Tories, Labour and the big Budget battle lines

- Published

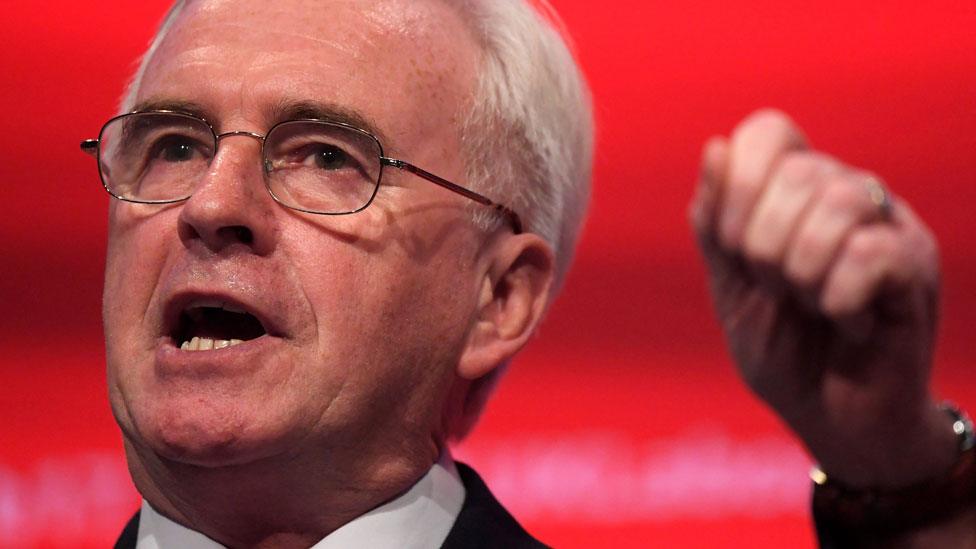

Today's speech from the shadow chancellor has drawn a neat red line between Labour and the Tories.

John McDonnell has said tax increases for the wealthy and for businesses should be used to support extra spending in health, education and the police.

"It's a message from the front line of public services, the government's got to act," he told me.

Labour would also borrow more to fund new house building.

The government believes that its own big offers on housing and - I am told by those in Whitehall - health will persuade voters that infrastructure and public services are safe in Conservative hands.

The problem for the Chancellor is how he proposes to pay for it.

And that will only become clear when he stands up in the House of Commons to deliver the Budget, external on Wednesday.

Cabinet colleagues are clear.

There is little to no stomach for tax increases - just look at the reaction to the proposal to increase taxes for the self-employed, announced in the last Budget in March.

Mr Hammond had to abandon it a week later.

Borrowing dilemma

Now, the Chancellor is being pushed towards more borrowing as the best route forward, with interest rates at historic lows and the deficit (the difference between what a government receives in taxes and what it spends) below 3%.

Which is perfectly manageable, according to many economists.

Mr Hammond is no fan of increased borrowing.

But he is under hefty political pressure to loosen the constraints of his fiscal rule to bring the deficit below 2% by 2020-21 and eliminate it entirely (balancing the books) by 2025.

Sajid Javid, the communities secretary responsible for housing, has made it clear he supports more borrowing to build homes.

And another Cabinet minister I spoke to simply said "yes" when I asked if Mr Hammond should borrow more money.

You can almost hear the howls of anguish in the Treasury.

The department keeps a tally of the extra spending requests that come in from departments.

They run to tens of billions of pounds and are the subject of dark jokes and bleak mutterings among those close to the Chancellor.

According to them Mr Hammond should be given some credit for allowing more borrowing to support infrastructure investment.

His last Budget was actually fiscally stimulative, with the deficit forecast to increase next year.

But more borrowing to fund day-to-day expenditure (for example to increase public sector pay) is far harder to square with his deeply held belief in fiscal conservatism - not building up debts for future generations.

Tax approach

On that narrow point, interestingly, Labour is in a similar position.

Mr McDonnell told me that he also only supports increasing borrowing to fund infrastructure investment.

Extra funding for public services should come from increasing taxes.

"It's not about borrowing, I have made it absolutely clear," Mr McDonnell said.

"This is our fiscal rule - we do not borrow for day to day expenditure, we only borrow for infrastructure development.

"What I've said, though, is that we can fund these top priorities we've put forward if you stop the tax giveaways to corporations and to the rich, if the Chancellor listens to us on that, he could tackle the crisis we've got on public services, without borrowing."

Mr McDonnell wants to tax the wealthy and businesses more heavily.

Mr Hammond knows there is little room for him on that territory.

That's the dividing line.

If the Chancellor wants to be big and bold on Wednesday, he'll have to be big and bold on borrowing as well.

- Published16 November 2017

- Published16 November 2017