Nikkei hits new highs after Japan election

- Published

Japanese stocks hit their highest level since 1996 on Monday after Prime Minister Shinzo Abe won a clear election victory.

The Nikkei climbed more than 1% in its 15th consecutive day of gains, a record winning streak for the index.

The ruling coalition is set to retain its two-thirds majority, suggesting Mr Abe's economic policies will continue.

The Nikkei index of 225 leading Japanese shares finished 239 points higher at 21,696.6.

The yen hit a three-month low against the US dollar, helping boost shares of Japanese exporters.

A weaker yen tends to lift the shares of export firms because it makes their products cheaper to overseas customers.

However, Japan's fresh stock market highs also reflect a global rally, as the country's equity markets are tracking gains on markets elsewhere.

Nissan, Mitsubishi and Sony all moved ahead in early trade, although Toyota's shares slipped after it temporarily suspended production at its factories because of a powerful typhoon.

Shinzo Abe's election victory means his economic policies are likely to continue

Mr Abe, who heads the Liberal Democratic Party (LDP) coalition, said the election was first and foremost about the nuclear threat from North Korea.

Analysts expect the victory will also mean the government's economic policies will remain largely unchanged.

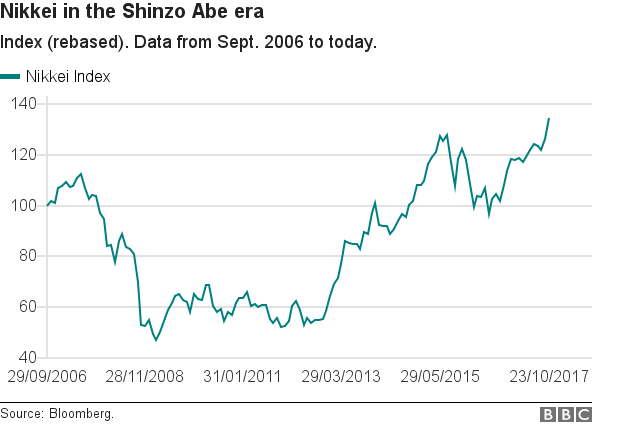

Since he was first elected in 2012, Mr Abe has pursued a "three arrows" policy of monetary easing, fiscal stimulus and structural reform.

The policy, known as "Abenomics", was supposed to jumpstart Japan's economy after two decades of stagnant growth.

Lately, the Japanese economy has shown signs of life, with strong stock market gains, upbeat manufacturing data and six straight quarters of growth.

"The one area where there's been not much success is structural reforms. I guess that's what most people had hoped for, but we haven't really seen much on that front," said Marcel Thieliant from Capital Economics.

Mr Thieliant also suggested there will be more headwinds for the economy if Mr Abe follows through on his plan to increase the country's sales tax again in 2019.

- Published22 October 2017

- Published19 October 2017