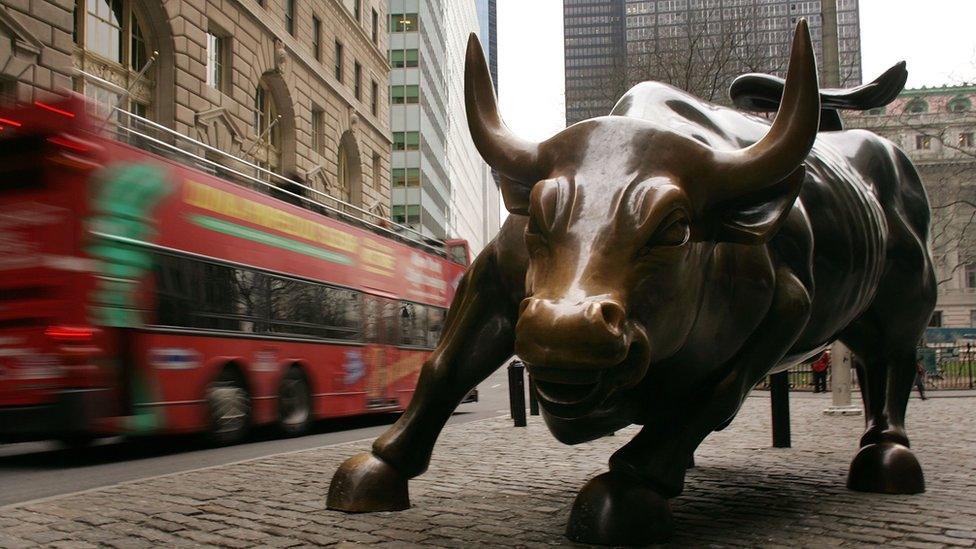

Financial crisis rules for banks eased by US Senate

- Published

The US Senate has passed a bill to roll back banking regulations put in place in the wake of the 2008 financial crisis.

The bill exempts banks with less than $250bn in assets from strict oversight under the Dodd-Frank Act of 2010.

The draft legislation was approved in a 67-31 vote and must now go through the House of Representatives.

The Dodd-Frank act was brought in with the aim of avoiding another financial meltdown.

Supporters of the 2010 act say it has made the financial system safer - forcing large financial institutions to hold more money to use in the event of a financial shock, increasing protections for consumers, and improving stress tests.

Its opponents, including small to mid-sized banks, community banks and other financial institutions, say the regulation has inhibited growth and is overly complex.

The Senate vote delivers US President Donald Trump one of his most significant victories to date. He made it a campaign promise to repeal the act and has called it "a disaster".

The US Chamber of Commerce said the vote for the bill proved that helping small businesses and boosting economic goals was something Republicans and Democrats could get behind.

"This legislation will bring a long-awaited respite to Main Street businesses across America whose growth has been stifled in the post-crisis regulatory era," the chamber's chief executive, Thomas Donohue, said.

Divided Democrats

However, the bill has divided Democrats sharply. Some have supported it, while others - notably Senator Elizabeth Warren, from Massachusetts - have strongly opposed repealing crisis-era banking regulations.

Democratic Senator Elizabeth Warren has led the campaign against the bill

Ms Warren has said it would weaken consumer protection and open the door to risky behaviour that banks want to pursue for higher profits.

"[The new bill] puts American families in danger of getting punched in the gut in another financial crisis," she said on Tuesday.

In the House

When the bill moves to the House, some Republicans are expected to ask for more provisions to further ease restrictions on small lenders.

"To expect that the House would have a desire to have some fingerprints on this final product is more than reasonable," said Republican Bill Huizenga.

Any changes made to the bill in the House would need to go through the Senate again and further Republican amendments could see Senate Democrats pull back on their support for it.

The Dodd-Frank act was named after the Congressmen who campaigned for the legislation.

- Published8 June 2017

- Published3 February 2017