Five key messages from the Bank of England

- Published

Imported inflation that followed the pound's fall post Brexit is easing back - and wages starting to grow

While policymakers voted unanimously to keep interest rates on hold at 0.5%, there were signs that further increases could be on the way.

Stronger global growth is expected to help the UK economy, as inflation starts to ease and pay begins to increase.

Here are five key messages from the Bank of England's latest Inflation Report:

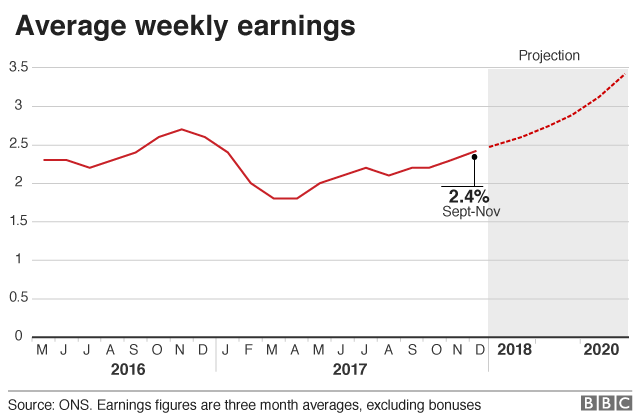

1. Prepare for a pay rise

Prices have been rising faster than pay for much of the last year.

However, the Bank believes the era of falling real pay - once inflation is factored in - is coming to an end.

It noted that pay growth had already returned to around its pre-crisis rate for those switching jobs and said there were signs that pay rises would soon spread.

A survey conducted by the Bank's Agents, which serve as its eyes and ears across the country, showed that private sector companies expect to increase staff pay by around 3.1% this year.

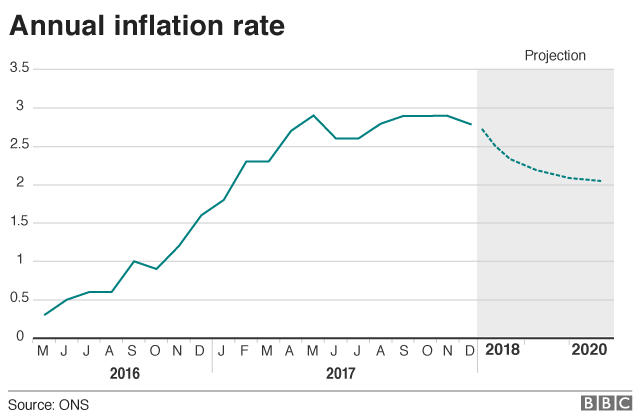

2. Inflation will start to ease

Inflation, as measured by the consumer prices index (CPI), rose to 3.1% in November, which is well above the Bank's 2% target.

The fall in the value of the pound after the Brexit vote pushed up import costs, which translated into higher shop prices.

Mark Carney, Governor of the Bank of England, warned that while inflation could once again rise above 3% mainly due to rising oil prices, policymakers expected inflation to ease back as the impact of the fall in the value of the pound diminishes.

However, the MPC expects domestic cost pressures to build. The Bank has the power to keep a lid on these pressures as they build, which is why they are signalling that the next rate rise could be around the corner.

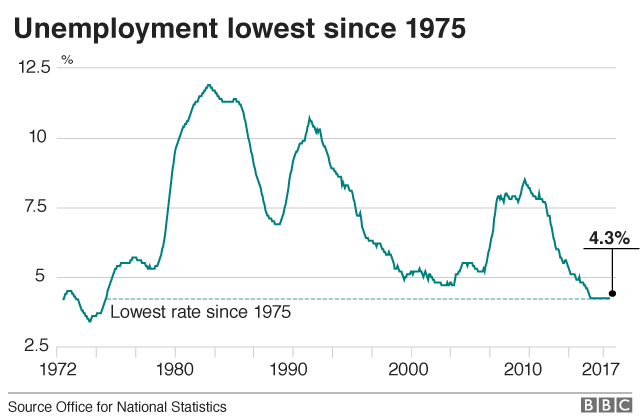

3. The UK jobs market will remain strong

Britain's jobs-rich recovery is expected to continue in the coming years, with the unemployment rate remaining at a four-decade low until the start of the next decade.

