Christmas shopping: the winners and losers

- Published

Christmas is the most important trading period of the year for most retailers, which is why their performance over the festive season comes under such scrutiny.

This festive season, those with strong online operations and some supermarkets have fared well, while the names of the losers would sound familiar to somebody walking down a High Street in the 1980s.

Competition among retailers is intense, and adding to their problems is evidence that shoppers are reining in spending.

A survey by Visa, whose debit and credit cards are used for a third of payments in the UK, found consumer spending fell in 2017 - the first decline for five years.

So who are the winners and losers?

LOSERS

Marks & Spencer

The High Street giant reported falling sales over the final three months of the year.

Overall, sales were down 1.4%. Clothing dropped 2.8% while food sales were down 0.4%. The comparison could be said to be against a strong rise last year, but that itself was against a particularly weak 2015.

M&S says, however, that Christmas trading itself was not too bad and offset a weak clothing market in October, but it also referred to "continuing underperformance" in its food business.

House of Fraser

Few were expecting good news from the department store group after it revealed last week that it was seeking a cut in rents at its stores.

In the six weeks to 23 December, sales in stores fell by 2.9%, although Black Friday sales were up by 0.8%. Worse, online sales dropped by 7.5% over the six-week period.

However, House of Fraser said its strategy of discounting fewer products bumped up profit margins across the business by about 0.5% over the festive trading period.

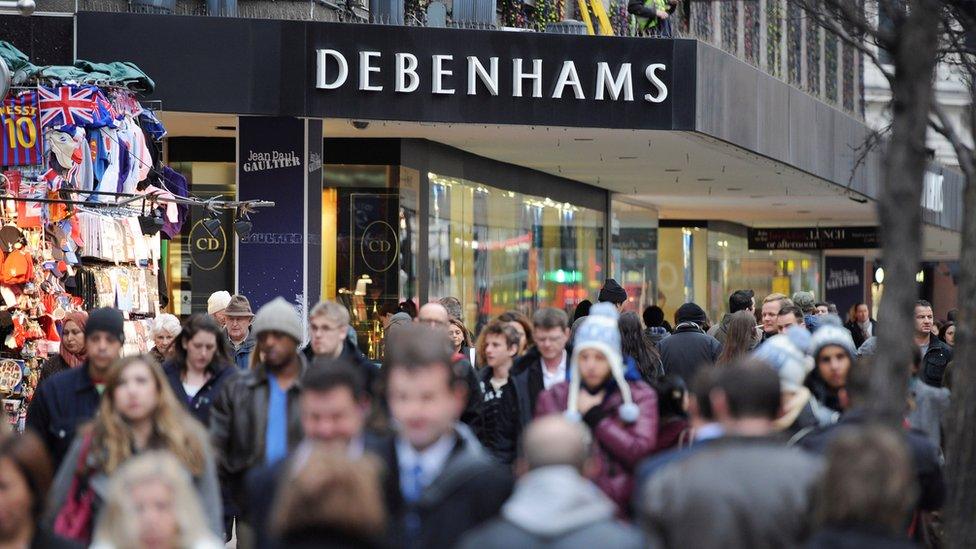

Debenhams

The early release of a trading statement is seldom a sign of good news and so it proved for Debenhams.

The department store warned its full-year profits would be lower than expected as it struggled amid a "volatile and competitive" market.

Its statement, which came out nearly a week ahead of schedule, said UK like-for-like sales fell 2.6% in the 17 weeks to 30 December.

Debenhams did manage to increase sales over the six-week Christmas period, but that was only after it resorted to cutting prices, and it added that the first week of the post-Christmas sale went worse than expected.

Mothercare

Mothercare issued a profit warning as it reported a fall in sales both at its stores and online.

The baby goods retailer said it had decided not to cut prices ahead of Christmas "to protect our brand positioning", with the aim of then making big discounts in the end of season sale.

But the strategy didn't work. In the 12 weeks to 30 December, like-for-like sales fell 7.2% year-on-year, while online sales fell 6.9%.

Annual profits are now likely to be between £1m and £5m, compared with analysts' forecasts of about £10m.

WINNERS

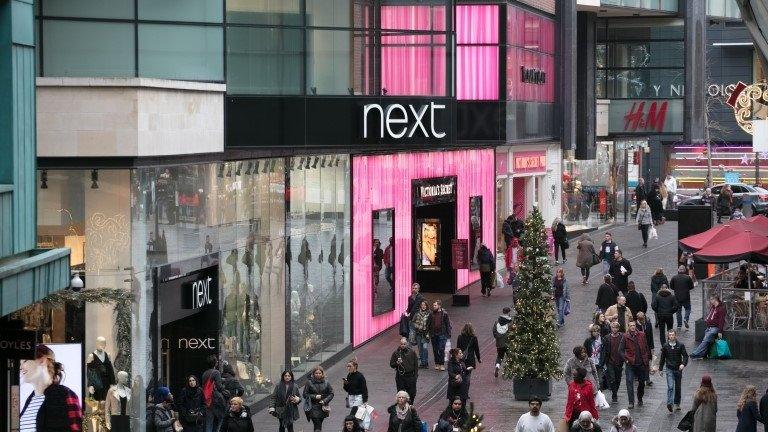

Next

The company was first out of the blocks with its trading statement and stormed into an early lead.

Confounding expectations of a fall in sales, Next said that the cold snap boosted trade ahead of Christmas, sending full-price sales up 1.5%.

Sales in stores fell by 6.1% in the period between 1 November and 24 December, but online sales rose by 13.1%.

Supermarkets

The over-arching story here could be said to be a mixture of growth in premium food sales coupled with ruthless competition for everyday items.

Most food sellers have said higher quality ranges did well over Christmas, but they also talk about intense price pressures.

John Lewis-owned Waitrose - well known for its upmarket food offering - saw sales rise 1.5%.

Tesco said it saw "record sales and volumes" in the four weeks leading up to Christmas Day. UK sales rose 2.3% in the 19 weeks to 6 January.

It pointed to sales of Tesco's Finest and the upmarket Go Cook range as doing well. However, it also said it had provided its "most competitive offer for many years", underlining that shoppers remained price conscious as a rule.

Morrisons, the UK's fourth-largest supermarket, said Christmas trading was particularly strong, with sales for the last six weeks up 3.7% compared to a year ago.

Sales at the online arm of the supermarket, Morrisons.com, rose by more than 10% and its "The Best" premium range grew by 25%.

Sainsbury's reported rising food sales in the last three months of the year. The UK's second-largest supermarket chain said grocery sales rose 2.3%, helped by higher food prices.

It said customers bought more Taste the Difference food than last year as "people treated themselves". But it also singled out discounted turkeys and other trimmings as the draw for shoppers.

Discounter Lidl exemplifies the trend for value. It reported record UK sales for December, up 16% compared with the same period in 2016. However, unlike the other figures here these are not like-for-like, so they do not strip out the effect of new store openings. As Lidl is expanding very fast, it will inevitably see strong sales growth on this measure.

Boohoo

Woohoo! The online fast fashion supplier saw revenues double to £228m in the four months to the end of December to £228m. As well as its main Boohoo brand, the 12-year old Manchester-based company also owns the PrettyLittleThings and Nasty Gal brands.

The retailer can hardly keep up with its growth itself. It has made two chunky revisions to its revenue growth expectations since September. Initially it expected 60% for the current financial year, then 80%, now 90%.

- Published11 January 2018

- Published8 January 2018

- Published4 January 2018

- Published3 January 2018