Carpetright and Mothercare shares dive on trading worries

- Published

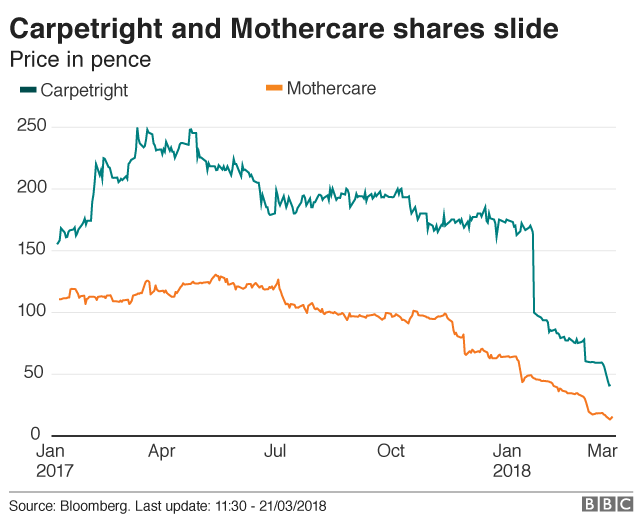

Shares in Carpetright and Mothercare have plunged amid fears about the retailers' futures.

Carpetright slumped 14% after a report suggested it would cut jobs and close stores as part of a rescue plan to stop it going into administration.

Mothercare, which is in the midst of a store closure programme, fell almost 12%.

It comes amid a wider High Street slowdown that has seen a host of big businesses shut stores or go bust.

At the weekend, the Sunday Times reported that Carpetright could go down the route of a company voluntary arrangement (CVA), which would allow to it to shut loss-making stores and secure deep discounts on rental costs.

That would follow similar recent arrangements at fashion retailer New Look, restaurant chains Jamie's Italian and Prezzo, and burger chain Byron.

Carpetright, which has 409 UK shops, has been struggling with underperforming outlets which have made its rental costs harder to shoulder.

Earlier this month the firm said it would swing to a full-year loss and had started talks with lenders to ensure it does not breach the terms of its bank loans.

In a statement on Monday, the retailer said it was exploring "a range of options" to bolster the business and a final decision about its future had not been made.

Mothercare is in the midst of a store closure programme

Earlier this month Mothercare said it was in talks with its banks after poor trading put it at risk of breaching the terms of its loans.

It plans to cut its store numbers from 140 to 80.

A spokesman for Mothercare declined to comment on Monday's share price fall.

Laith Khalaf, senior analyst at Hargreaves Lansdown, said: "There's no public information specifically released about Mothercare today, but if you look across the market quite a lot of retailers are in the red.

"Mothercare is one of the weaker players in a sector that is struggling across the board, which might explain why its shares have fallen more than other firms' today."

High Street slowdown

High Street retailers have been buffeted by higher overheads, falling consumer demand and the rise of online spending.

Many retailers also embarked on debt-fuelled expansion during the good years, leaving them dangerously exposed in the current climate.

Last week, Toys R Us said it would close all of its UK stores after the chain collapsed into administration in February, and electronics retailer Maplin also went bust.

On Monday, the owner of the Bargain Booze and Wine Rack chains, Conviviality, said its chief executive was stepping down after the firm revealed last week it had failed to set aside £30m to pay a tax bill.

The company, which is also a major drinks wholesaler, said Diana Hunter would step down from the board with immediate effect, with chairman David Adams stepping into the breach until further notice.

- Published14 March 2018

- Published2 March 2018