Storms complicate Puerto Rico's debt problems

- Published

Insured losses in Puerto Rico are estimated at $40bn-$85bn

Puerto Rico's more than $70bn in debt is casting a shadow over recovery efforts on the Caribbean island, which was badly destroyed by Hurricane Maria.

Puerto Rican Governor Ricardo Rosello, who is seeking federal funds, warned of a "massive exodus" without aid.

US President Donald Trump wrote on Twitter on Monday night that the island was in "deep trouble".

He added that its debts, "sadly, must be dealt with".

In May, Puerto Rico declared a form of bankruptcy, seeking to restructure more than $70bn (£52bn) in debt.

Analysts said a chief risk is that the storm will accelerate the population decline on the island, exacerbating its economic problems and hurting its ability to repay.

Puerto Rico's population has already fallen by more than 8% since 2010 to about 3.4 million.

"Really, the fundamental thing is if people leave the island, will they be willing to come back," said Cate Long, founder of the research firm Puerto Rico Clearinghouse.

Trump tweet

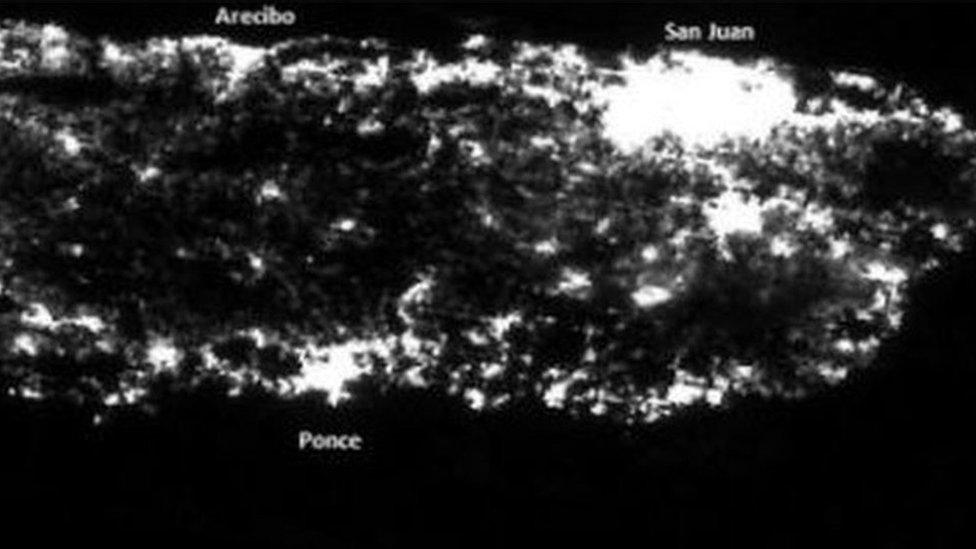

Puerto Rico is facing the collapse of its electricity and communications network as it evacuates flooded families and examines damaged infrastructure. A major dam is at risk of failure.

Insured losses across the Caribbean are already estimated to range from $40bn to $85bn, with about 85% of the damage found in Puerto Rico, according to disaster modelling firm AIR Worldwide.

President Trump said the priorities for federal relief were immediate needs for food, water and medical assistance.

In his tweets, he did not address longer-term rebuilding plans, but he contrasted its situation with Texas and Florida, which have also been hit by major storms this season.

"Texas and Florida are doing great but Puerto Rico, which was already suffering from broken infrastructure & massive debt, is in deep trouble," he wrote.

"Much of the island was destroyed, with billions of dollars ... owed to Wall Street and the banks which, sadly, must be dealt with."

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The federal panel that oversees Puerto Rico's finances said it would work to speed recovery funds.

But the island's debt means that it cannot borrow money for the emergency on its own.

Some Democrats have said relief is coming too slowly.

"The situation is desperate. Puerto Rico has taken a serious punch to the gut and they need our help," Sen Chuck Schumer said in a statement.

'Completely different set of circumstances'

Credit ratings agency Moody's issued a report on Monday examining the impact of the disaster on the debt. It noted that the federal response was key.

"Severe damage to infrastructure and private property that is not offset through federal relief efforts will signal reduced economic capacity," the report said.

The island's status as a commonwealth and not a state means it has fewer advocates in Congress, which could complicate funding efforts, said Ted Hampton, a Moody's analyst.

The price of Puerto Rico debt declined on Monday, as traders factored in possible losses.

But Mr Hampton said the situation was still evolving and it was too soon to say how the situation will develop.

"There is going to be a pause and disruption near-term, but we've often seen by the same token that after devastating hurricanes the influx of federal aid and other funds... can really spur an economy - so a year from now, or maybe two years from now, who knows?" he said.

Puerto Rico had been working on a financial plan with cuts that would satisfy the federal oversight panel.

But Governor Rosello told broadcaster CNN that the hurricanes were "a game changer" for those discussions.

"This is a completely different set of circumstances," he said.

- Published24 September 2017

- Published26 September 2017