HSBC posts huge jump in profit as Asia business grows

- Published

HSBC's profit jump has been partly put down to its asset business in the Pearl River Delta

Banking giant HSBC has reported pre-tax quarterly profits of $4.6bn (£3.5bn) for the three months to the end of September.

The result marks a huge 448% increase from $843m posted in the same period a year ago.

At that time, earnings were hit by a one-off loss of $1.7bn from the sale of its Brazilian unit.

The latest result met market expectations and was helped by cost-cutting and a focus on Asia.

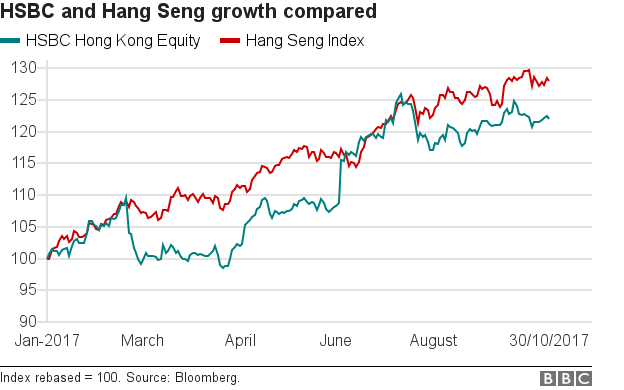

"Our pivot to Asia is driving higher returns and lending growth, particularly in Hong Kong and the Pearl River Delta," HSBC's chief executive, Stuart Gulliver, said in a statement.

The firm's earnings were further boosted by higher premiums from its insurance and asset management businesses in Asia.

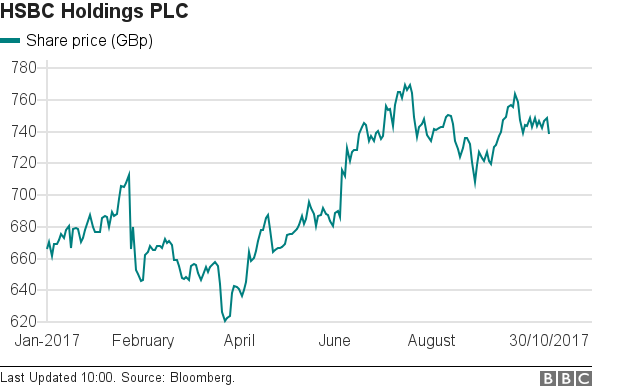

HSBC's shares were down more than 1% in late morning trading in London following the earnings update. Analysts attributed the downward move to profit-taking by investors.

John Flint, currently head of retail banking and wealth management, takes over from Stuart Gulliver in February

Since the 2008 financial crisis, HSBC has been cutting jobs and selling assets to make the group more profitable, while still making dividend payments to shareholders.

Despite its origins in Asia and renewed emphasis on the region, the bank has its headquarters in the UK.

Like other major financial institutions, it is having to make adjustments to its operations ahead of Brexit.

It had suggested in the past it may move 1,000 jobs to Paris, although in a conference call following its results on Monday, finance director Iain Mackay said it could be less than that.

Mr Mackay said these quarterly results included $12m in costs in relation to Brexit, mostly on legal advice to help with contingency planning. He said HSBC expects to spend $200m-$300m on Brexit relocation costs.

'Innovate and accelerate'

The bank's continued bet on Asia, one of the world's fastest-growing economic regions, has been part of its strategy to expand the business and make up for losses elsewhere.

Earlier this month, the bank's new chairman, Mark Tucker, said it would be working "to develop and agree the key actions required to ensure we build on and enhance HSBC's current momentum".

Those initiatives will be led by HSBC's newly appointed group chief executive, John Flint, who formally takes over from Stuart Gulliver next February.

Mr Flint has said the bank had to "innovate and accelerate the pace of change required" to meet the expectations of shareholders, customers and employees.

Laith Khalaf, senior analyst at Hargreaves Lansdown said HSBC's investment banking division's performance was "weak", but had "held up better than many of its competitors".

He stressed the growing importance of the bank's Asia-generated business: "Regionally it's Asia which is doing the heavy lifting for HSBC, and while the bank is headquartered in the UK and is the second largest company in the FTSE 100, its business primarily resides in the far East.

"Indeed, 70% of its profits so far this year come from Asia."

- Published27 October 2017

- Published12 October 2017

- Published31 July 2017