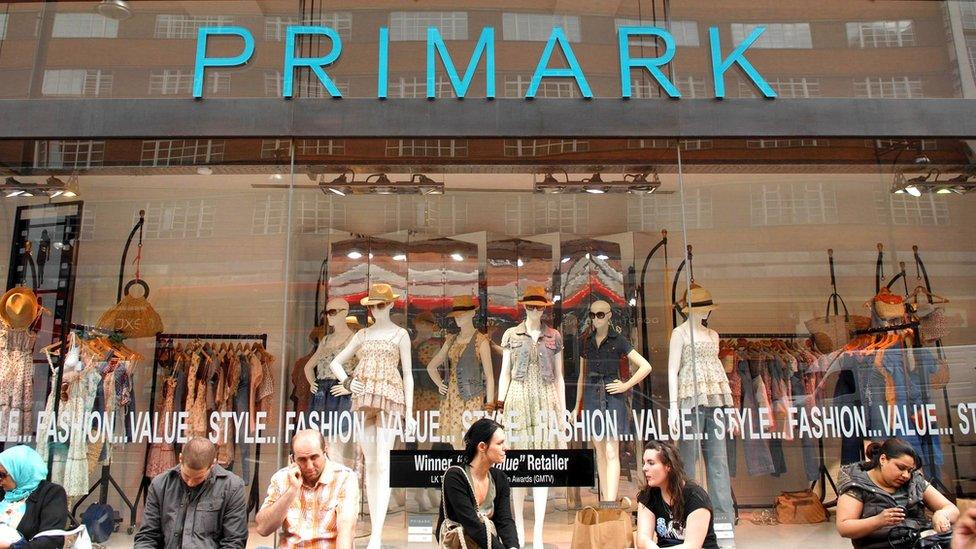

Primark owner Associated British Foods sees profits jump

- Published

Associated British Foods (ABF) said its annual profits surged, buoyed by growth at its Primark clothing chain and a recovery in its sugar businesses.

The food-to-fashion group said adjusted operating profit rose 22% to £1.36bn in the year to 16 September, with group revenues up 15% at £15.4bn.

Primark's revenues rose 19% to £7.05bn as the chain continued to expand.

ABF also said it welcomed the government's intention for a Brexit transition period beyond March 2019.

"In common with many other businesses, we share a concern about the risk of abrupt changes to the UK's customs procedures," it said.

'Stealing share'

Primark's sales come as other retailers have struggled to boost profits amid a challenging High Street environment.

Even after opening 30 stores in nine countries with 1.5 million square feet of selling space, ABF said Primark still had room for "significant growth".

The company said trading at Primark had been "excellent", particularly over the summer.

In the UK, Primark "performed particularly well", ABF said, with sales up 10% from last year and its share of the total clothing market "increased significantly".

"Primark has grown faster than any of the other top 10 clothing market players over the past five years", said Charlotte Pearce, a retail analyst at GlobalData. "By providing value for money in its trend-led clothing, it has been able to steal share from midmarket retailers as shoppers trade down".

Shares slip

With more than 60% of ABF's sales and profits generated outside the UK, ABF's results were boosted by the weaker pound.

AB Sugar, ABF's sugar unit, benefited from an increase in EU sugar prices as well as structural changes at the unit.

However, ABF said it expected profits at the unit to fall in the current financial year, and these comments sent the company's shares down 3.5% in morning trade.

The company expects "progress" in its grocery and ingredients businesses, whose brands include Twinings, Ovaltine, Kingsmill bread, Jordans, Dorset Cereals, Patak's and Blue Dragon. Grocery results in the past year "were held back by the trading environment faced by the UK bakeries," the company said.

ABF, which spent £79m on business acquisitions in the past year, said it had completed the acquisition of Acetum, an Italian producer of high-quality balsamic vinegar.

Chief executive George Weston said: "These results reflect our international diversity, and the strong underlying performance of our businesses was driven by management actions throughout the year".

Brexit uncertainties

ABF operates in 50 countries worldwide, with significant businesses in Europe, southern Africa, the Americas, Asia, and Australia.

The UK's decision to leave the EU had an immediate impact on ABF's results last year due to its effect on currency markets, the company said.

"As the UK government continues its negotiations, uncertainty remains as to the extent to which our operations and financial performance will be affected in the longer term," ABF noted.

The company said it had contributed to government-led consultations on potential changes and their potential impact on businesses "to help inform the exit strategy".