US Fed chairs through the ages

- Published

At every key moment in US economic history, the chair of the Federal Reserve has set the pace.

Here are six of the most notable and quotable figures to have run the country's central bank:

Marriner Eccles (in office, 1934-48) was a banker in Utah, whose testimony to Congress calling for government action to solve the US's financial and economic woes brought him to the attention of President Roosevelt, and eventually the job of transforming the US's central bank.

Mr Eccles once said: "The United States economy is like a poker game where the chips have become concentrated in fewer and fewer hands, and where the other fellows can stay in the game only by borrowing. When their credit runs out, the game will stop."

William McChesney Martin (1951-1970) came up with perhaps the most famous description of the Fed's job when setting interest rates.

"The Federal Reserve… is in the position of the chaperone who has ordered the punchbowl removed just when the party was really warming up."

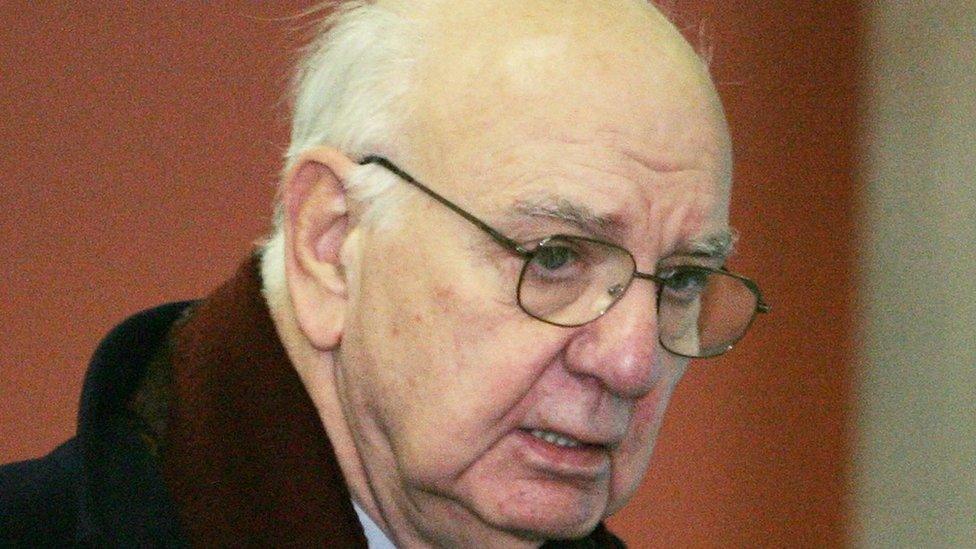

Paul Volcker (1979-87) led the Fed as it tackled and finally defeated the high inflation of the late 1970s and early 1980s. Part of the job was delivering some painful truths to the US Congress.

"The standard of living of the average American has to decline. I don't think you can escape that."

Alan Greenspan (1987-2006) was in charge during the longest economic expansion in US history, so by the end of his tenure, his prestige seemed fixed, as did his fondness for dense, impenetrable commentary on the state of the economy.

"I guess I should warn you, if I turn out to be particularly clear, you've probably misunderstood what I said.''

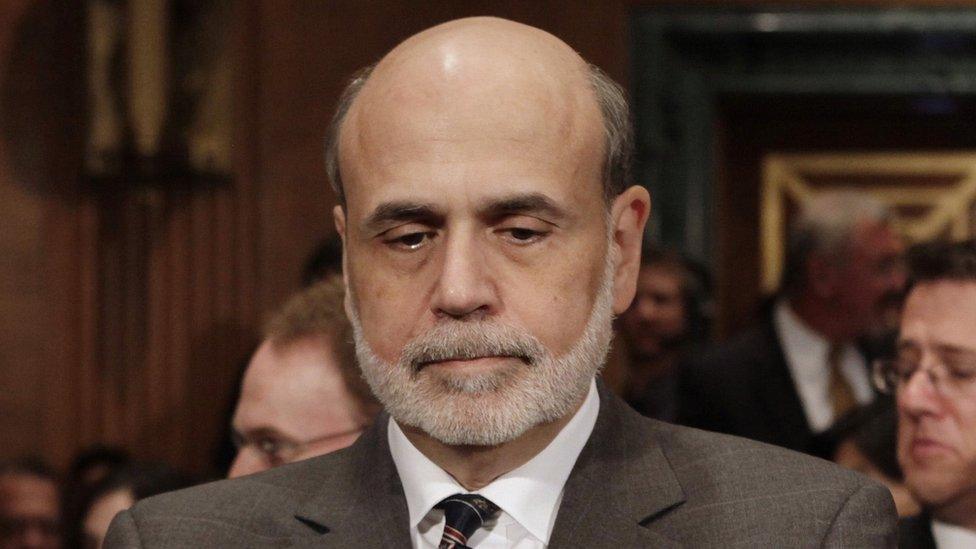

Ben Bernanke (2006-14) led the Federal Reserve into an entirely new approach to monetary policy as the central bank struggled to combat the financial crisis and great recession of 2007-09.

"The lesson of history is that you do not get a sustained economic recovery as long as the financial system is in crisis."

Janet Yellen (2014-) has overseen the Fed's slow return to normal monetary policy and pushed for ever more transparency in its communication with the US public.

"Although we work through financial markets, our goal is to help Main Street, not Wall Street."

- Published1 December 2017

- Published28 November 2017