Brexit: Don't put bankers first in talks, says Labour

- Published

- comments

Labour has accused the government of prioritising financial services over manufacturing in Brexit trade talks.

Discussions over the UK's post-Brexit trading framework with the EU are expected to begin later this year.

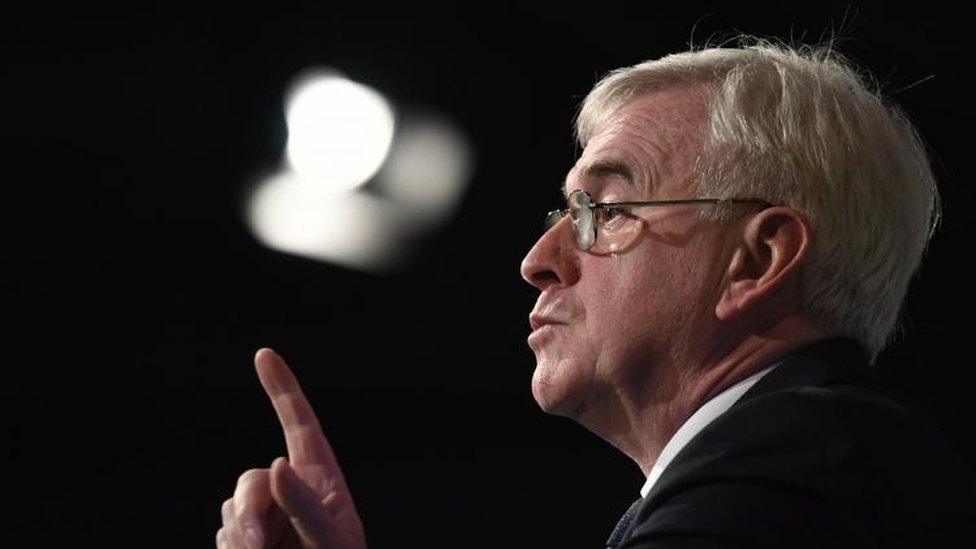

Shadow chancellor John McDonnell said it was clear the government aimed to "win a deal for financial services first and then worry about the rest of the economy later".

The chancellor has argued for a post-Brexit deal to include banking.

On Wednesday, Philip Hammond said: "A trade deal will only happen if it is fair and balances the interests of both sides.

"Given the shape of the British economy, and our trade balance with the EU27, it is hard to see how any deal that did not include services could look like a fair and balanced settlement."

John McDonnell said that showed the government was favouring financial services, such as banking and trading, over other parts of the economy.

Speaking to the British Chambers of Commerce's (BCC) annual conference in London, Mr McDonnell said: "There is no other reason to raise a specific deal for financial services, even if it is as bad and fantastical as proposed, while just last week refusing to negotiate a new customs union that would protect our manufacturing trade."

Goods v services

A spokesperson for the Chancellor said, "It's plainly ridiculous to suggest the Chancellor has anything other than the best interests of the whole economy at heart."

"As he made clear in his speech yesterday, the UK financial services hub is an engine that powers the real economy not just in London, but across the UK."

Labour has said the inclusion of financial services in a trade deal is a "red line" for Labour, so the criticism appears to be one of emphasis.

Financial services are important to the UK - the sector employs more than two million people and paid £70bn in tax last year, according to lobby group The City UK and accountancy giant PwC.

But when it comes to trade with the EU, the picture is less clear cut.

The UK sells more financial services to the rest of the EU than it buys. Exports were worth £27bn in 2016, according to the Office for National Statistics.

So it's big, but it's not as large as goods sales to the EU. They were worth much more, at £145bn. However, we buy more products from the EU than we sell there.

Britain's exports of services to the EU have grown in recent years, whereas sales of products have fallen.

At the moment, this discussion is moot.

The EU's chief Brexit negotiator, Michel Barnier, has resisted the inclusion of banking in a post-Brexit arrangement, saying a trade deal including financial services "does not exist".

The International Trade Secretary, Liam Fox, told the BCC's conference the UK should not be penalised for leaving the EU.

"The idea of punishing Britain to me is not the language of a club, it is the language of a gang," he said.

- Published7 March 2018

- Published7 March 2018

- Published7 March 2018

- Published4 March 2018