Fed nominee Jerome Powell shares views with Congress

- Published

Jerome Powell said the case for a December interest rate rise was "coming together"

Jerome "Jay" Powell, President Donald Trump's pick to lead the US central bank, the Federal Reserve, is about to become "the most important economic policymaker in the world".

At least that's how one senator put it at Mr Powell's confirmation hearing in Washington on Tuesday.

Mr Powell, a former investment banker and current governor of the Federal Reserve, is widely expected to be approved by the Senate.

So what did we learn about his views?

On the economy

Mr Powell said he expects US GDP to grow 2.5% in 2017, and continue at a similar pace next year - a healthier rate than the US has seen for years.

Coupled with a low 4.1% unemployment rate, he said that means the economy is ready for the Fed to remove the policies, known as "accommodation", it put in place to boost economic activity after the financial crisis.

"We've been patient in removing accommodation and I think that patience has served us well," he said. "It's time for us to be normalising the interest rate and the size of the balance sheet as well."

In his remarks, Mr Powell said the case for an additional rate rise in December is "coming together" and repeated that he expects the Fed's balance sheet to shrink to $2.5tn-$3 trillion (£1.9-£2.2 trillion) over the next three or four years.

The US unemployment rate was 4.1% in October, one sign of a strong labour market

But he also admitted to uncertainty about some areas - such as relatively weak inflation.

"Is is transitory or are there more fundamental things at work?" he said.

"We really don't know yet," said Senator Richard Shelby, a Republican from Alabama.

"No, we don't," Mr Powell agreed.

On regulation

Mr Powell presented himself as a moderate on regulation - a stance that may have left some members of both parties dissatisfied.

He praised some of the rules that have been put in place since the crisis, such as stress tests and new powers to liquidate failing institutions. But he also made it clear that he wanted to revisit some measures.

"I'm not going to characterise what we're doing as deregulation," he said. "I would rather think of it as looking back over eight years... and making sure that what we did make sense."

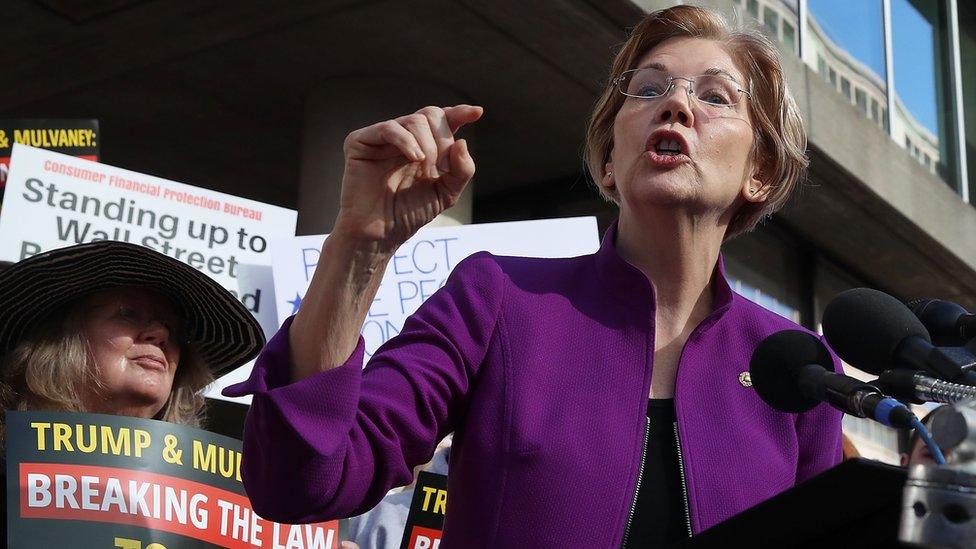

Senator Elizabeth Warren opposes regulatory rollback embraced by the Trump administration

He added that he does not think there are banks that are still "too big to fail" and told Senator Elizabeth Warren, a Democrat from Massachusetts, he didn't see the need for new or stricter rules.

"Honestly Senator, I think they're tough enough," he said.

"This worries me," she responded.

On the tax cut and national debt

Democratic senators repeatedly asked Mr Powell to say how the Republican tax cut proposal, which is estimated to cost $1.5tn, might affect the economy.

Mr Powell just as repeatedly declined to do so, saying those policies are not his responsibility but the purview of Congress.

"It's a bit of a fine line that we have to walk on this and I'm hoping I can walk it," he said.

After pressing from Democrats, Mr Powell said he was concerned about "the sustainability of our fiscal path in the long run" but he declined to take a position on the tax bill, which is one of the president's priorities.

"Obviously if we increase the national debt. we're going to make those problems even worse," he said. "I think the idea would be to get GDP growing faster than debt over a long period of time."

On the biggest risk

Mr Powell called cyber security "maybe the single-most important risk that our financial institutions, our economy, our government institutions face".

He pledged to make the issue a priority both internally and in the Fed's bank supervision.

He also dismissed the idea that the rise in the value of cryptocurrencies such as Bitcoin might create a bubble that threatened the economy.

"In the long run cryptocurrencies of that nature could matter. They don't really matter today," he said. "They're just not big enough."

On the Fed's independence

Democrats said they were worried that Mr Powell would face pressure from the White House to set policy for political purposes.

Since entering office President Trump, who has latitude to make his mark at the Fed due to an unusually high number of vacancies, has expressed a preference for low interest rates.

Historians say pressures from the White House were a factor in the inflation surge of the 1960s and 1970s.

Mr Powell said he was "strongly committed to an independent Federal Reserve."

"I would add, nothing in my conversations with anyone in the administration has given me any concern on that front," he said.

- Published2 November 2017

- Published27 October 2017

- Published20 September 2017