Black Friday is 'bonkers' for retailers, say critics

- Published

- comments

Wallets will be feeling a bit lighter this weekend as shoppers turn out in search of a bargain ahead of Christmas.

It's estimated that £10bn could be spent in the UK over the Black Friday period, £2.5bn in a single day.

Retailers like Dixons Carphone say it's a critical chance to boost their market share and provide customers with "real deals,"

But the chief executive of the fashion chain Fat Face has suggested it is "bonkers" to cut prices now.

Anthony Thompson said his stores won't be taking part.

"It's bad for customers, it's bad for business, it's bad for UK retail," said Mr Thompson.

"What customers are looking for at Christmas is great value for money, not make-believe promotions and fake prices, and that's often what they get on Black Friday.

"All it's doing is moving sales from December into November. It's not growing the market and everyone is having to sell things at reduced margins."

But is he right?

Some shoppers say they are weary of the custom, imported a few years ago from the United States.

There's the scrum to get to the best deals, the sales gimmicks, and guilt that you've spent more than you planned.

On top of that consumer group Which? has highlighted that many supposed deals may not be money-savers at all.

'Real deals'

But other big retailers could not disagree more.

The chief executives of retailers Sainsbury's Argos and Dixons Carphone said it was a fantastic day where consumers were getting real deals because they are able to work with manufacturers to produce the goods they wanted at the prices they wanted.

Seb James, chief executive of Dixons Carphone, told the BBC's Today programme: "We think we sell more because we gain market share.

"We're so big we can go and work with manufacturers a year ahead and work to make products that are better value by streamlining processes.

"The deals customers get are real deals."

John Rogers, chief executive of Argos, now owned by Sainsbury's, told the BBC's Wake up to Money that his division, which also includes Habitat and clothing and general merchandise at the supermarket chain, had been planning for this Black Friday since the event 12 months ago.

"It's a year in the planning. It's our biggest day of the year," he said.

James Daunt, the managing director of the bookshop chain Waterstones, said Black Friday provided "retail theatre" and gave them a "very good December day".

"We want to get people in our shops and enjoying themselves, and when they do that they're liable to pick up things they might not otherwise have done," he said.

Gamble

Most retailers on - and offline - will find it difficult not to join in.

They may be reluctant to forgo full-price sales in the busiest season of the year. But if they don't join the sales frenzy, they may lose out to rivals who do.

"I bet most retailers wish it was an American import that never arrived," said Steve Rowe, chief executive of Marks and Spencer, another brand that isn't offering Black Friday deals, though it does have some discounts running in store.

But discount supermarket Lidl is getting involved for the first time this year, whilst rival Asda announced Black Friday sales this week, after sitting it out in 2015 and 2016.

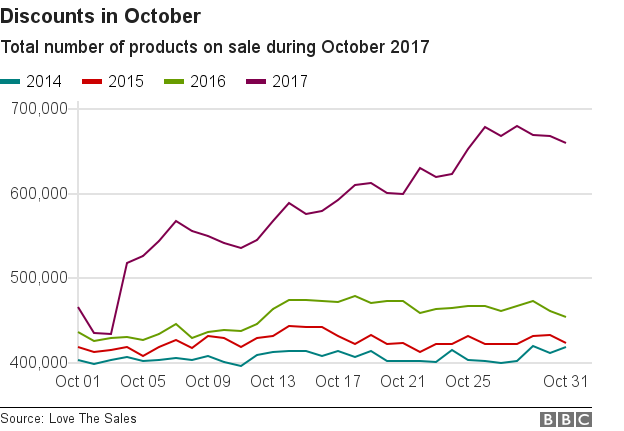

Moreover the intense competition has pushed retailers to start sales earlier and earlier, stretching back into October and to offer more and more items at a discount each year.

According to data collected from hundreds of stores by sales aggregating website Love the Sales, there was an unprecedented 43% increase in the volume of items on sale in October this year compared to last year.

That represents a big gamble. You have to order the stock in advance, but buy too little, and there won't be enough left to take advantage of last-minute shoppers paying full price around Christmas. Buy too much, and deeper discounting will be needed in Boxing Day and January sales to clear the shelves.

Early Christmas

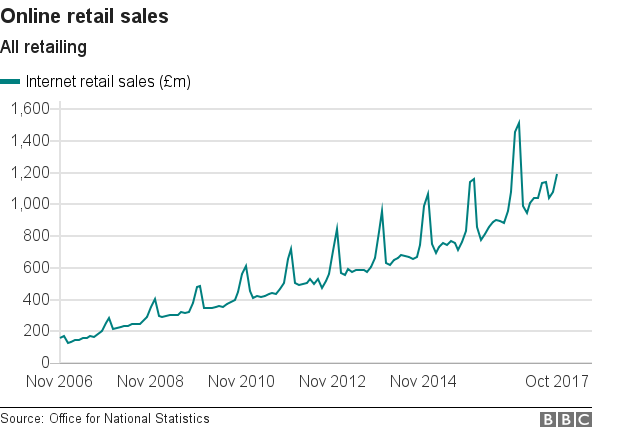

For smaller online retailers, like the eBay computer accessories firm Velocity Outlet, there's no question over whether to take part.

There is so much online traffic, it's about making the most of it while you can, says co-founder Eddie Latham. Last year the firm saw sales of £350,000 in a single day.

"Everyone builds up for this day and it's almost like Christmas has come early," he says.

But if shoppers focus spending on one weekend in late November, does that mean they will buy more overall?

Black Friday may simply change the timing of when we make our purchases, says Alan Clarke, chief UK economist at Scotia Bank: "Why spend now when I can wait for the sales?"

Others though argue Black Friday is helping to promote a new consumer culture during the build-up to Christmas, which will help boost retail sales.

"Anything that helps to encourage consumers to go shopping and supports the retail sector is a good thing," says Kien Tan, Director of Retail Strategy at consultancy firm PwC.

- Published20 November 2017