Rupert Murdoch's Sky bid challenged by Comcast

- Published

- comments

US cable TV giant Comcast has made a £22.1bn bid for Sky, challenging an existing offer from 21st Century Fox.

Rupert Murdoch’s 21st Century Fox had already agreed an £18.5bn deal to buy the 61% of Sky it does not already own.

Comcast is the biggest US cable TV firm. It also owns the broadcast TV network NBC and Universal Pictures.

Comcast chief executive Brian Roberts called Sky "an outstanding company" and said he was "confident" the offer would be cleared by regulators.

Mr Roberts added: "We would like to own the whole of Sky and we will be looking to acquire over 50% of the Sky shares".

Comcast said its bid of £12.50 a share was 16% higher than the 21st Century Fox offer.

Sky's shares were up more than 21% at above £13 in afternoon trading on the London Stock Exchange.

What is Comcast?

Comcast is a US multinational media and telecommunications giant.

Its cable TV business is one of the largest in the US, and Comcast Cable also sells internet and phone services.

It owns NBCUniversal, which has news, entertainment and sports cable networks such as NBC and CNBC, as well as film giant Universal Pictures.

Dreamworks Animation, which has made films including Shrek, Madagascar and Kung Fu Panda, is a subsidiary of Universal Pictures.

Why does Comcast want to buy Sky?

Analysts from Liberum say there is "a strong rationale" for Comcast to buy Sky as it would give it immediate leading positions in pay-TV markets in the UK, Germany and Italy, as well as a presence in Spain.

Comcast already has NBC Universal film and TV assets, but the deal "would give it a very powerful distribution pan-European network," Liberum said.

Earlier this month, Sky won the lion's share of Premier League TV rights for the football seasons between 2019 and 2022.

Comcast chief financial officer Michael Cavanagh said the Premier League auction was a factor, but not the driving force behind the offer.

Liberum said the lower price for the Premier League TV rights contract had taken out the risks of price inflation.

What issues has 21st Century Fox had with its Sky bid?

Fox's Sky bid has not been viewed favourably by the UK's competition authority, which in January provisionally found that it would not be in the public interest.

The Competition and Markets Authority (CMA) is concerned that if the deal went through, the Murdoch Family Trust would have too much influence over public opinion and the political agenda.

However, Fox has been trying to mollify competition concerns.

Last week, Fox said it would keep Sky News running for at least 10 years, with a fully independent board for the channel, to try to make the proposed deal more attractive to regulators.

The CMA will send a final report to Culture Secretary Matt Hancock by 1 May, and he will then have 30 working days to make the final decision about whether the deal will go ahead.

Comcast owns Dreamworks Animation, which has made films including Shrek

Will the Comcast offer affect Disney's bid for Fox?

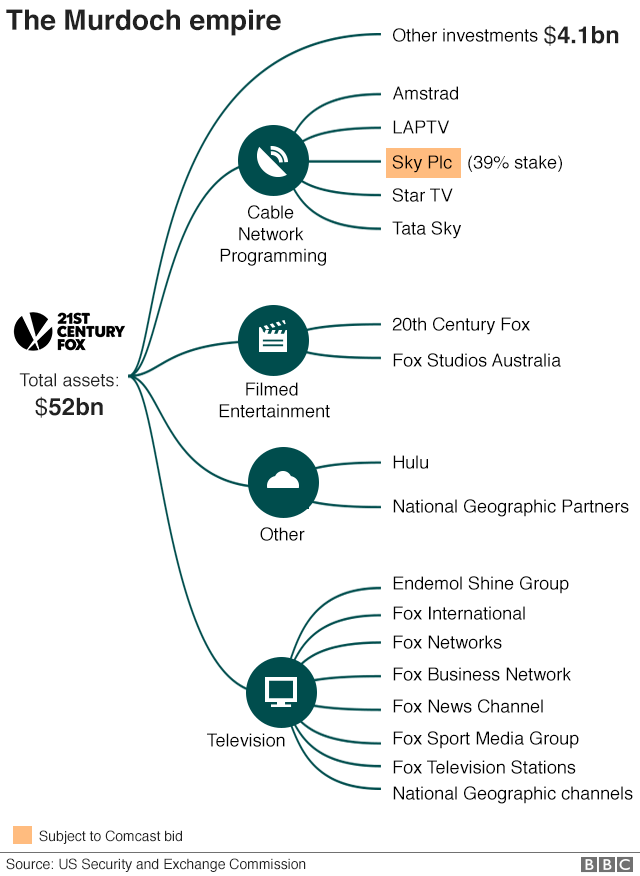

In December last year, Walt Disney agreed to buy the bulk of 21st Century Fox's business, including its 39% Sky stake.

Neil Wilson from ETX Capital said that after Comcast's own bid for Fox was rejected in favour of the Disney deal, there was every chance "Comcast would spoil Mickey's party".

"By making a play for Sky now it can get what it wants before Disney gets close - timing is everything and Comcast seems to have played its hand very well so far," he said.

Stewart Purvis, a board member at Channel 4, said: "We knew Comcast were interested in gate-crashing the [Sky] deal in some form."

"This simple deal will be attractive to regulators, it will be very attractive to shareholders, it'll force the price up they'll be prepared to pay... but it also potentially derails this whole deal between the Murdochs and Disney, which would be in Comcast's interests.

"They may be in love with Sky, and they may be prepared to pay a lot of money for Sky, but they've also got their eye on 'How can we disrupt our competitors?'," Mr Purvis said.

Analysts at Liberum said that if Fox wanted to counterbid for Sky, it would "presumably need approval from Disney" to fund the bid.

If Disney refused, then Fox would have to find the money itself, "which means it is then looking at a loss if Disney did end up acquiring 100% of Sky".

Mr Roberts said Comcast was prepared to co-own Sky with either Fox or Disney, as long as Comcast held a majority stake.

However, Comcast has said it would like to own the whole of Sky.

How will regulators view the Comcast bid?

BBC media editor Amol Rajan says Comcast's bid looks unlikely to face the same regulatory hurdles as Fox's push for full control, "since media plurality, commitment to broadcasting standards, and the political heat around the name Murdoch do not arise".

In making its offer, Comcast said Sky News was "an invaluable part of the UK news landscape", and it intended to "maintain Sky News' existing brand and culture".

The Liberum analysts said there was a "very good chance" that Comcast's bid would succeed.

Neither Fox nor Disney will want to get into a bidding war, "especially given the [regulatory] complications surrounding Sky News", they said.

The UK government may also be looking for a way to defuse the political risks from the Fox bid, they added.

- Published23 January 2018

- Published12 February 2018

- Published23 January 2018