UK economy faces 'longest fall in living standards in 60 years'

- Published

- comments

The UK is on course for its longest fall in living standards since records began over 60 years ago, the Resolution Foundation think tank has said.

Its post-Budget analysis says the squeeze on incomes is set to last longer than that which followed the post-2008 crash.

It says real disposable incomes are now set to fall for 19 successive quarters.

The think tank was critical of the abolition of Stamp Duty for many first-time buyers.

The Resolution Foundation is a not-for-profit research and policy organisation, which says its goal is to improve outcomes for people on low and modest incomes.

In its Autumn Budget response, external, it said the £3bn cost of the Stamp Duty measure broke down to a subsidy of £160,000 per extra home owner.

The Foundation said this meant Chancellor Phillip Hammond could have simply bought people typically priced properties in over a quarter of local authorities, or built around 140,000 homes.

In his Budget speech, Mr Hammond said young people would benefit from the move: "This is our plan to deliver on the pledge we have made to the next generation that the dream of home ownership will become a reality in this country once again."

'Grim backdrop'

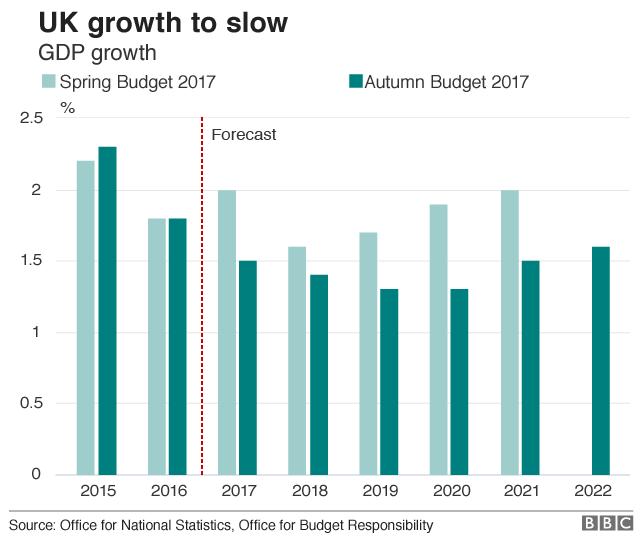

The Resolution Foundation's main focus was on the growth downgrade, which it said put the economy on course to be £42bn smaller in 2022 than previously expected.

On Wednesday, the independent Office for Budget Responsibility (OBR) cut its growth forecast sharply for 2017, from 2% to 1.5%, with growth for the next five years forecast to come in well under 2%.

The Foundation said that tax and benefit policies were set to put downward pressure on living standards and upward pressure on inequality, and would take an average of £715 away from the poorest third of households a year, while giving £185 to the richest third.

However, it welcomed the action taken by the government on Universal Credit. The chancellor announced a £1.5bn package to "address concerns" about the delivery of the benefit, and promised to scrap the initial seven-day waiting period for processing of claims.

Torsten Bell, director of the Resolution Foundation, said: "Faced with a grim economic backdrop, the chancellor will see this Budget as a political success. But that would be cold comfort for Britain's families given the bleak outlook it paints for their living standards.

"Hopefully the OBR's forecasts will prove to be wrong because, while the first sentence of the Budget document reads 'the United Kingdom has a bright future', the brutal truth is: not on these forecasts it doesn't."

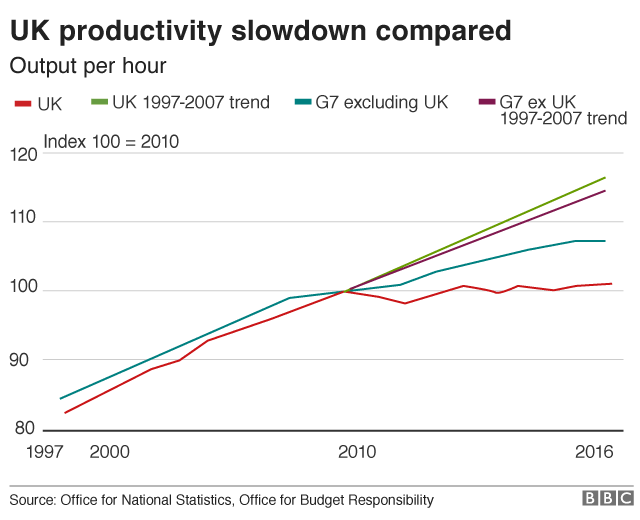

One of the key issues holding back incomes is the slow pace of productivity growth, which was revised down by an average of 0.7% a year up to 2023.

The Chancellor, Phillip Hammond, tried to address the productivity problem in Wednesday's Budget by expanding the National Productivity Investment Fund (NPIF).

This was launched last year to provide additional investment in housing, infrastructure, and research and development. The Budget increases the size of the NPIF from £23bn to £31bn.

He also is increasing the Research and Development (R&D) Expenditure Credit, effectively tax relief for companies doing R&D.

A Treasury spokesperson said: "Over three million more people are in work, and we are helping everyone earn more and keep more of what they earn.

"We are increasing the National Living Wage by an inflation-busting 4.4%, freezing fuel duty and taking millions of people out of income tax altogether. The only way to increase pay in the long term is to improve our productivity, so we are investing over £30bn across the country to boost digital connectivity, improve skills and training, and build an economy that is fit for the future."

Mr Hammond, who was under pressure from sections of his party in the run-up to Wednesday's speech, won praise for his Budget from Tory backbenchers. MPs told the BBC it was "very solid".

- Published23 November 2017

- Published11 March 2020

- Published22 November 2017