Stock exchange boss leaves with up to £12.6m amid boardroom row

- Published

Departing LSE boss Xavier Rolet owns a vineyard in Provence, France

The chief executive of the London Stock Exchange, Xavier Rolet, is in line for payments up to £12.6m, as he leaves the company amid a bruising boardroom row.

The stock exchange said, external Mr Rolet had "agreed to step down with immediate effect" at the board's request.

Mr Rolet was due to leave next year, but one of the firm's biggest shareholders claimed he was forced out.

Bank of England Governor Mark Carney said on Tuesday the situation needed to be cleared up as soon as possible.

The departing chief executive will be paid his salary of £800,000 for 12 months of gardening leave, and a potential bonus worth £1.6m.

Mr Rolet, who led the LSE for over eight years, also has a number of long-term incentives under which he could theoretically earn £10.2m.

The move seeks to draw a line under a bitter dispute over who should run one of the the UK's most important financial companies.

It has also been announced that the stock exchange's chairman, Donald Brydon, who faced a shareholder vote on whether to remove him from the board, will step down in 2019.

LSE chief executive Xavier Rolet (L) and chairman Donald Brydon (R)

"At that point it would be in shareholders' interests to have a new team at the helm to steer the future progress of the company," the firm said.

'Unwelcome publicity'

Sir Chris Hohn, the hedge fund tycoon whose fund owns more than 5% of the LSE, has pushed for Mr Rolet to remain as the stock exchange's boss, and for Mr Brydon to leave instead.

However, it has now been announced that Mr Rolet will be put on gardening leave for 12 months, and will not return to the company.

Mr Rolet said: "Since the announcement of my future departure on 19 October, there has been a great deal of unwelcome publicity, which has not been helpful to the company.

"At the request of the board, I have agreed to step down as chief executive with immediate effect. I will not be returning to the office of chief executive or director under any circumstances."

Mr Rolet added he was "proud of what we have achieved during the past eight and a half years".

Under Mr Rolet's leadership the company's value has gone from £800m to nearly £14bn, but press reports have suggested some staff disliked his management style.

Chief financial officer, David Warren, will take over as interim chief executive from Mr Rolet.

Analysis

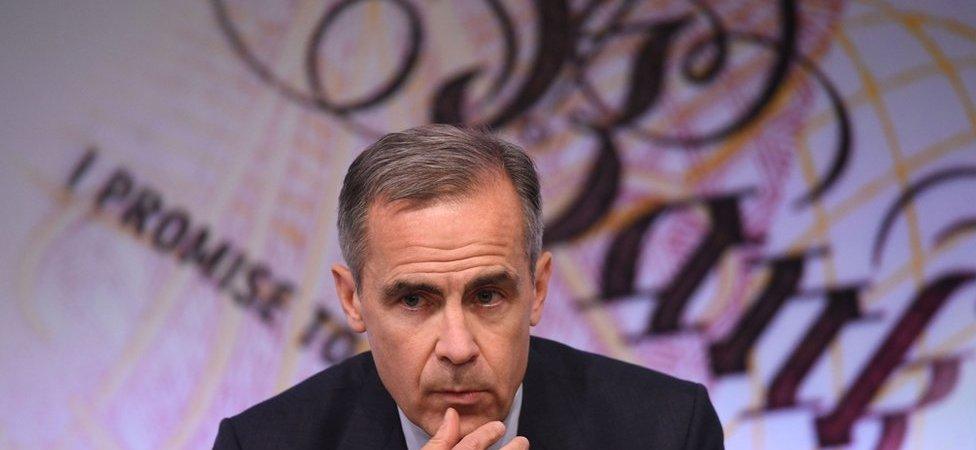

Bank Governor Mark Carney intervened in the battle at the stock exchange

By Dominic O'Connell, Today Business Presenter

A raised eyebrow used to be enough for the governor of the Bank of England to bring wayward City firms into line.

On Wednesday, Mark Carney, the current governor went much further with his intervention in the battle over the future of the London Stock Exchange and its chief executive Xavier Rolet.

In saying he found it hard to see why there was a row about an "agreed succession plan" and suggesting "everything comes to an end" he was in Bank of England terms raising both eyebrows and waving a giant neon sign.

The warring factions have abruptly fallen into line. But who is the winner?

City tradition says the last person out is the winner, which would make the chairman the victor - but the end result is that both men have lost out.

It is not known whether Sir Chris will now retreat. He may want more change at the top, and there is the separate prospect - never to be discounted at the LSE - that a big international rival will table a bid.

Keep an eye on ICE, the owner of the New York Stock Exchange.

- Published10 November 2017