Budget 2017: Double Budget effect on your finances

- Published

Two Budgets in one year means the prospect of significant upheaval for your finances - adding to changes we already know about.

Chancellor Philip Hammond will probably want his sequel to be less dramatic in political terms than his March Budget.

Previous Budgets and government policy mean we need not wait until Wednesday to know of some key changes ahead.

They include promises to increase the amount of earnings free from income tax and alterations to student loans.

Some predict there will be further help for young people and there will be keen interest in any changes to public sector pay and benefits.

"We're expecting the over-45s to shoulder most of the pain in this year's Budget," said Clive Relf, partner at adviser Kreston Reeves.

Helping the young

There are predictions of a focus on financial assistance for the pressed younger generation in part owing to a political calculation of lost voters at the last general election.

This has already begun with a promise to change the threshold at which student loans are repaid. Students will pay back when they earn £25,000 per year, rather than £21,000, Prime Minister Theresa May has said.

What to watch for in the Budget, external

At the Conservative party conference, Mrs May also announced that the government was cancelling an increase in tuition fees which would have taken them above £9,500.

High deposit demands from mortgage lenders to first-time buyers have prevented many people from buying a home.

Chancellor Philip Hammond told the BBC's Andrew Marr Show that it was "not acceptable" that young people find it so hard to buy a home, and said the Budget, external would detail plans to build 300,000 new homes a year in England.

The chancellor said the government would focus on speeding up developments where planning permission has been granted and would use the "powers of state" to get "missing homes built".

The government also plans to pay to clean up polluted industrial sites for house building, get town hall bosses to allocate small pockets of land to small developers and guarantee loans by banks to small house builders.

Changes already earmarked for next April and subsequent financial years include:

A manifesto pledge to increase the personal allowance - the amount earned before income tax is paid - to £12,500 by 2020-21. This currently stands at £11,500

The threshold for higher rate of tax has also been pledged to increase to £50,000 by 2020-21. At present it is £45,000, except in Scotland (owing to devolved powers) where it is £43,000. The Scottish government will announce its intentions for the higher rate in December

Many working-age benefits will be halfway through a four-year freeze by April. These include Jobseeker's Allowance, Employment and Support Allowance, some types of Housing Benefit, and Child Benefit. However, state pensions, Maternity Pay and some disability benefits are excluded. This is on course to save the Treasury £4.6bn, according to the Institute for Fiscal Studies (IFS)

The roll-out of Universal Credit - a merger of various benefits - to new claimants and re-claimants continues. This is less generous than the system it is replacing

The gradual process allowing people to pass on property to their descendants free from some inheritance tax will enter its second year. It will reach its target by 2021

Many buy-to-let landlords are seeing the amount of tax relief that they can claim on mortgage interest payments cut over the course of four years. The process began in April. Eventually, they will only be able to claim at the lower rate of tax, not the higher

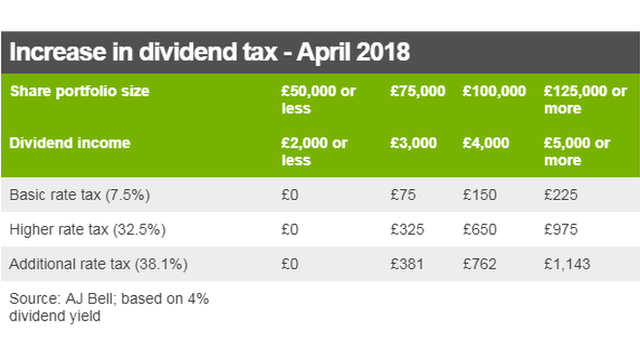

Director shareholders will see a tax break reduced on the dividends they receive. The tax-free dividend allowance - which came into force in 2016 - will be reduced from £5,000 to £2,000 from April. That will affect those who own a small business and pay themselves in dividends alongside a small salary and people with large portfolios of shares, perhaps by hundreds of pounds

One thing that was set to change, but will no longer happen in April is the abolition of class 2 National Insurance contributions.

This flat rate paid by self-employed workers making a profit of more than £6,025 a year was expected to be abolished in April 2018 but this has been deferred by the government for a year pending a further review.

Also in the world of work, from April of next year public sector employers will have to decide whether freelancers are really self-employed or should be staff - a move many believe could be extended to the private sector.

Pay rises?

Reports suggest nurses are in line for a pay rise in the Budget

The cap on public sector pay rises in England and Wales has been in place in some form since 2010.

However, the government has already announced that ministers will now get "flexibility" to breach the 1% limit.

Police officers have already been offered a 1% rise plus a 1% bonus, with prison officers offered a 1.7% rise - both funded from existing budgets.

Public sector pay was frozen for two years in 2010, except for those earning less than £21,000 a year, and since 2013, rises have been capped at 1% - below the rate of inflation, which currently stands at 3%.

- Published4 November 2017

- Published26 October 2017