Bookies brace for possible sales hit

- Published

Britain's betting industry is bracing for lower revenues after the government said it will cap the size of stakes gamblers can make on fixed-odds betting terminals (FOBTs).

Punters can currently stake up to £100 per spin on the controversial machines, dubbed by critics as the "crack cocaine of gambling".

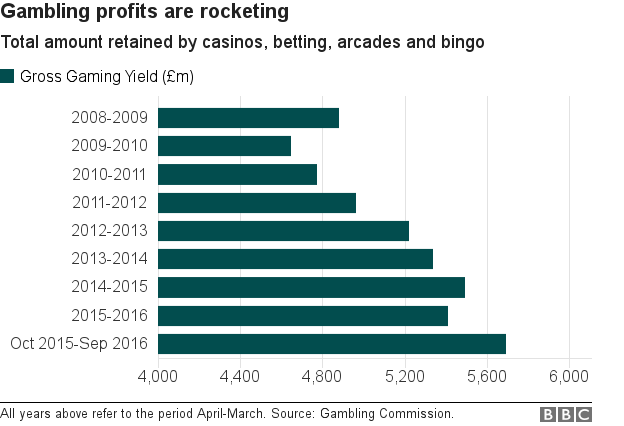

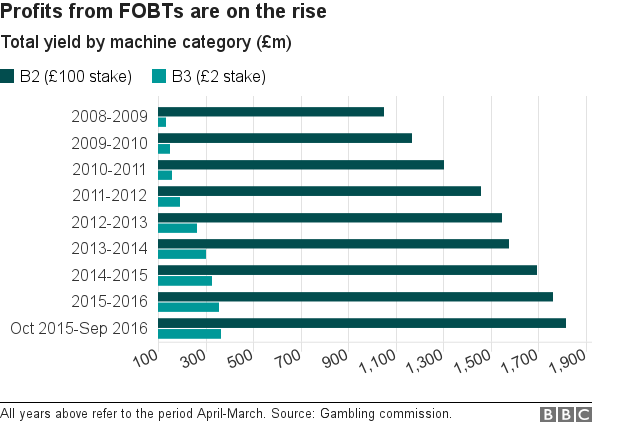

The machines generated more than £1.8bn in revenue last year, helping to support growth for bookmakers.

But the Department for Digital, Culture, Media and Sport (DCMS) has now launched a 12-week consultation into cutting maximum bets from £100 to either £50, £30, £20 or £2.

The DCMS has also called for a review of the spin speed on FOBT games, and says gambling companies will need to collaborate on a two-year long campaign to promote responsible gambling.

It's the result of a government review into gambling industry practice that started in October 2016.

So what does this mean for the future of gambling companies?

Rise of the machines

Gambling machines have been a regular sight in pubs, clubs and cafes for decades. But when FOBTs hit the High Street at the turn of the millennium they offered something new: computerised casino games such as roulette and blackjack at the touch of a button.

FOBTs are found in both casinos and betting shops in the UK, but are much more common in the latter. Each machine accepts bets up to a pre-set maximum and pays out according to fixed odds on the simulated outcomes of games.

Two categories of games are available. B3 games have a maximum stake of £2 and a maximum prize of £500. The more contentious B2 games allow for bets of up to £100 with the potential for the same-sized prize. The spins in a game can come as often as every 20 seconds.

Initially a small number of high-margin games were available, but changes to tax laws in 2001 allowed the industry to introduce lower-margin games to FOBTs - sending their numbers skyrocketing.

The gamble paid off

The UK is unusual in allowing gamblers to bet as much as £100 a spin, and the popularity of FOBTs has boosted sales in recent years.

The latest Gambling Commission figures show there are over 34,000 B2 machines around the UK which offer the higher £100 bet limit. There are also 22,600 B3 machines offering the lower-stakes £2 option.

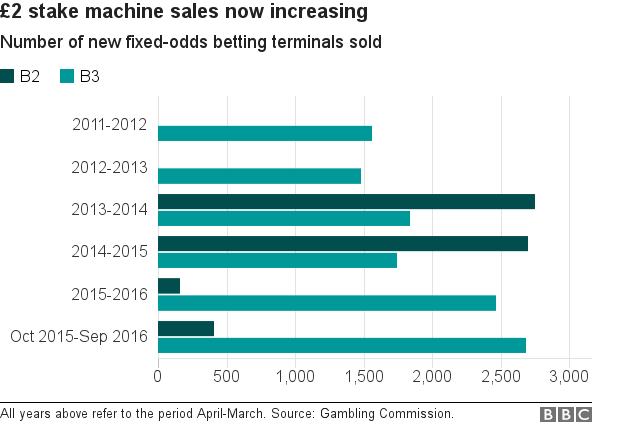

However, sales of lower-stakes B3 machines, with a £2 maximum bet, are now growing far more rapidly than their £100 stake counterparts.

Sales of B3 machines climbed from about 1,500 five years ago to more than 2,600 last year, according to the Commission.

How would cuts affect the industry?

Several options are on the table now the government has proposed cutting maximum bets to either £50, £30, £20 or £2.

The industry argues that, to a degree, a £50 limit already exists in betting shops because punters have to register as members if they want to bet more than this amount, and their request can be denied.

Labour and the Liberal Democrats have both expressed support for a £2 stake - as have many local councils.

But Paddy Power Betfair says a £2 cap would cut the revenue of some bookmakers by between 33-43%.

The Association of British Bookmakers (ABB), the betting industry body, has also opposed cuts in the past. It says a £2 cap would cause 20,000 job losses, cut the 9,000-strong estate of high street betting shops by half, and lose the government millions in tax revenue.

The government's own estimates suggest a £2 cap could lead to a £5.5bn loss in tax revenues over the next 10 years.

The horseracing industry, which receives sponsorship money and levy funding from betting firms, could also be affected.

'Adapt and survive'

But views on the impact on industry players are varied. Dublin-based Goodbody Stockbrokers believes a £2 cap would lead to the closure of 3,000 betting shops, just over 30% of the UK's total.

"It's bad but it could be a lot worse," says Gavin Kelleher, an equity analyst at the firm.

And in a recent report, Barclays analysts have suggested "the market is pricing in a worst case scenario: we think a more 'benign' outcome is more likely".

Some within the gambling industry even agree, although bingo and arcade operators - which are not allowed FOBTs - would like to see the stakes reduced on the machines.

The British Amusement Catering Trade Association (Bacta), supports a "substantial reduction" in maximum bets but has not suggested by how much.

The industry body, which represents bingo and arcade operators, has also suggested that no betting shops would be forced to close even if the betting cap were lowered to £20.

"I don't think it'll be as catastrophic as has been suggested by the bookmaking industry," said Bacta chief executive John White.

"If there is a reduction - I think the political force is unstoppable now - they'll adapt and survive as good businesses do."

The ABB has hit back at groups such as Bacta, saying they are simply trying to protect profits.

Whatever their motives, the stakes have never been higher for the betting industry.

"This is a huge concern for the industry. We are worried that if the Government starts with limits on betting machines, where do they go next? Are we going to see fixed prices on the horses?

"It could cripple the industry and thousands of jobs with it. Surely people should be allowed to make their own choices on how to spend their own money," said Andy Bell from Freebetting.co.uk. , external

- Published31 October 2017

- Published8 December 2016