Millions miss bills as finances bite

- Published

An estimated 4.1 million people are in financial difficulty owing to missed domestic or credit bills, a major study has found.

These consumers - most likely to be aged between 25 and 34 - have failed to pay bills in three or more of the last six months.

The findings come as part of a survey of 13,000 people by the regulator, the Financial Conduct Authority (FCA).

It suggests 25.6 million consumers could be vulnerable to financial harm.

This means that they display at least one of a series of issues, such as lack of internet access or an overdraft, so their finances would be at an increased risk if something went wrong.

Rising costs

The Financial Lives research, the first of its kind by the regulator, revealed a range of concerns among consumers at a time of weak wage growth, but also low-cost credit.

It concluded that 15 million people had low levels of resilience to a bill shock, that eight million were struggling with debt, and 100,000 had used an illegal money lender in the last 12 months.

One in six (17%) of those with a mortgage or who are paying rent, an estimated five million people, said that they would struggle if monthly payments rose by less than £50.

A rise in interest rates, heavily hinted by policymakers at the Bank of England, could affect many of these people - especially if the Bank rate rose rapidly.

Analysis: Kamal Ahmed, economics editor

Rent, car loans, mortgages, credit cards, pay day loans, unsecured credit, overdrafts - with real wages falling, the amount of debt we are taking on is rising and the pressure we are under is increasing.

For many, a savings cash buffer to deal with shocks and rising prices is non-existent.

When it comes to the build up of debt, this is a classic story of supply and demand.

The digitisation of financial products - making many loans little more than a mobile phone swipe away - has meant that supply has become broader and easier.

Historically low interest rates have also made products cheaper, meaning that taking on debt appears to be low cost, in the short term at least.

In the same week as the BBC News Money Matters series revealed worrying levels of debt among young adults, the FCA report highlights the issue again for 25 to 34-year-olds.

Its findings show that 23% of consumers of this age were "over-indebted", the highest proportion of any age group.

The report also found that this group were most likely to be in difficulty (13%) or just surviving with their finances.

"This [research] exposes the story around the scale of those who are potentially in difficulty in the younger generation," said Christopher Woolard, executive director of strategy and competition at the FCA.

Problems at every age

He added that there were "challenges" faced by every age group and that flexibility was required to ensure that these various issues were tackled.

The report revealed:

Among 18 to 24-year-olds: 20% had no savings and 55% had debts, primarily student loans. Single parents are most likely to use high-cost loans

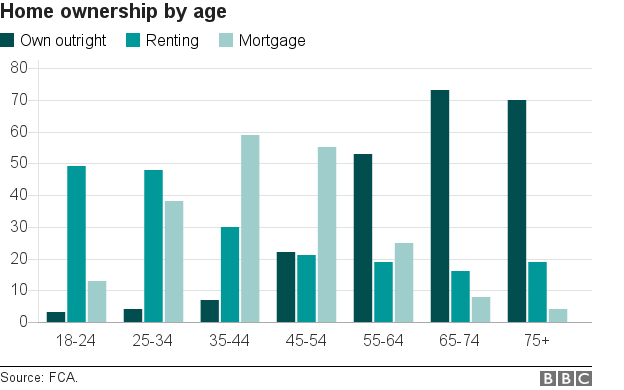

Among 25 to 34-year-olds: Nearly half (48%) were renting but of them, only a quarter (24%) had contents insurance

Among 45 to 54-year-olds: An above-average proportion (15%) had an interest-only mortgage, so had not yet started paying off the capital of their home loan. They also had high overdraft and credit card balances

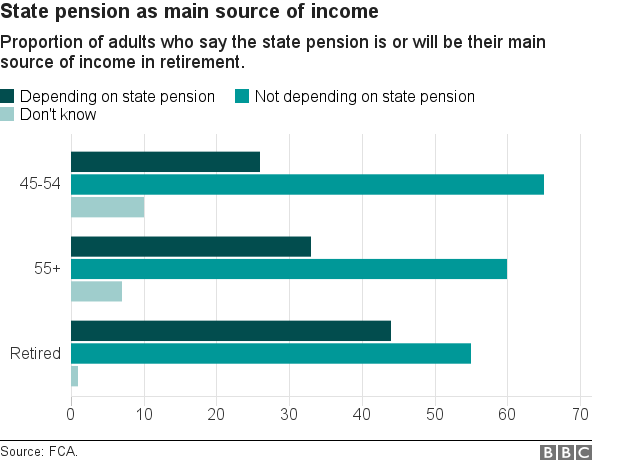

Those aged 55 and over: a third (33%) said that the state pension would be their main source of income - an income which pension experts say would be insufficient

Those aged 65 and over: More than a third (35%) do not use the internet and so miss out on cheaper deals, but of those who do, they are least likely to check that a website is secure, leaving them exposed to scams

Gareth Shaw, from consumer group Which?, said: "That such a high number of people in middle-age have not properly considered how they will manage in retirement should be cause for concern.

"The current complex pensions system is leading to disengagement, leaving consumers vulnerable through the real lack of information, support and tools needed to empower consumers to make informed decisions about their financial futures.

"Today's figures should spur on the FCA to take action to deliver a consumer-friendly pensions system that everyone can engage with."

The FCA said that the survey would provide a "wealth of information" that would be used when deciding how to protect vulnerable consumers in the future.

A Treasury spokesman said the government had tightened rules "to ensure that money can only be lent to people who can afford to repay".

"We have also cracked down on pay day loans, saving borrowers over £150m a year, and are introducing an energy cap to help people with household bills," he added.

- Published18 October 2017

- Published29 September 2017

- Published9 July 2020

- Published1 December 2016