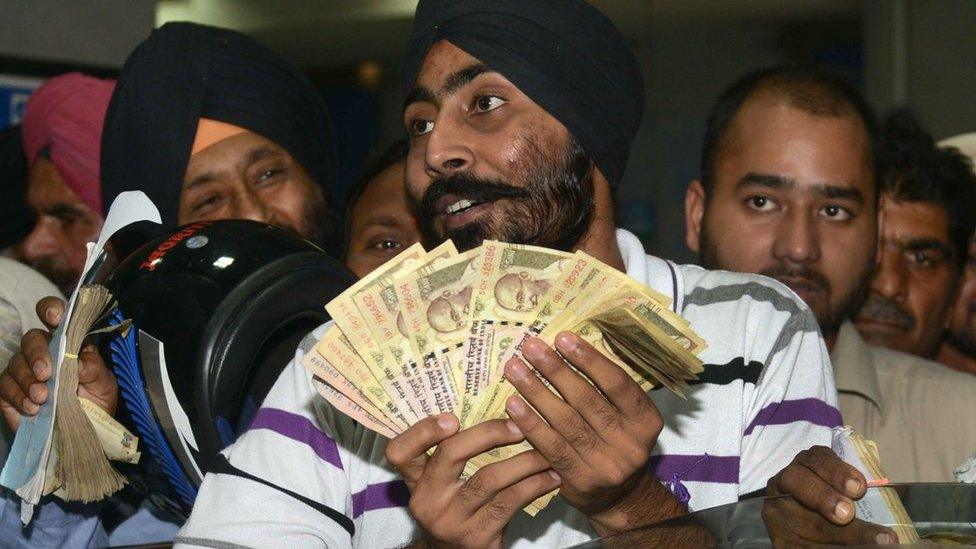

In November last year, India's government announced a ban on banknotes with a face value of 500 and 1,000 rupees (worth $7 and $14 respectively). The aim was to make it difficult for black marketeers and tax evaders to retain ill-gotten gains.

The move caused anger, chaos and widespread cash shortages as ordinary consumers rushed to exchange their money before the deadline.

But the impact of the banknote ban has faded.

Analysts said the new goods and services tax was a bigger cause of disruption for retailers, in the recent quarter.

Anjali Verma, economist at Phillip Capital India in Mumbai predicted that the impact of the new tax would be temporary: "GST impact is just a one quarter phenomena, or at (most) one month after that. But then in the medium to long term it's expected to be a positive."

"I would expect GDP for the full year will be somewhere closer to 6%."

- Published29 August 2017

- Published30 August 2017

- Published30 August 2017