Ed Balls: Treasury has 'washed its hands' of duty

- Published

- comments

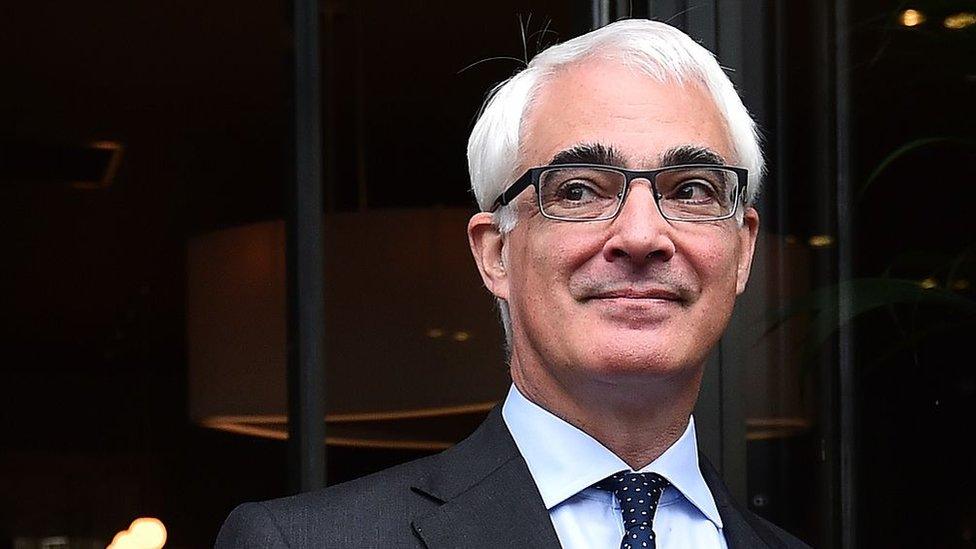

Ed Balls said the Treasury should be setting a clear objective for financial stability

The Treasury under the Conservatives has "washed its hands" of responsibility for financial stability, former Labour MP Ed Balls has said.

"It has said 'leave it all to the Bank of England,'" Mr Balls told the BBC.

It comes as former Labour prime minister Gordon Brown also said the Bank had been left "exposed".

The Treasury said oversight of the banking sector had been strengthened and improved since the financial crisis, with the Bank at its heart.

"The Government plays a full and responsible role in setting financial stability policy, while respecting the role of the Bank of England," a Treasury spokesman said.

Mr Balls told the Today Programme that the Bank had been successful at controlling inflation over the last 20 years.

"But I think just as the Treasury sets the inflation target the Treasury should be setting a clear objective for financial stability and policy," the former Labour shadow chancellor said.

Mr Balls, who has previously argued for more political control of the Bank, said its governor Mark Carney was "doing a brilliant job".

"But to do this on his own with the Bank of England would be super human. These are politically contentious things and the chancellor should take more responsibility," he said.

The Bank's Financial Policy Committee monitors the health of the banking sector

He was speaking after an event marking 20 years since the Bank was granted independence by Labour.

The Bank was given sole control of interest rates by then-chancellor Gordon Brown in 1997, with Mr Balls as one of his main advisers.

At the time they put regulation of the financial sector under the control of the Treasury, the Bank and a newly-created City watchdog.

But the system was criticised for its failure to spot the financial crisis of 2007 and 2008, and in the aftermath the Conservative-led Coalition put the Bank in charge of ensuring the health of the sector.

Bank 'left exposed'

Some critics have suggested Mr Brown's decision to split financial regulation between three bodies had contributed to the crisis.

But on Thursday, Mr Brown, who was chancellor from 1997 to 2007 and then prime minister until 2010, said the failure came about because the organisations did not work together closely enough.

He warned that a decade later, the Bank was being left "exposed" as the main financial regulator, which would "haunt us if a crisis were to hit Britain".

"There is no way you're going to deal with a crisis unless the Bank and the government are working together," he said.

Mr Brown suggested the Treasury and the Bank should set up a joint group to deal with financial stability and issues like housing.

On Thursday, Mrs May set out the relationship with the Bank, saying it was the government's role to ensure the economy serves "the interests of ordinary working people".

The Treasury also stays in contact with the Bank through regular meetings, and has a non-voting official on the Bank's interest rate-setting committee.

Next financial crisis

At the same event, Mr Brown also warned that the UK and other major economies were at risk of being "complacent" about the next financial crisis.

He suggested the next financial meltdown could come from Asian banks which are not subject to formal regulatory oversight, known as "shadow banking".

Mr Brown suggested China could deal with a banking crisis - but other Asian countries might struggle

"If that crisis were to emerge, would we really know who owed what to whom and on what terms?" Mr Brown said.

He said the G20 group of the world's biggest economies was not doing enough to track those or other financial risks.

As a result, he said, the "dangers of either complacency or of simply not being aware of what is going on in the world arise".

He added that the co-operation put in place during the financial crisis - which he helped to lead - had been watered down since 2010.

- Published28 September 2017

- Published28 September 2017

- Published9 August 2017