China's parliament unveils major ministry shake-up plan

- Published

China has said it plans to merge its banking and insurance regulators as part of sweeping changes to its central government structure.

The planned shake-up, along with the creation of several new ministries, was announced by the annual sitting of the National People's Congress (NPC).

The move will combine the insurance and banking bodies and is aimed at reducing systemic risk in the financial sector.

Reforming China's financial landscape has been a central task for Beijing.

What will happen under the merger?

The Banking Regulatory Commission (CBRC) will be combined with the China Insurance Regulatory Commission (CIRC) to form a super regulator, overseeing all of China's banking and insurance sector.

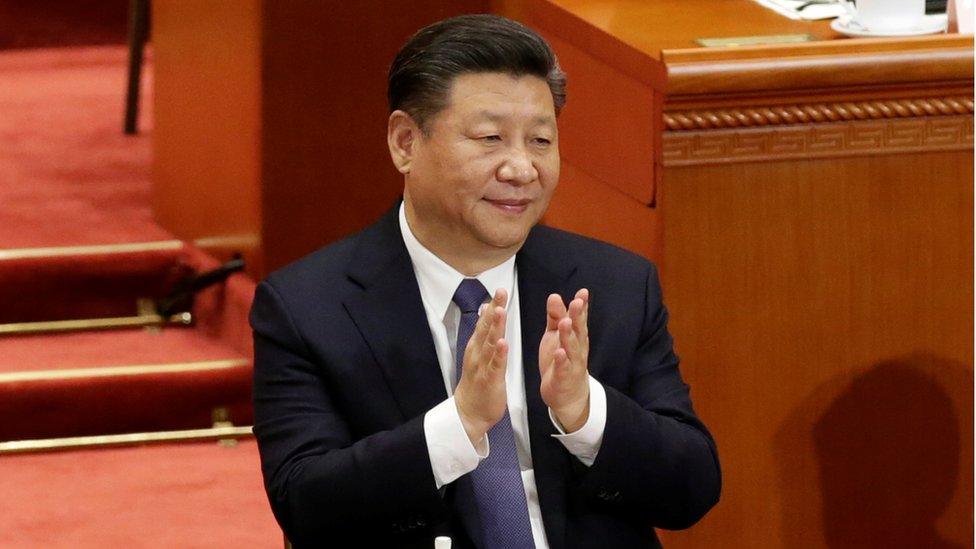

President Xi Jinping's top economic advisor, Liu He, said the sweeping reforms would be profound

Some of their roles will be transferred to the central bank - the People's Bank of China (PBOC) - which will take on responsibility for making new laws and regulations.

President Xi Jinping's top economic advisor, Liu He, said the sweeping reforms would be "profound" and would help abolish inefficiencies across state agencies.

"Deepening the reform of the party and state institutions is an inevitable requirement for strengthening the long-term governance of the party," Mr Liu said.

Why does China say this is needed?

The reforms are part of President Xi's plans to strengthen the central government's control over the economy, crack down on the financial industry and guard against excessive borrowing and risk.

The rising level of debt being carried by some Chinese firms, by state-owned enterprises and by local governments has been a widespread cause for concern for several years.

Central bank governor Zhou Xiaochuan said that loopholes in the financial regulatory system needed to be closed and that flaws in regulations needed to be corrected in order to defuse financial risk across the sector.

On the sidelines of the NPC - the annual parliamentary meeting - last week, he said the PBOC would take the lead in co-ordinating those efforts.

As part of recent efforts to reduce financial risk in the country, Beijing took control over China's giant Anbang Insurance Group last month.

Anbang is recognised as one of China's richest and most opaque conglomerates. It's best known for its aggressive international acquisitions, including New York's Astoria Hotel.

Beijing has been cracking down on the financial industry to guard against excessive borrowing and risk

Analysts described Beijing's unusual move to take control of the company as a warning shot to other Chinese firms engaged in particular types of financial engineering and leveraged acquisitions.

What other changes have been announced?

Several new ministries will also be created as part of the new reforms, including a new ministry for agriculture and one for rural villages.

Other new ministries include ones overseeing natural resources, immigration, culture and tourism, and the environment.

The intellectual property rights bureau will also be restructured.

Several of the changes reflect Beijing's commitment to its so-called three critical battles: continuing efforts to resolve major risks in the economy; an unprecedented campaign against poverty; and a continued fight to reduce pollution.

The NPC, which is regarded as a rubber stamp for decisions made by China's ruling communist party, is currently mid-way through its annual two-week gathering.

On Sunday, the removal of the two-term limit on the presidency was approved, effectively allowing Xi Jinping to remain in power for life.

- Published11 March 2018

- Published5 March 2018

- Published18 October 2017