The economic lessons Japan can teach the West

- Published

Shinzo Abe's government is continuing efforts to boost the Japanese economy

It's been almost five years since Shinzo Abe took power as Japan's prime minister for the second time.

Mr Abe promised to smash deflation, and break the country out of a two decade slump. The results have been mixed.

The three arrows of Abenomics - government spending, monetary easing, and widespread reform - have been launched with varied firepower.

While the value of the stock market continues to climb, and the economic outlook looks bright, years of stagnant wage growth, and the country's rapidly ageing population are offering many lessons to other developed economies. Here are three of them:

Low unemployment

Low unemployment doesn't always lead to higher pay, which is what conventional economic theory would suggest.

A shrinking number of those out of work is meant to push up pay, as a scarcity of workers forces companies to offer more generous packages to attract the right staff. This in turn would push up prices as households spend more.

But in reality pay growth remains weak around the world - even as unemployment has fallen to rates seen before the 2008 financial crisis.

Japan's low unemployment has not led to increased wage growth

Japan is an example of just how low unemployment can go without triggering runaway pay growth.

On paper, the country is close to full employment. Companies are facing the most severe staff shortages since the early 1990s, while unemployment is at a two decade low of 2.8%.

However, the rise of casual and part-time contracts has led to a dual labour market, where "non-regular" workers are paid much less than their permanent counterparts.

In Japan, the share of workers on fixed-term or part-time contracts rose to 37.5% of total employment in 2016, from 20.3% in 1994, according to the Organisation of Economic Co-operation and Development (OECD).

A "job for life" mentality also remains entrenched in Japanese society - which also limits earnings growth, as fewer workers threaten to leave unless they get a bigger pay rise.

Koichi Hamada, a special adviser to Mr Abe, says the rise of automation poses a threat to millions of Japanese jobs, and has a stark warning on pay.

"For those who are replaced by artificial intelligence, the world is very tough, and I don't think that wages and prices in Japan, at least, will rise as [they did] 20 years before."

Koichi Hamada warns that the rise of automation poses a threat to millions of Japanese jobs

He adds that creativity and experimentation are vital to ensure workers are not left on the scrap heap.

"In Japan loyalty is emphasised too much - and the idea that younger people should obey. We need a new experiment, one that allows the possibility of failures.

"In order to take the Japanese society forward younger people, or those who experienced foreign business or the intellectual world, [should be able to] voice more freely to senior people."

Ageing workforce

Japan's population is ageing fast, and an elderly population puts immense pressure on the public purse. The OECD recently warned that the country's future economic prosperity depends on how it manages its demographic decline.

Yoshihiko Kunihiro (left) says 10% of his workers, like Nakao Sugiyama (right), are over 60

Living longer is a reason to celebrate, but it also has to be paid for. Families in developed economies are having fewer children than in the past, meaning there are not as many workers to pay the pensions of retirees.

An ageing population is projected to increase elderly-related social spending in Japan by another 7% of gross domestic product (GDP) over the next 40 years.

One solution is to get people to work longer.

Yoshihiko Kunihiro, the president of Tokyo-based technology firm Fullheart Japan, says that 10% of his workforce is over 60. His oldest employee is 78 - and still works full-time.

In the UK, the government has already linked the state pension age to longevity.

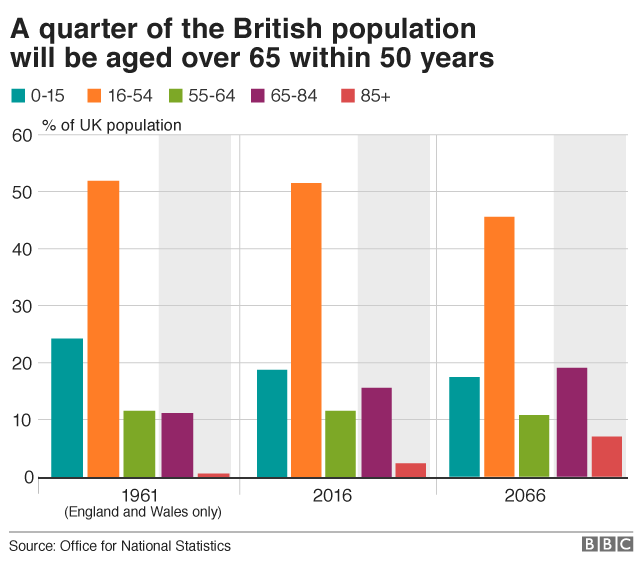

Britain's fiscal watchdog has warned that demographic changes will see spending on state pensions balloon over the next 50 years - by which time a quarter of the UK's population will be aged over 65.

According to the Office for Budget Responsibility (OBR), long-term spending on UK state pensions is projected to rise from 5% of GDP in 2021-22, to 7.1% of GDP in 2066-67 - or from around £100bn to £140bn at today's prices.

If governments still want to balance the books, this means they will have to raise taxes or cut spending in our areas of the economy to foot the bill.

Deflation danger

Who doesn't like falling prices? It may seem like a blessing, but extended periods of deflation can push economies into stagnation.

A prolonged period of falling prices can weigh in the minds of workers and companies.

After years of deflation, Japan's debt has ballooned to more than 200% of GDP

Stagnant wage growth becomes entrenched, confidence is lost, pay deals stay lacklustre, companies become more reluctant to hire, the process repeats.

Deflation is also bad for debt. This is because while total spending in an economy fluctuates, amounts owed do not fall.

So when the cash size of an economy shrinks, debt burdens become bigger relative to its size.

After years of deflation, Japan's gross debt pile has ballooned to more than 200% of GDP, and is on course to rise to an eye-watering 600% by 2060 if the government does not raise more revenue.

Abenomics has helped to reflate the economy, with total spending up, helping to limit growth of its debt burden. The jury is out on whether it will last.