‘I was duped by an OAP loan shark’

- Published

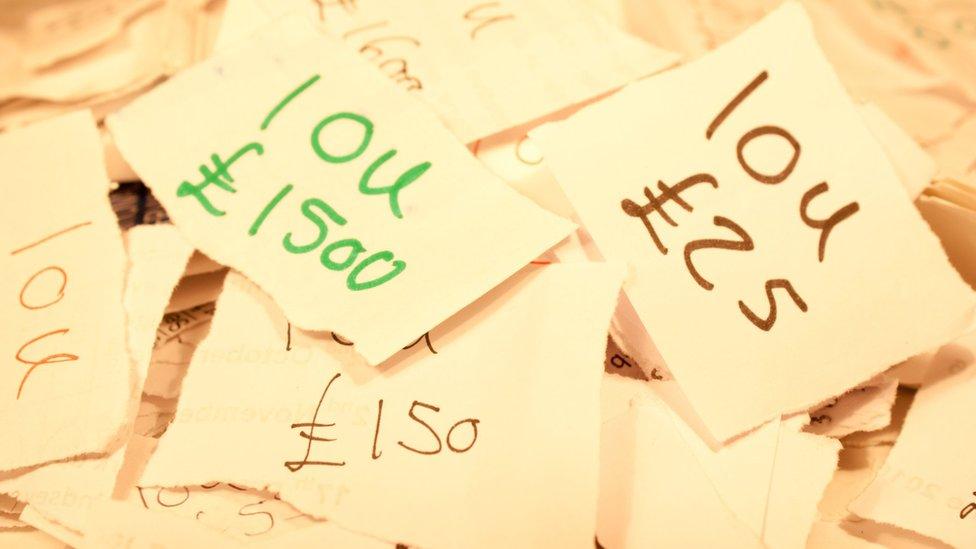

It is difficult to identify to know how much unauthorised lending is going on, says the FCA

More than 300,000 UK households are currently using illegal money lenders to make ends meet, says the Illegal Money Lending Team, the body that investigates and prosecutes loan sharks.

Loans sharks are operating in Post Offices, casinos and even at school gates - handing out cards to children asking their mothers to call them if they need new trainers, according to a recent study by the financial regulator, the Financial Conduct Authority.

But the FCA also admits it is difficult to identify and quantify unauthorised lending activity.

If caught, illegal lenders face fines or imprisonment, but borrowers feel secret shame and often don't tell people they've borrowed from a loan shark.

The BBC's Money Box programme spoke to one man, Neil (not his real name), who met a loan shark in his local bookmakers. This is his story:

'I was starting to struggle financially,' says Neil

"I'm in my early fifties, and was born in Yorkshire. I was, and still am, part of a medium-sized family business. I used to live a full on lifestyle - quite a lot of travelling and eating out.

I was used to a certain level of income, I suppose. I never thought that that would ever change significantly. It all started when my father became ill, and my mother developed early stage dementia.

Change of fortune

So being from a family that's very supportive, I pulled back from the business and moved in with my parents to offer them the support they needed.

Then the family business had a reversal of fortunes, and the income that I was used to started to taper off. I was starting to struggle financially.

I also became a very heavy drinker, and that was a significant factor. Normally, I'm quite rational and level-headed. It was a perfect storm.

Living with my parents, I would need to take some time out, so I would go out into the local town to the bookmakers. I wanted to try and get some decent-sized wins, to be able to offset some of the financial obligations that I had.

Father figure

"He was a regular visitor to the same bookmaker, and someone that I would pass the time of day with. We struck up a sort of rapport: he'd lost his parents, not that long ago, and when I met him, I'd lost my father too.

He came across as being quite friendly, jovial, and happy-go-lucky - a bit of a father figure.

He was retired, a pensioner - he told me he'd previously done various low-paid, factory jobs. He lived in almost sheltered accommodation, as he was an elderly man.

He told me about his gambling problems: at one point he'd left his wife and family, because his gambling problems had escalated to the point where he could no longer cope.

'I had become addicted to roulette machines'

It makes the whole context of what I went through even more poignant really.

Offering loans

"Looking back, I had become addicted to roulette machines. And he was keeping a close eye on me, and would step up and offer me money to be paid back with interest.

The first loan I took was on a Tuesday, for £200; I paid back £300 on the Friday.

It then started to escalate. If I failed to pay one week, it was added to - with interest. One payment could double in size, and then have to be spread over a month.

It was a very, confusing and complex situation. It all mushroomed very quickly.

Nothing was ever written down. Nothing was ever signed for. Nothing was ever explained. There were no interest rates mentioned. It was just a case of 'you owe me'.

The further I got into it, the more embarrassed I became about opening up about it to anybody else. I remember thinking: as long as I comply with this guy, everything's going to be fine.

Cold and calculating

"When I started to struggle to pay, I saw a very manipulative and cold and calculating side to his character.

I'd confided in him about my drinking problems, and given him quite lurid accounts of some of my struggles with alcohol. And he basically told me that if I didn't comply with him, he would tell my sister about the extent of my alcohol problems.

'I saw a very manipulative and cold and calculating side to his character'

He had a stepson who is quite a well-known thug in the area. He would subtly make mention of the fact that his stepson might have to come - and have words with me.

It was horrible. I estimate that over a five year period of meeting him every week I paid him at least £60,000.

Coming to a head

"Things came to a head when I was forced to use a charitable food bank, to put food on the table. I was paying the loan shark around £700 a month.

I went online and read some articles about where a victim had come forward, and the loan shark had been prosecuted.

I printed off some information and presented it to the loan shark and said: what do you think about that? And he said that I should put the information in the bin.

'He'd used my vulnerability, my weaknesses, and sort of gained control of my life'

That's when I realized that this man was so belligerent and so thick skinned, that I had to do something quite drastic to stop him.

The second trigger was seeing a documentary on the BBC about the work of the Illegal Money Lending Team.

I suddenly had a much greater view of what loan sharks are like, because I realised that they're not all baseball-bat wielding, shaved-head, tattooed thugs.

I saw that there are different types of loan shark, including the psychological ones that become friendly.

And that's when I realized that this man had really done a number on me. He'd used my vulnerability, my weaknesses, and sort of gained control of my life.

Help and support

"I went to my local police station and gave a statement. They approached the Illegal Money Lending Team on my behalf, who were fantastically supportive. They sent a welfare officer to see me, and gave me a lot of verbal reassurance, which was what I needed.

At that point I then spoke to my sister and business partner, and came clean about what had been happening for such a long time.

They were shocked, and upset. But I knew that this was the only way forward.

It's all being handled by the Illegal Money Lending Team now. We're hoping for a very positive outcome.

As far as I'm concerned, I'm not paying this money anymore."

You can hear the full interview on Money Box on BBC Radio 4 here.