Young face growing mortgage debt burden

- Published

- comments

Young first-time buyers are increasing their overall mortgage debt in order to tackle short-term financial pressures.

The average mortgage term is lengthening from the traditional 25 years, according to figures from broker L&C Mortgages.

Its figures show the proportion of new buyers taking out 31 to 35-year mortgages has doubled in 10 years.

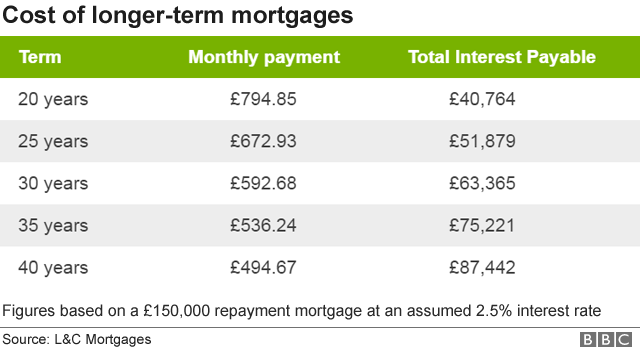

That means lower monthly repayments, but a bigger overall bill owing to the extra interest incurred.

The extra total cost can be tens of thousands of pounds.

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

Term time

The average term for a mortgage taken by a first-time buyer has risen slowly but steadily to more than 27 years, according to the L&C figures drawn from its customer data.

More detailed data shows that in 2007, there were 59% of first-time buyers who had mortgage terms of 21 to 25 years. That proportion dropped to 39% this year.

In contrast, mortgage terms of 31 to 35 years have been chosen by 22% of first-time buyers this year, compared with 11% in 2007.

The total cost of a £150,000 mortgage with an interest rate of 2.5% would be more than £23,000 higher by choosing a 35-year mortgage term rather than a 25-year term.

The gain for the borrower would be monthly repayments of £536, rather than £673.

David Hollingworth, of L&C Mortgages, said that interest-only mortgages were far less of an option for first-time buyers than a decade ago, and many needed to find a large deposit.

The income squeeze also meant that many "needed some slack in the monthly budget", so were choosing the longer-term mortgages.

Lenders have been offering longer mortgage terms, of up to 40 years, to reflect longer working lives and life expectancy.

He suggested that borrowers regularly reviewed their deals.

"Ideally, if you keep the term shorter, it will save you money in the long run," he said.

House prices

First-time buyers in some parts of the country have seen prices rising very slowly since the financial crisis, assisting affordability, despite stricter checks by lenders.

The latest survey from the Royal Institution of Chartered Surveyors (RICS) showed that more of its members expected house price falls than those expecting rises in the next three months.

Price falls have been most marked in London and South East England in September, they said, with falls also recorded in East Anglia and North East England.

On a national level, demand from new buyers and sales also fell in September, the survey suggested.

- Published12 October 2017

- Published9 July 2020

- Published6 October 2017