UK government borrowing narrows after EU credit

- Published

- comments

UK government borrowing nearly halved in December from a year earlier, helped by a rebate from the European Union.

Public sector borrowing, excluding state-owned banks, fell to a lower-than-expected £2.6bn last month, a £2.5bn fall from December 2016.

The UK received a £1.2bn rebate from the EU due to a reduction in the bloc's budget and changes to contributions.

The Office for National Statistics (ONS) also noted the collapse of Carillion could affect public finances.

The ONS said that the government had stated it would provide funding required by the Official Receiver to maintain public services.

"Any impact of these financial interventions on public sector finances will be announced in due course," it said.

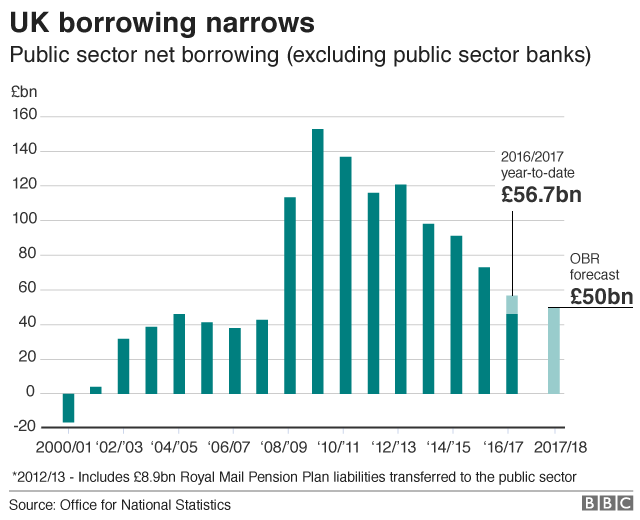

The ONS said public borrowing for the financial year to date now totalled £50bn, down nearly 12% from the same period a year earlier and the lowest year-to-date total since 2007.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said low public borrowing in December reflected falling government spending, "not a resurgent UK economy".

Central government tax receipts rose more slowly in December than they had in the previous eight months, while current expenditure fell by 0.8% compared with the previous December "primarily because the UK received a £1.2bn credit from the EU", he added.

"The credit reflects both a reduction of the size of the EU's budget and the underperformance of the UK economy this year; contributions are linked to the size of Britain's economy relative to the rest of the EU," said Mr Tombs.

A Treasury spokesman said: "We have made great progress in reducing the deficit by three quarters since 2010, but government debt is still far too high.

"Our balanced approach to government spending is getting debt falling, while investing in key public services and keeping taxes low."

Ruth Gregory, an economist with consultancy Capital Economics, said December's public finance figures provided "some good news" for the Chancellor of the Exchequer Philip Hammond.

"However, we shouldn't get too carried away by these figures. We doubt that borrowing will come in too much below the OBR's current forecast," she added.

Analysis: By Jonty Bloom, BBC business correspondent

The government is expected to borrow £49.9bn pounds in this financial year, which ends in March. So the news that it has already borrowed more than that might look like bad news.

However, millions of people and businesses are, at this moment, frantically filling in their tax returns, calculating how much they owe HMRC and posting off millions of very large cheques.

For the next two months the government will have more money coming in than it needs and so borrowing for the year as a whole will almost certainly be lower than £50bn.

But the government's borrowing problems are not over. Growth and productivity for the next few years are now predicted to be worse than previously thought, meaning balancing the books is going to take longer.

- Published22 January 2018

- Published22 January 2018

- Published16 January 2018