Bank deputy warns of Bitcoin bubble risks

- Published

Investors should be aware of the risks from the rapid rise in the price of digital currency Bitcoin, a Bank of England deputy governor has warned.

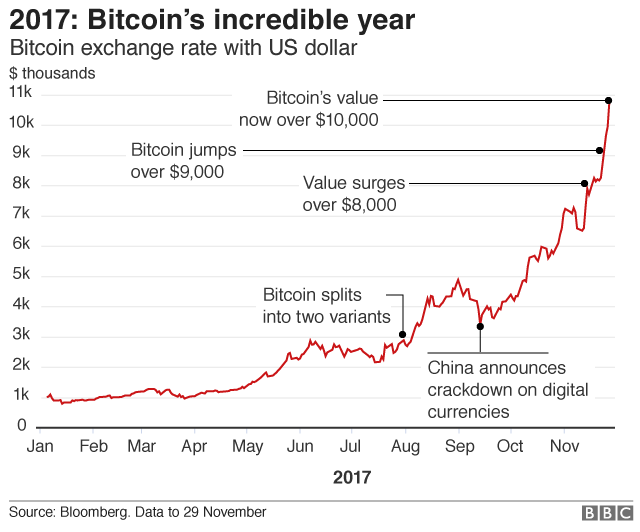

Bitcoin's value passed a record $11,000 (£8,200) on Wednesday after a sharp but often volatile rise this year.

Sir Jon Cunliffe, the Bank's deputy for financial stability, said that when prices grow so fast, "investors should do their homework and think carefully".

But he added that Bitcoin's rise was not big enough to unsettle the economy.

Unlike traditional currencies, Bitcoin is not issued by a central bank or government.

Bitcoin hit a high of $11,377 on one major exchange on Wednesday, an increase of more than 1,000% from the start of the year.

The digital currency - which works like virtual tokens - has fluctuated wildly since it was launched in 2009.

Critics have said it is going through a bubble similar to the dot com boom, whereas others say it is rising in price because it is crossing into the financial mainstream.

Asked about the surge, Sir Jon told the BBC: "People need to be clear this is not an official currency. No central bank stands behind it, no government stands behind it."

He said it was "closer to a commodity" than a currency, with people choosing to invest and trade in it.

Sir Jon says investors should "do their homework" about Bitcoin

Bitcoins are created through a complex process known as mining, and then monitored by a network of computers across the world.

A steady stream of about 3,600 new bitcoins are created a day - with about 16.5 million now in circulation from a maximum limit of 21 million.

Despite its price rise, Sir Jon said Bitcoin was "not of a size that would be a threat to financial stability" or a risk to the UK economy.

Financial regulators have taken a range of views on the status of digital currencies and their risks.

US regulators have moved towards treating some of them as currencies, whereas Korean regulators see them as commodities.

The UK's Financial Conduct Authority warned investors in September they could lose all their money if they buy digital currencies issued by firms, known as "initial coin offerings".

- Published11 December 2017

- Published29 November 2017