Government intervenes in GKN battle

- Published

- comments

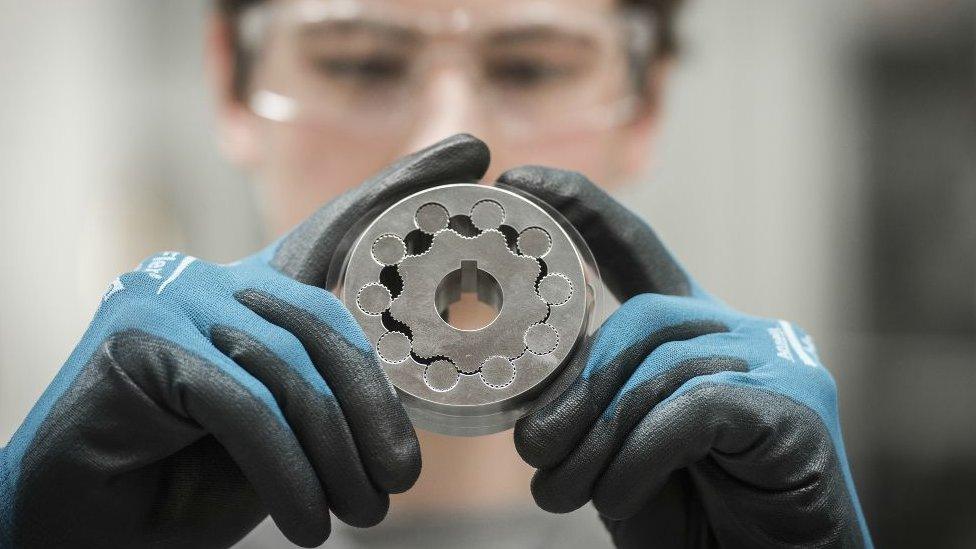

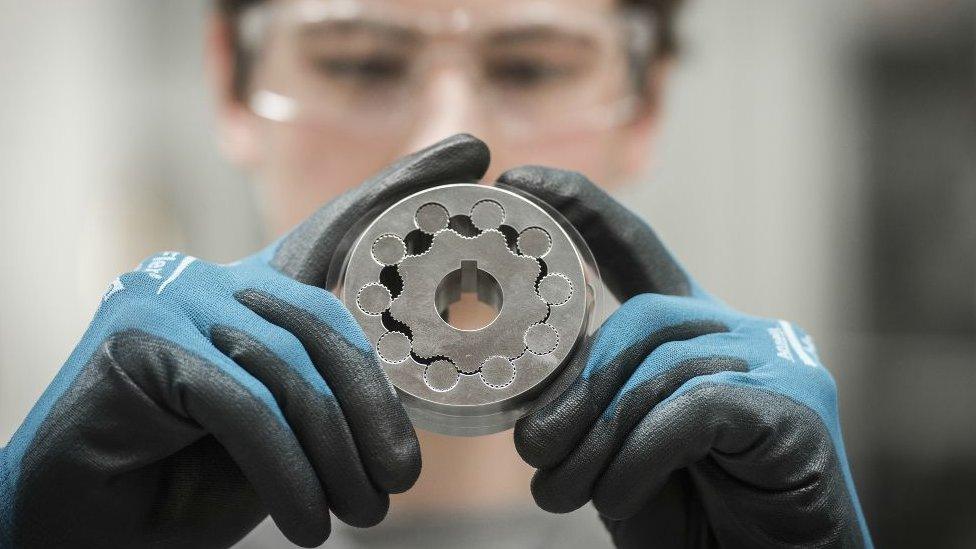

The battle royal for one of the UK's oldest and biggest engineering firms took another significant twist on Tuesday as the government prompted would-be-acquirer Melrose to offer a number of legally binding commitments if its £8bn takeover of GKN is successful.

Politicians and unions have voiced concerns that Melrose would carve up an important automotive and aerospace company into sellable chunks with the loss of UK jobs and skills.

GKN employs 60,000 worldwide with 6,000 based here in the UK.

Business Secretary, Greg Clark, wrote to Melrose asking the company to use rules set up after the debacle of Kraft's broken promises over Cadbury to give firm undertakings about GKN's future.

In response, Melrose has promised to spend at least 2.2% of revenues on research and development, create a new £10m apprentice fund and a pledge not to sell GKN's aerospace division for five years.

Fair hearing

According to people close to the deal, Melrose would have been happy to commit to most of this without prompting.

Meanwhile, unions have characterised this as an inadequate and last minute opportunity for the government to be seen working hard for wider national economic interests.

However, Melrose usually buys, restructures and sells again within five years so it seems unlikely it would willingly have tied its own hands by agreeing not to sell off a whole half of the business.

Its worth noting that Melrose reserved the right to float the division on the stock market and asked for a fair hearing if a long-term buyer, acceptable to the government, came along in the meantime.

The acquisition of tech darling ARM Holdings by Japan's Softbank saw promises made to increase investment and headcount and they appear to have been honoured so far.

Just how legally binding these kind of commitments are is yet to be tested in the courts and many lawyers are sceptical they could be enforced in situations where market conditions radically change.

Tied hands

Melrose is popular with investors because of its track record in making the companies it buys more valuable. That is precisely the reason that some union leaders are suspicious.

With two days left in which shareholders must decide whether to accept the bid - how many who liked the look of the Melrose bid will think again now that the company has tied its hands more than it may have liked?

Not many, according to one big shareholder who spoke to the BBC: "The point is that GKN has been poorly run for a long time, Melrose has been well run for a long time. I don't think these additional commitments will change the minds of the Melrose fans."

Certainly, the government thinks that Melrose has a good chance - and wanted to makes its concerns known while it still can.

Whatever happens between now and Thursday, the future of GKN will look very different. The current management plan to sell off the automotive division to US company Dana Corporation and become a "pure play" aerospace business - conglomerates are often valued at less than the sum of their parts.

Investors have until Thursday lunchtime to decide - 50.01% is the level of support needed.

- Published27 March 2018

- Published15 March 2018

- Published21 March 2018