In recent years, the Bank has lowered its estimate of how low it believes the unemployment rate can go before inflationary pressures start to build through employers needing to offer higher wages to attract and retain staff.

A couple of years ago, the Bank said inflationary pressures would start to build when unemployment dropped to 5% but it has since reduced this so-called "natural rate" to 4.25%, slightly below the current unemployment rate of 4.3%.

There are three main factors behind this:

Firstly, people are living longer and retiring later.

Secondly, we're smarter. A longer period in education means people are more adaptable when a downturn hits and are able to stay in work.

Thirdly, a series of reforms to the benefits system have helped to make work pay.

The Bank said the vote to leave the European Union had made Britain a less attractive place to work. The pound buys fewer euros and dollars for those sending money abroad, while a stronger European economy means more people can get work at home. The Bank said falling net migration would affect the outlook for the economy, which could hit medium-term UK growth.

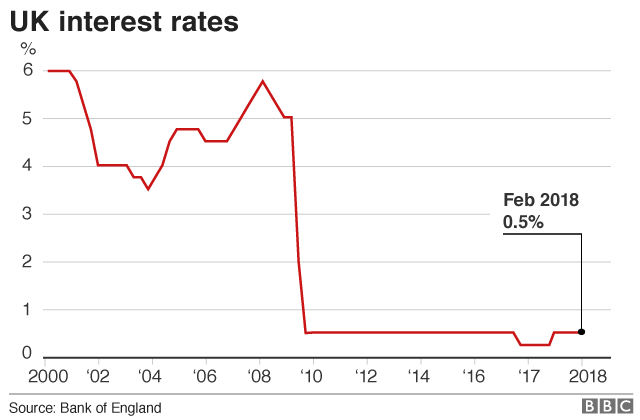

4. The impact of the last rate rise has been mixed

The interest rate rise from 0.25% to 0.5% last November has been felt differently by consumers and businesses.

Most businesses with variable credit are paying more interest on their loans, but competition among high street banks has helped to keep personal loan rates down, with the average rate on an unsecured £10,000 rising by just four basis points - 0.04% - since last summer.

Also, while on average banks and building societies have passed on the full rate increase to households with variable rate mortgages, the rate of interest earned on the average instant-access savings account has only edged up by seven basis points.

5. Global growth will drag up the UK economy

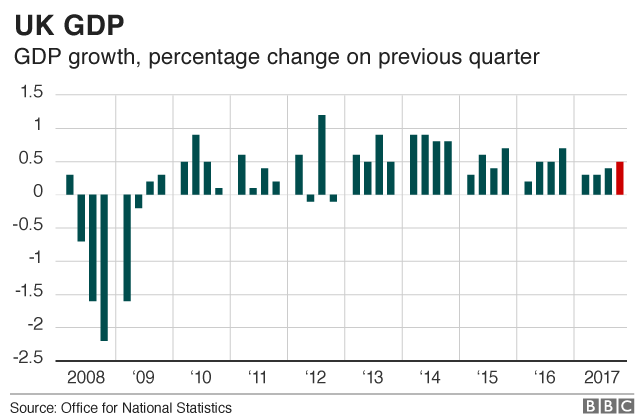

The global economy is firing on all cylinders and is expected this year to grow at a pace not seen since before the 2008 financial crisis and this is expected to lift UK economic growth.

While growth of around 1.8% over the next three years may not seem spectacular, the Bank has already warned that the UK may not be able to grow much above 1.5% per year before policymakers have to raise interest rates to prevent it from overheating.

Raising the UK's long-term growth will require stronger productivity growth and investment, which will help to increase the speed limit of the economy.

This will determine whether the UK is left in the slow lane.

Graphics produced by Daniele Palumbo.

- Published8 February 2018

- Published8 February 2018