Will the government's economic medicine work?

- Published

- comments

The MSD deal will be will be used as evidence the government's economic medicine is already working

Last week we got the diagnosis - this week we get the attempted cure.

Up to £1bn of investment in the UK by pharma company MSD - known as Merck in the US - will be used as evidence the government's economic medicine is already working.

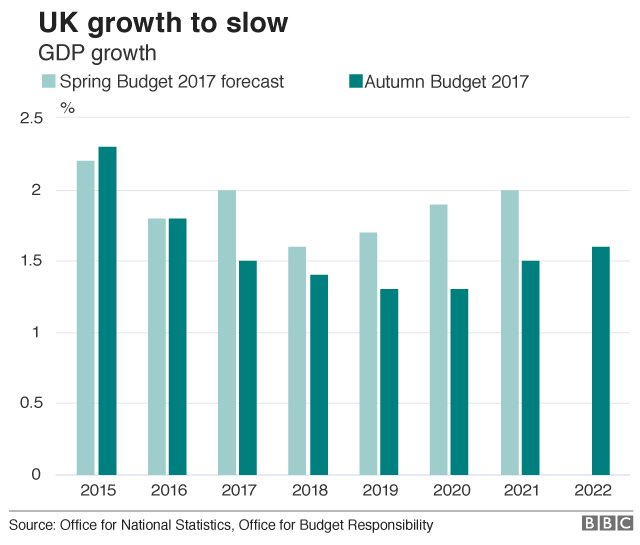

The long-awaited industrial strategy lands after a bleak economic assessment of the UK economy delivered by the independent Office for Budget Responsibility on budget day - which showed slowing economic growth and dismal productivity.

Business Secretary Greg Clark said "MSD's commitment today proves the process outlined in the industrial strategy can give companies the confidence and direction they need to invest in the UK."

There is more good news to come.

I understand that there is a pipeline of similar investments which will include a multi-million pound announcement from GSK next week.

What is the industrial strategy?

The industrial strategy is a hard thing to describe and therefore a hard thing to sell to a business community whose last real memory of state intervention in industry was in the 1970s of British Leyland and British Steel.

Hundreds of millions of pounds of public money were poured into companies that ultimately failed.

The new version contains four great challenges, five favoured sectors and a rather opaque investment mega fund.

The government insists it is not "picking winners", but is backing excellence

Here's the idiot's guide to how it's supposed to work.

Pick an industry that the UK is already good at and needs investment.

Chuck in a bit of government money, cluster the right institutions around it, commit to provide the skills base and give them somewhere to try their new stuff.

That could mean faster trials for drugs in the NHS or using public roads to test driverless cars.

Hey presto - private investment ensues.

Brexit antidote?

Some will see this as another example of government's dodgy track record in "picking winners" - the government insists it is backing excellence.

Of course, all of these new initiatives are being born under the star sign of Brexit which makes them children of uncertainty.

UK business investment only rose by 0.2% in the last quarter - the weakest quarterly growth since the end of last year suggesting firms are reluctant to spend on new machinery and equipment in the current climate.

So how much of this medicine is an antidote to Brexit?

Greg Clark has talked of these deals as "countervailing" that uncertainty.

He insists these are policies any government should be pursuing at any time but admits the need is particularly urgent right now.

This deal with the pharmaceutical industry is just the first in line - there will be another three - outlined today and confirmed in the weeks ahead.

Last week's economic forecasts seemed to show a deep economic malaise.

They could be wrong and some ministers privately think the only way is up from the downbeat assessment of future productivity growth.

According to the employers group, the CBI, 10% of businesses they surveyed have already triggered contingency plans by moving functions and people out of the UK.

That figure will rise to 35% by December and 60% by March of next year if there is no greater clarity on future trading arrangements with the EU.

It's unclear that this medicine will be fast-acting enough to delay those symptoms.

There was a time when a Tory government would have shied away from the words "industrial strategy" and its attendant ideas of state intervention.

This Tory government is unapologetic in saying it's useful, necessary and urgent.

- Published27 November 2017