'Optimism reminiscent of last financial crisis'

- Published

Barclays CEO Jes Staley: "There is something out there in the capital markets"

The newfound optimism about the state of the global economy is eerily reminiscent of the lead-up to the last financial crisis, the head of Barclays has warned.

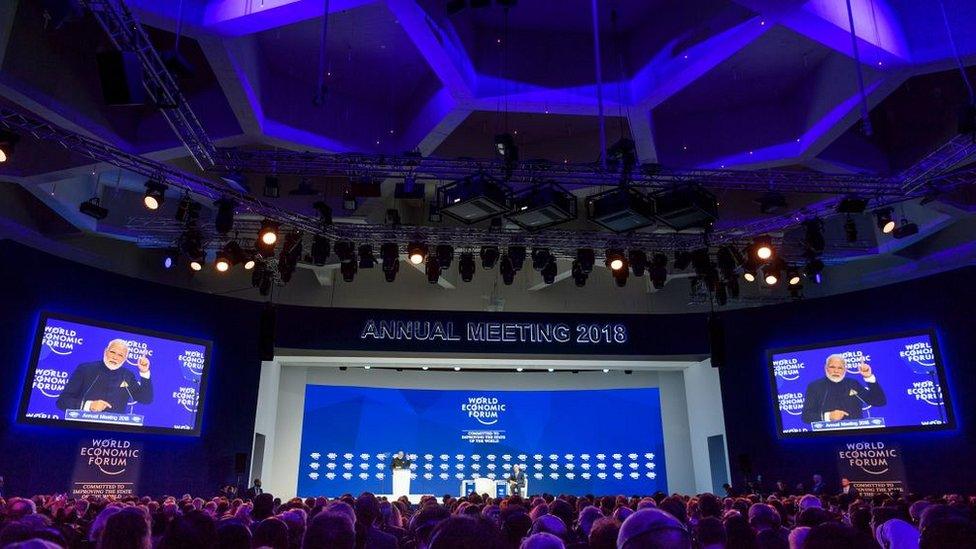

"I do feel like that it is a little bit like 2006," Jes Staley told delegates at the World Economic Forum in Davos.

"When we were all talking about whether we had solved the riddle of economic crises."

But he said big banks were now in a better position to deal with shocks.

Mr Staley's comments were delivered at the opening of an upbeat forum in the Swiss resort, at which the IMF upgraded its global growth forecast for 2018 to 3.9%.

Additionally, a survey of more than 1,200 chief executives by PwC found that most believed the world economy would "improve" over the next 12 months.

'Not sustainable'

Speaking on a panel ominously entitled "The Next Financial Crisis", Mr Staley said that despite an encouraging recovery, "there is something out there in the capital markets".

"Equity markets are at an all time high and volatility is at an all time low - that is not a sustainable proposition," he cautioned.

A PwC survey of more than 1,200 chief executives found most believe the world economy will "improve" over the next 12 months

He hinted that if the stress tests that Barclays was subjected to by the Bank of England were applied to other sectors of the economy, they would not be found to be in rude health, primarily because of high levels of debt.

Mr Staley also argued that the next financial shock would not be the fault of banks like Barclays and reiterated his faith in financial regulators.

"On one level, pre-2008, the regulators were there just to bear witness," he told Davos attendees.

"Today, the political body have told the regulators, I want you to regulate the system… so you avoid the next financial crisis."

Core mission

Fellow banking heavyweight Michael Corbat, the chief executive of Citigroup, shared Mr Staley's view that lenders were less exposed to risk, and emphasised that they had reverted to their core mission.

"We are not an insurance company, we are not an asset manager, we are not a hedge fund," Mr Corbat said.

"We are simply a bank."

"The most worrisome are policy mistakes either in the US - a fiscal shock or a trade war - or in China, says IHS Markit's Nariman Behravesh

Harvard economist Ken Rogoff, while sanguine about the prospect of a downturn in the near future, warned that there would be few tools left to deal with one if it occurred.

"There really isn't even a Plan A for central banks," he said, adding that although there would be probably be further fiscal stimulus and quantitative easing, "I don't think either would work as well as they did last time".

The risk of political upheaval, which was front and centre at last year's WEF, seems to have faded, and Donald Trump, who will bring his protectionist message to Davos on Friday, was hardly mentioned by executives.

Cascade concerns

Of more concern, according to Nariman Behravesh, chief economist at IHS Markit, were "low-level threats" that could end up ruining the recovery.

"The most worrisome are policy mistakes either in the United States - a fiscal shock or a trade war - or in China," he said, referring to overzealous interest rate rises in the former, and a rapidly reduction of debt in the latter.

But Mr Behravesh added that while the risk trade friction was "uncomfortably high", the chances of an out-and-out trade war were still low.

The very fact the economic recovery is happening globally could be bad news, warns SkyBridge Capital's Ray Nolte

Ray Nolte, managing partner at investment firm SkyBridge Capital, also downplayed the prospects of another crisis, but said the harmonious nature of current economic growth was of concern.

"This really is a global recovery. Europe has really pulled out of it, the US is doing well, Asia is doing pretty well - much more coordinated than in past cycles where you have always had one country lagging, or one region lagging."

However, the very fact that the recovery was happening pretty much everywhere could spell bad news, he explained.

"What will tend to happen is countries will get out of step at the same time. This can have a cascading effect."

"You had the US able to bail out Europe in 2011… you don't have that if everyone is in sync."

'It will happen'

Yet Mr Nolte noted that while the global economy was motoring ahead at a steady pace - it was not yet at breakneck speed.

"It's not like we are at 4% growth and the breaks are going to have to be jammed on," he said.

"This party can go on for an extended period of time".

"When the next turn comes... it's likely to be more violent," says Citigroup's Michael Corbat

According to Prof Rogoff, anticipating precisely how the party will eventually end is no less tricky than it was 12 years ago.

"It will happen," he predicted, "somewhere none of us are looking".

Citigroup, CEO Michael Corbat struck a more sombre note: "There is a numbness out there, there is an ambivalence out there that's concerning.

"When the next turn comes - and it will come - it's likely to be more violent than it would otherwise be."